Cometis app matches corporates to best exchange depending on listing requirements

A new smartphone and tablet app developed by Cometis promises to link corporate bond issuers with the German stock exchange that best suits them, providing what it calls a ‘decision aid’ to busy executives.

The program, currently available from both the Apple and Android app stores, is known simply as Bond App. It is intended for use by CEOs, CFOs and IR managers at existing or potential bond issuers to obtain a quick overview of potential bond listings to see how they might fit their company.

‘It serves as a decision aid for issuers, suggesting which stock exchange is suitable for the issuance of a corporate bond and the obligations that might follow,’ explains Ulrich Wiehle, Cometis’ CEO. ‘Together with our partners, we can offer all issuers a practical and concise guide to the capital markets once again.’

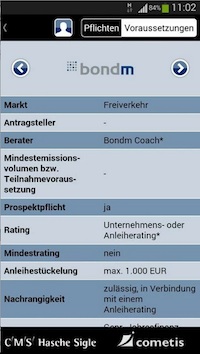

The Bond App in action

Users are able to browse by exchange and see questions outlining the listing requirements of each

The app currently lists the main exchanges in Germany – including the Frankfurt Stock Exchange, Börse Stuttgart’s Bondm and the exchanges in Dusseldorf and Munich – along with their listing requirements, though there are plans to expand it.

Corporate users are able to browse by exchange, too, and see a list of questions outlining the requirements of each listing. These include, among others, which documents to submit, the minimum issue size (if any), the necessary credit rating (if any), and the deadlines for publishing annual and bi-annual reports.

Cometis sought the help of exchange operators Deutsche Börse and youmex, as well as corporate law firm CMS Hasche Sigle, in developing the app.

Eric Leupold, head of issuer and primary market relations at Deutsche Börse, notes that demand for corporate bonds as a finance vehicle means the app will provide a vital link for potential issuers. ‘Businesses are increasingly using the bond segments as previously they might not have had any point of contact with the correct capital markets,’ he says. ‘With the Bond App and our recently published best practice guide on entry standards for bond issuers, all the relevant information is available at a glance.’