Before the headlines about Reddit investors driving massive spikes at GameStop, AMC Entertainment, Rocket Company and others, there are signs that investing groups were at least contributing to – if not driving – changes in trading volume, share price and ownership.

Often in these investing groups – which include WallStreetBets, PennyStocks, RobinHoodPennyStocks and others – users publish due diligence (DD) posts. These can go deep on a company’s financials and recent announcements to produce a recommendation to buy or sell. These DDs can get hundreds – and now thousands – of upvotes and comments.

The old adage is that retail investors don’t drive price movement or changes in volume because, as individuals, they’re too small. But Reddit investing groups could challenge that notion. We wanted to know whether hundreds of people all buying hundreds of shares at the same time can have a bigger impact than previously imagined. So IR Magazine provided IHS Markit with links to 20 popular Reddit posts to explore the impact the DDs had on the stock. We wanted to remove any noise or distortion that may have been caused by recent interest in these groups, so all 20 posts are from 2020 or earlier.

The companies mentioned in the Reddit posts are almost all small caps, and Christopher Blake, director of research and analysis at IHS Markit, says that’s illuminating in itself. ‘Sometimes we see headlines that imply that retail is driving the entire market,’ Blake says. ‘Those concerns are a little overstated. There’s a difference between the ability to drive the whole market and the ability to drive GameStop.

‘When we look at this analysis and the tickers most commonly being discussed on Reddit, we see an inherent bias toward smaller companies with less liquidity that retail could have an impact on. Whether it’s correlation or causation, this data shows that yes, they could impact your stock and volume.’

Median volume change was 870 percent

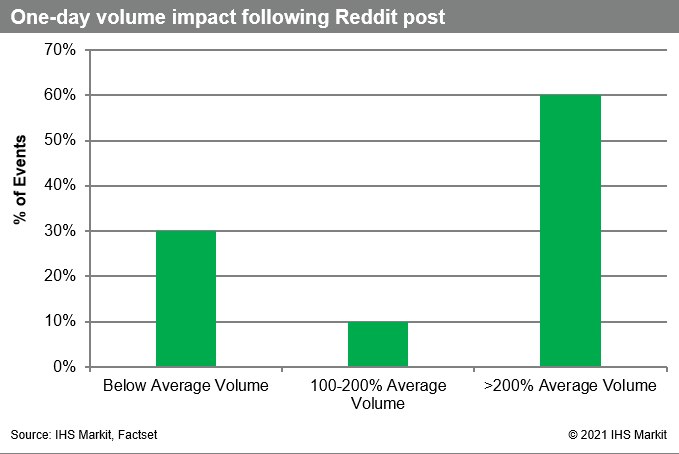

The IHS Markit team looked at the trading volume averages for each of the 20 companies in our study, comparing the average volume for the prior 30 days to the volume on the next trading day after a popular Reddit post.

In 60 percent of the cases we looked at, trading volume was more than 200 percent higher than the 30-day average. In 10 percent of the cases, it was 100 percent to 200 percent higher, while in 30 percent of cases it was actually below average. The median volume change was much higher, at 870 percent.

It’s unlikely that retail investors on Reddit are driving these volume changes in their entirety, Blake says, but they may cause spikes in volume that catch the attention of quant hedge funds, which further drives momentum.

‘It’s safe to say at a high level that there are quantitative hedge fund models that look at more variables than any of us can comprehend, and it’s a safe assumption that volume is one of those metrics,’ he explains. ‘Momentum leads to more momentum. It’s really hard to say with 100 percent certainty when the volume is elevated whether that has come from retail [or] other sources, but in this case it’s safe to say it’s both. The retail guys are going out and buying, but the quant traders are picking up on it as well.’

In light of what happened at GameStop and other companies, Blake says it’s likely that quants are keeping track of the tickers being discussed on Reddit now, if they weren’t already.

Stock prices moved after Reddit posts

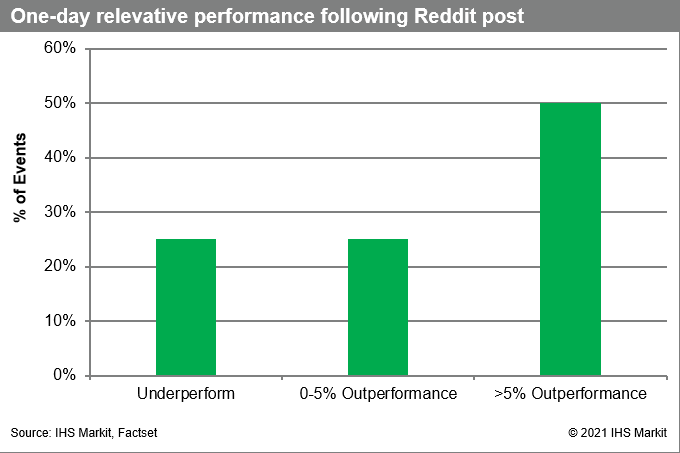

The IHS Markit team looked at price performance on the next trading day, relative to the market. The market was measured using either the Russell 1000 or Russell 2000, depending on the company’s market cap at the time of the post.

