The IR Magazine Awards & Conference - South East Asia 2016 showcased the region's broad spread of IR talent

The IR Magazine Awards – South East Asia used to be all about Singapore – but not anymore. While DBS Group, based in the city-state, put in a strong performance at this year’s event, companies from other countries showed the region now has several centers of IR excellence.

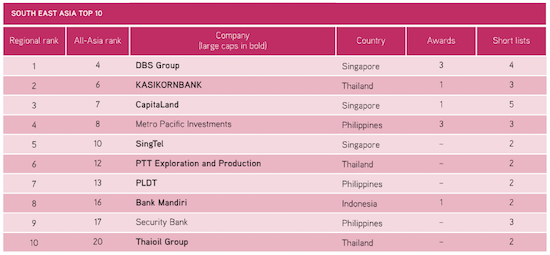

The grand prix for best overall IR highlights the regional diversity of the winners. The large-cap award went to DBS Group, the mid-cap to Metro Pacific of the Philippines and the small cap to Garuda Indonesia. Even stronger evidence comes from the South East Asia Top 25 rankings: firms from Indonesia, the Philippines, Malaysia and Thailand boast 9 places; in the top 10, they occupy seven spots.

Kamar Samuel (right) from Financial PR presents the grand prix for best overall investor relations (large cap) to Michael Sia of DBS bank

Singapore still delivered several winners, with CapitaLand notable among them. The firm’s long-standing and successful head of IR, Harold Woo, recently moved to a more senior role, but his replacement Rui Hua Chang showed why she was given the job by winning the best large-cap IRO award. Woo, meanwhile, picked up a lifetime achievement award for his services to the IR industry.

The awards followed a morning conference where panelists discussed career boosting, best practice trends and dealing with activists, among other issues (see Conference recap: Sound bites from Singapore, below).

You can read the research behind the awards in the IR Magazine Investor Perception Study – Asia 2015/2016, which includes interviews with award-winning IR teams, investor feedback on IR practice and rankings for more than 110 companies in South East Asia. To order a copy, please contact Dahman Djimani at [email protected] or +44 20 7749 9138.

Grand prix for best overall investor relations

Large cap: DBS Bank

What the investment community says

‘Financial reporting from DBS is very progressive and it thinks about integrated reporting standards. We get clear and regular updates and good access to management’ – Singapore, sell side

Mid-cap: Metro Pacific Investments

What the investment community says

‘I’m nominating Metro Pacific because of the organization of its IR briefings and the answers from a thorough investor inquiry service that demonstrates good knowledge of the business’ – Philippines, sell side

Small cap: Garuda Indonesia

What the investment community says

‘The most improved of all my companies is Garuda as it is now a lot more proactive and has started doing profiling on corporate access and investor events. There is more information and it is more talkative. This year it also attended our conference’ – Singapore, sell side

Best investor relations officer

Large cap: Rui Hua Chang, CapitaLand

What the investment community says

‘The investor relations department is easy to talk to and we get answers to our questions. Generally, CapitaLand’s IR is more transparent and more intelligent than most’ – Singapore, buy side

Small & mid-cap: Albert Pulido, Metro Pacific Investments

What the investment community says

‘Albert Pulido is responsive and provides good meetings and access’ – Philippines, sell side

Lifetime Achievement

|

|

After nearly 20 years in stockbroking, Harold Woo joined CapitaLand Group as head of IR in 2003. A multiple winner of the IR Magazine Award for best IRO and collector of numerous other awards over the years, in 2015 Woo moved on to a new role at CapitaLand, as senior adviser for investor and partner relations. He remains very involved with IR, however, and continues to report to CFO Arthur Lang. He also remains president of the Investor Relations Professionals Association (Singapore), a position he has held since 2012.

Best sustainability practice

DBS Bank

What the investment community says

'DBS keeps us abreast of its sustainability actions' - Singapore, buy side

Best IR by an SGX Catalist Company

MegaChem

Best IR by a senior management team

Large cap: Lance Gokongwei (CEO), Universal Robina Corporation

What the investment community says

'The IR team at URC just seems to know all the answers. I've never heard anyone say, We'll get back to you. The CEO makes the effort to meet us and good guidance is provided' - Singapore, buy side

Small & Mid-cap: Alvin Lao (CFO), D&L Industries

What the investment community says

'Alvin Lao, CFO at D&L industries, stands out for his willingness to help investors and analysts' - Singapore, sell side

Best in sector

Communications & technology: Singtel

Consumer: Universal Robina Corporation

Energy: PTT Exploration and Production

Financials (excluding real estate): DBS Group

Healthcare: IHH Healthcare

Industrials: Precious Shipping

Materials: PTT Global Chemical

Real estate: CapitaLand

Utilities: Metro Pacific Investments

Best in country

Indonesia: Bank Mandiri

Malaysia: IHH Healthcare

Philippines: Metro Pacific Investments

Singapore: DBS Group

Thailand: KASIKORNBANK

| Conference recap: Soundbites from Singapore A panel on career-building at the IR Magazine Conference – South East Asia 2015 was, by coincidence, all women: ‘By building my reputation as somebody who really knows the technology industry, I became a source for a lot of the investment community as well as for management and the board. Building your own brand is incredibly important’ – Jeannie Ong, chief strategic partnership officer, StarHub, and director of the Investor Relations Professionals Association (Singapore) ‘Companies don’t just hire a fantastic, credible IRO. They hire people. So who are you holistically as opposed to just who you are in your job? Thinking about how you show up as an entire person can really help your credibility, particularly if you’re taking on leadership opportunities for charitable organizations’ – Christina Southgate, head of executive search for Asia-Pacific, LinkedIn ‘A qualification or certification is important, but you don’t need an MBA to be a successful manager. Instead, certification gives people confidence and an important link to others’ – Sarah Crawshaw, managing director for Asia-Pacific, Taylor Bennett Heyman ‘I have two types of stakeholders: internal and external. External stakeholders are CapitaLand’s investors, both institutional and retail, as well as equity and fixed income. Internal stakeholders include different strategy business units. As an IRO, I’m working horizontally and vertically throughout the organization’ – Rui Hua Chang, head of investor relations, CapitaLand A ‘fireside chat’ about shareholder activism gave IROs practical tips to pre-empt activist campaigns: ‘We issued a corporate update right before the activist went public. We felt a lot of things had to change – and rapidly – but we realized we hadn’t been telling the entire story in our annual or quarterly reports. We needed to explain things much better. The lesson learned was to assess what you’ve been doing and communicating because maybe it’s not enough’ – Peter Poli, outgoing CFO for Grand Banks Yachts Other sessions covered more on best practices in IR. Case study presentations from Metro Pacific Investments, Thai Union Group and Asia Aviation, with particular attention on Asia Aviation’s structured and measurable IR revamp, are available to view online here.  Jeannie Ong speaking on her panel |

Sponsors of the IR Magazine Awards & Conference - South East Asia 2015

This article appeared in the Spring issue of IR Magazine