How to approach meetings with hedge funds, as discussed at a recent IR Magazine Webinar

Hedge funds are back. One estimate from hedge fund analysis specialist Hedge Fund Research puts the size of the industry in the first quarter of 2011 at just under $2 tn, close to the peak it reached in 2008 before the financial crisis.

While hedge funds were once viewed as short-term traders backed by wealthy individuals, the reality today is very different. The majority of assets managed by hedge funds now come from institutional investors such as pension funds and mutual funds. The investment strategies of hedge funds have also shifted, with more now focusing on company fundamentals and long-term performance.

To explore how IR professionals should approach meetings with hedge funds in reaction to these changes, IR magazine held a webinar in July featuring IR officers from two large US stocks with plenty of experience dealing with alternative asset managers: Jeff Smith, director of IR at FedEx, and Victoria Hyde-Dunn, director of IR at Visa.

‘There is a consensus building that communicating with hedge funds is increasingly important for IR professionals and the management team,’ said Hyde-Dunn. ‘In the past, many IROs and their management teams shied away from having a dialogue but nowadays hedge funds are a very important component within a stock’s portfolio.’

For Smith, the conversation has moved away from avoidance and on to prioritizing. ‘From our standpoint we look at turnover,’ he said. ‘By definition, if you have an annual turnover that’s more than 100 percent, it’s hard to describe yourself as a long-term shareholder. Those companies with high turnover will be the ones filling in our schedule, but will not be the top priority for our schedule.

‘Beyond just looking at those numbers, I’m not going to put anyone in front of my management team whom I haven’t met with and had a conversation with first, so that I know what his or her conversation style is and how aggressive he or she is with questions. I just don’t want to put my management team in a situation where it has to be worried about Reg FD disclosures.’

Warming to a theme

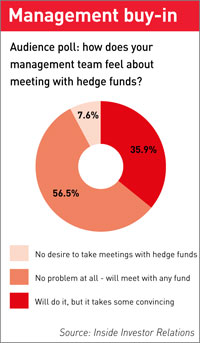

Over the last several years, IROs have become more comfortable meeting with hedge funds and treating them as they would any other investor. The same cannot always be said for management, however. In a poll of the webinar audience, listeners were asked how their management feels about meeting with hedge funds.

Just over half (56.5 percent) said management has no problem at all and will meet with any fund. But a significant minority (35.9 percent) said that while management will meet with hedge funds, it takes convincing.

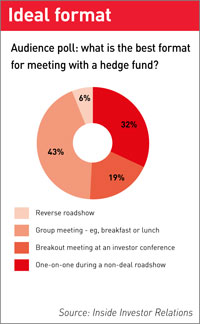

Smith advised IROs to be aggressive with the sell-side firms organizing conferences to make sure management gets one-on-ones with the right kind of hedge funds. He also suggested putting the hedge funds you are more cautious of into group meetings to help soften up their questioning. ‘It seems like they are less likely to ask you something that would be a Reg FD violation if their competitors are in the room listening to your answer,’ he explained.

For finding out about hedge funds in advance of meetings, Hyde-Dunn said she uses a mix of market intelligence services, brokers and internal research. ‘If you still can’t find any information on them, then when you’re talking to them on the phone, just ask,’ she added. ‘They’re more than happy to tell you about the firm, how long they’ve been in business, what their typical holding time frame is and why they’re interested in your space and your sector.’

Speaking more generally, both panelists advised IROs not to treat hedge funds differently from other types of investors, as today hedge funds can be some of the most supportive long-term shareholders. This is certainly the case at Visa, where hedge funds have been key shareholders and supporters of the stock since the credit card company’s $18 bn IPO in 2008.

‘We still have many hedge fund firms that have been shareholders since day one of our IPO and throughout the past three years,’ said Hyde-Dunn. ‘They’ve even added to their positions. Some have sold a little, but on the dips they’ve bought back up.’

The full webinar, part of a series of executive briefings on key topics for IR professionals, is available to listen to here.

This article appeared in the September print edition of IR magazine.