Half of the companies we looked at experienced a 5 percent or higher stock price increase on the next full trading day after a popular Reddit post. The median performance was much higher, at 19 percent. Five of the posts preceded outperformance of less than 5 percent, while the other five preceded underperformance.

Alexander Yokum, senior associate at IHS Markit, also points out that the retail investors weren’t wrong with their picks. The median outperformance for the 30 days after the Reddit posts was 10 percent but, Yokum adds, these posts were made during a bull market.

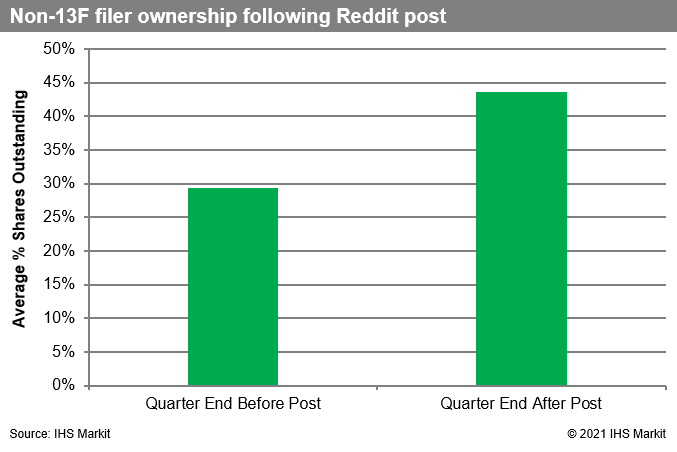

Percentage of owners that don’t file 13Fs increased

Finally, we wanted to look at whether the changes in trading volume and temporary share price increases led to a lasting change in companies’ shareholder bases.

IHS Markit looked at the percentage of non-13F filers in the quarter-end before the Reddit post and the quarter-end after the post. Non-13F filers aren’t exclusively retail investors – they can also be funds with less than $100 mn in assets under management, or foreign investors – and they’re calculated by taking the shares outstanding at quarter-end, adjusting for short interest double-counting, and subtracting any known ownership from public filers or insiders.

In the quarter-end before the Reddit post, the median non-filer ownership was 29 percent. In the quarter-end after the post, it was 44 percent –a striking 15 percentage-point rise. There was also a very small increase (2 percentage points) in hedge fund ownership in the companies we looked at.

Neither GameStop nor AMC Entertainment were included in the study with IHS Markit, but both serve as dramatic and extreme case studies for the impact Reddit investors can have on a shareholder base. Before GameStop’s price rose so dramatically, Fidelity owned 9.3 mn shares. By the end of January, it owned just 87. Similarly, at AMC Entertainment, Silver Lake sold its $713 mn stake in the company after its share price increased fivefold.

What does this mean for IR teams?

One of the companies that has been discussed extensively on Reddit, and was part of this study, is Ideanomics. The small-cap financial technology company has attracted interest from short-sellers – ‘we got punched in the face a little by shorts,’ says Tony Sklar, the company’s senior vice president of investor relations – and has had a volatile year in the markets.

Sklar says he is unaware of the discussion of Ideanomics, which continues now, on Reddit but that the company values its retail shareholders. He adds that the IR team produces a frequent company newsletter for retail shareholders, having pulled back from issuing a high volume of press releases after the short interest intensified.

This analysis found that small-cap, thinly traded stocks are more likely to be at risk of retail investors having an outsize impact on their share price.

‘If there’s a post about your company, you also want to have some level of understanding about the degree to which it could impact your stock,’ Blake says. ‘There are some companies that can probably be safely nonchalant, but that’s not everybody. Understand the extent to which you’re exposed now and the extent you could be at risk if there’s a concerted effort in the future.’

For companies that are in the at-risk category, it’s worth having a crisis communication plan in place, says Michael Miller, executive director of investor relations advisory at IHS Markit.

‘There’s a proactive aspect from an IR perspective,’ he says. ‘Have a crisis plan in place so if companies in industry or with a similar short interest as yours are affected, you might want to let your CEO or CFO know that it can lead to long-only investors exiting the stock. If that happens to you, you can be proactive while that’s happening to start to build a targeting plan when those long-only investors are gone.’

It’s also worth noting that since the GameStop situation emerged, membership of these Reddit investing groups has exploded. In July WallStreetBets had 1.4 mn members; as of March 2021, it has 9.4 mn. It’s possible, if not likely, that the impact of these groups could be even greater now than it was last year.