Second annual event held by IR Club and Cometis in Frankfurt

IROs who gathered for last week’s IR 2014 conference, held jointly by IR Club and Cometis, arrived to a traditional Frankfurt welcome. On the night before the one-day event, attendees were invited to eat, drink and be merry at one of the city’s oldest Apfelwein (apple wine) taverns.

Seated on long wooden benches, the assembled group enjoyed jugs of apple wine and platters of food, including grie soss (green sauce), said to be the favorite dish of German polymath Goethe.

Your correspondent thoroughly enjoyed the evening. Given the 8.30 am start the next day, however, I decided not to follow the suggestion put to me by one guest that you must drink five glasses of Apfelwein before you can truly appreciate it.

Hosts Patrick Kiss and Michael Diegelmann open IR 2014

The conference was the second annual event put on by IR Club, a German-language social media site for IROs, and Cometis, the Wiesbaden, Germany-based financial communications firm.

A total of 190 people signed up this year, says Patrick Kiss, head of IR at Deutsche EuroShop and founder of IR Club, up from 162 in 2013. A plan to keep the number of sponsors in check worked out well, as more than half the attendees came from listed companies.

After an introduction from Kiss and Michael Diegelmann, founder and director at Cometis, the conference kicked off with a panel discussion about IR careers. Diegelmann said the country’s IR industry still has plenty of growth potential given that companies have further to go in recognizing the importance and benefits of investor relations.

The morning also saw a presentation on how to find and connect with the right investors. Brendan Fitzpatrick, managing director for analytics and targeting at Ipreo, offered up some advice on adding to your shareholder register.

Roadshows are better than investor conferences for getting to the key decision makers, he said, because when you’re at an investor’s office, the portfolio manager is more likely to make it to the meeting.

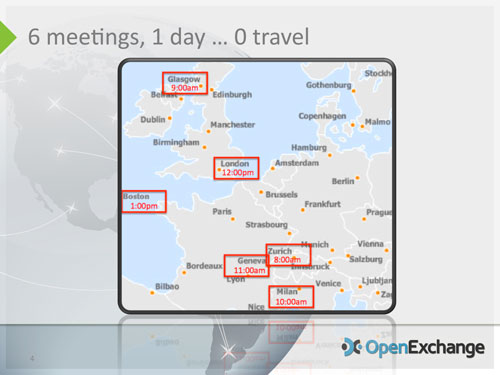

Mark Loehr, CEO of OpenExchange, a platform that facilitates virtual meetings between companies and investors, spoke in the same session. Virtual meetings have really taken off in the last four months, he told the audience, citing several examples of large US companies adding virtual components to their roadshows. In one case, an issuer conducted six meetings across two continents and four countries, all before lunchtime.

Of the last 100 virtual meetings, 60 percent were international, 50 percent were group meetings – and 90 percent were sell-side supported, said Loehr. The sell side has played a key role in any multi-party or multi-session virtual meeting as its expertise at logistics and selecting investors has been very helpful, he explained.

Mark Loehr of OpenExchange gave examples of recent virtual roadshows

He added that direct meetings between companies and investors tend to take place where both sides are extremely comfortable with videoconferencing and OpenExchange’s platform.

After lunch, a packed room gathered to hear a panel on corporate access, featuring two speakers from the UK and one from Germany. Corporate access is a hot topic right now in the UK, where the regulator is putting pressure on investors to stop paying for access via trading commissions.

Michael Hufton, founder of ingage, a new online service that aims to connect companies and investors directly, outlined new rules proposed by the UK’s Financial Conduct Authority that aim to make investors pay for management meetings from their own costs.

This is likely to affect the way institutions engage with companies, said Hufton, who believes investors will look to bypass the sell side to reduce the amount they spend on corporate access. The issue will affect German companies that market to investors based in the UK, he added.

John Gollifer, general manager of the UK’s IR Society, said he expected the new corporate access rules to play out over a couple of years rather than have a big immediate impact. Given the service provided to companies by brokers, the ‘last thing’ UK companies want – especially smaller companies – is for the sell side to ‘fall away,’ he commented.

The broker’s perspective came from the third panelist, Nils Wittenhagen, director of institutional sales at Close Brothers Seydler Bank, who made the case for the continued role of the sell side in the corporate access chain. His daily contact with portfolio managers makes him highly valuable to issuers that do not have the same level of access or insight, he pointed out.

Audience polls conducted during the session highlighted mixed feelings among German companies about the state of the corporate access industry. Just under two fifths said they were concerned about ‘inherent conflicts’ of interest in the current system, while 35 percent said they weren’t sure.

The final panel of IR 2014 considers the future of equity investing in Germany

A majority of 60 percent said the current system didn’t enable them to reach all the investors they would like to, though the question was admittedly setting the bar very high for the status quo.

A final session tackled the attitude of the German public to equity markets, where individuals are more reluctant to invest in shares and equity funds than in other European countries, such as the UK and France.

A slide shown by one panelist noted that the number of private shareholders in Germany has declined by 100,000 since 2012. The overall view of the panel was that more needs to be done, in terms of education, investment and enthusiasm, to boost interest among Germans in stock market investing.