New white paper suggests IR could be left behind by changing communications landscape

A new white paper published by Falls Communications suggests the very nature of IR could be outdated and left behind by a stock market and communications industry that have changed unrecognizably over recent years.

In a document entitled ‘It’s time to rethink IR’, the firm sets out why the very way in which IR operates could be in need of a vital spring clean. Its central idea is that a rethought IR program could bring a marketer’s expertise to bear, using established methods to keep up with a changing communications environment.

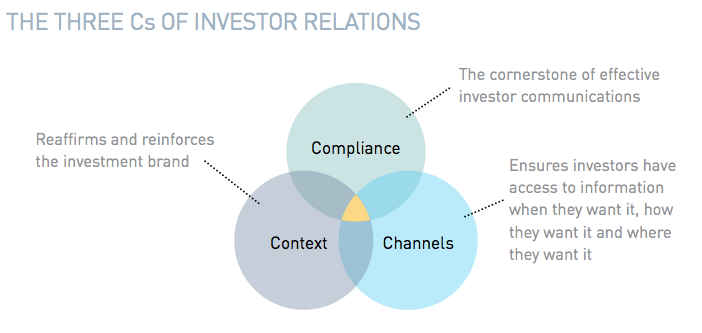

‘The problem with IR today is that it continues to get more primitive as the markets keep getting more sophisticated,’ notes the paper’s introduction. Though IR departments have a good focus on compliance, the paper adds, increased emphasis is needed on the other two of the ‘three Cs of IR’: context and channels.

Source: It's Time to Rethink IR

IR Magazine spoke to Rob Berick, managing director at Falls Communications, to find out more about an updated IR mind-set.

What led you to adopt this new approach?

A number of factors converged to lead us to it, chief among them being a growing chorus of companies that say they are either having trouble telling their story or getting their story heard by the right audiences.

We have also heard complaints from long-focused institutional investors who are finding it harder to get the chance to fully understand a company. One told me he is tired of getting only information a stock trader would want (like data points) rather than the broader context he needs to evaluate investment opportunities. I found this particularly ironic given that most companies prefer to have a shareholder base of investors rather than traders.

The continued rise in shareholder activism has a part to play, too, particularly when considering the communication-savviness of such investors.

Your idea centers around the creation of ‘investment brands’ ‒ will IR programs follow these?

At its core, the investment brand is the road map that articulates a company’s core attributes ‒ or what my branding/marketing colleagues call the ‘central essence’ ‒ for investors. It’s the authentic and distinctive identity for the company among investors, that indelible mark that is clear, meaningful, unmistakable and unique.

How a company builds and protects its investment brand can depend on different things. Most importantly, however, are the preferences and needs of its particular target audience.

It’s important to remember that investors are not a homogeneous group, though: they want different things at different times, and via different channels – so a company should try to have the same ‘omni-channel’ approach with the financial markets as it has with its customer end-markets.

What is currently the main stumbling block for traditional IR departments?

Time. IROs just don’t have the time to address the three Cs of IR ‒ compliance, context and channels ‒ equally or properly. The urgent demands that confront IR departments every day leave little time for them to consider or address less urgent but still important issues, which are too often those surrounding context and channels. This time constraint is even more pronounced at companies where the IR role is only part of an executive’s daily responsibilities.

You mention expanding IR into multiple channels, including the IR website and other digital tools. Which of these avenues do you think is most exciting, or is yet to be fully realized?

While there are a number of exciting channels emerging, the one I think offers the most unrealized potential is corporate and IR websites. Not only is your website a highly cost-effective, 24-hour call center for investors, but it can also be a powerful investment brand ambassador and investor engagement tool if conceived and maintained with a marketer’s mind-set.

Over the years, I’ve spent a good amount of time reviewing corporate and IR websites and have found far too many companies are not properly using this key channel to market, using cookie-cutter templates and no contextually useful information.

Again, bringing a marketer’s mind-set to this section of the site, there are a number of strategies and techniques that can be employed to better capture and cultivate investor interest. Personally, I don’t see much reason for a company to explore other digital platforms or online tools if its website content and functionality aren’t fully realized.