IR Magazine hosted a webinar in March, asking: where’s the value in social media?

Three IR professionals using social media in their day-to-day jobs took part in an IR Magazine webinar in March, during which they discussed the value they get from tools like Twitter, Facebook and blogs for investor communications. The event was sponsored by Hemscott, a Morningstar company.

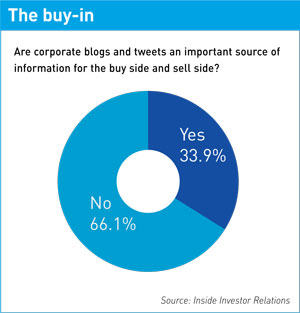

While there is plenty of interest in social media among IROs, many companies remain skeptical of their value. Indeed, in a poll conducted during the webinar among audience members, roughly two thirds said they do not think corporate blogs and tweets are important sources of information for the buy side and the sell side. It was useful, therefore, to hear about the experiences of three IROs who have already taken the plunge.

For Andrea Wentscher, IR manager for retail investors at BASF, social media have helped the chemicals company to broaden the group of people it reaches. On the webinar, Wentscher explained that BASF’s 400,000-odd retail shareholders have traditionally been located in Germany, but the company is now beginning to make contact with private shareholders in other markets, like the rest of Europe, Asia and the US.

The IR department has also established contact with local retail banks and chemicals industry associations that were not previously on BASF’s distribution list. ‘Social media provide for us an opportunity to reach new contacts,’ said Wentscher.

Working the web

Feedback collected over the last 18 months while using a number of different social media tools for IR convinced Patrick Kiss, head of investor and public relations at Deutsche EuroShop, to make social media an integral part of a new corporate website that launched this March.

The new site includes links to Deutsche EuroShop’s Twitter, Facebook, YouTube and SlideShare accounts, embedded YouTube videos and SlideShare presentations, and an IR-specific blog, called ‘IR Mall’ – a suitable name for a company that invests in shopping centers.

In conversations with the investment community, Kiss said he and his colleague in the IR team are pointing out the existence of the blog in the hope investors will begin to use it as a first port of call whenever they have a question. ‘This should be the platform that makes our professional life easier – at least hopefully,’ commented Kiss.

There has already been a lot of positive feedback, he said, although he added that he does not expect much engagement from the investment community through the blog or other social media channels, because investment professionals are often not allowed to make comments on social media.

The third and final panelist, Friederike Edelmann, director of investor relations at SAP, is a relative newbie to social media. She began using them for IR only around 12 months ago after noticing that other technology firms were embracing the practice. ‘We started looking at it from an IR perspective about a year ago,’ Edelmann said.

‘The main concern we had was legal issues, but also what size budget [we would] need, what resources we would need. As you can imagine, resources – even at SAP – are limited. As a tech company, however, we need to be up to date with technology.’

But Edelmann cautioned against using technology simply for technology’s sake. ‘We have to make sure it adds value, so before you start using any of these technologies for your communication make sure… you can update the pages, you can update the feeds and keep the news flow going,’ she recommended.

Value for money

One difficulty with social media is demonstrating value, particularly to senior management. When investment professionals will not engage over these channels, it makes it hard to justify their use. This point was driven home by the news in February that Austrian company Strabag had stopped using Twitter for IR, citing a lack of interest and engagement.

During the webinar, the panel trio explained that their bosses are already social media converts and are happy for them to experiment, so the pressure is off to demonstrate value on a day-to-day basis.

Kiss recalled that, while on a roadshow in the US, several investors had asked his CEO (who was sitting next to him at the time) what Deutsche EuroShop does on Twitter and Facebook, and whether they could view some of the company’s properties on YouTube. ‘He realized that, after we had already found big investors via web 1.0, maybe the next step could be web 2.0 – so he is very positive,’ said Kiss.

Another reason to get involved in social media now is that it seems communication will increasingly take place over these channels, the panel predicted.

‘I think the whole area of communication will change and we as companies – as IR departments – have to adapt because the young people, the young generation, will be our next contacts within the next five or 10 years,’ said Wentscher.

Click here to listen to a full recording of the webinar.