Senior managing director Rob Berick says new service allows companies to track the impact of online conversations on stock price

When it comes to social media, talking might be optional – but listening is essential. That’s the rationale behind a new product developed by IR, media and corporate communications firm Dix & Eaton to help companies monitor social chatter and analyze its impact on their stock price.

The IR Web Intelligence system, set to be launched this month, aims to break down social media and blog discussions to ascertain what’s being said, where, the tone and which voices carry the most influence.

The service includes real-time analysis of data and IR counsel based on that analysis, comments Rob Berick, Dix & Eaton’s senior managing director who oversees the firm’s investor relations practice.

‘From a risk management standpoint, if you become aware of someone who is blogging as if he/she was a disgruntled employee, it would allow you to see where the source of the rumors are coming from and measure the reach,’ he explains.

‘You could see what this person’s Twitter reach is, how many followers he/she has, how many times he/she is being retweeted. Is it a gadfly or a source of potential damage to your company’s valuation? Or reputation?’

The new product was developed with Berick’s marketing colleagues, who already had a system to monitor social networks. Together, they took this existing tool and ‘changed the sonar settings’ to track investor conversations.

‘The philosophy behind it is really rooted in how marketing folks are looking at the social media channels for customer data and consumer data,’ Berick states.

‘I thought there was probably a lot of richness that could be gleaned from an investor standpoint as more conversations are taking place in the social space.’

One of the key features of the new product is its ability to compare social conversations and trading data, adds Berick.

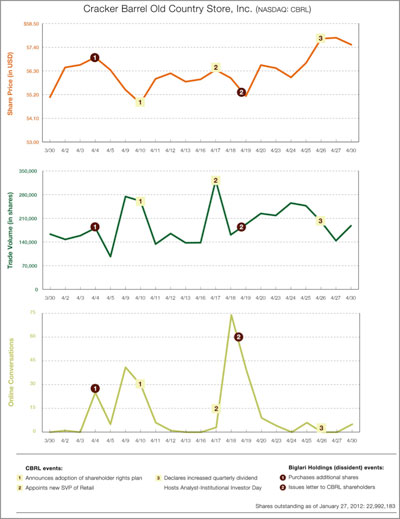

To test the system, he went back and recreated the noise around US restaurant chain Cracker Barrel’s proxy fight last year against Texan investor Sardar Biglari.

Cracker Barrel is not a client of Dix & Eaton’s now and wasn’t at the time of the proxy fight.

‘In this particular case, it was pretty telling to see how much the conversation volume tracked with the trading volume,’ Berick says. ‘You could go back to see the conversation during those heavy trading days and what news flow was influencing the stock.’

Dix & Eaton’s new service tracked online conversations about Cracker Barrel against trading volume and share price

The growth of sites like StockTwits, an investor-focused social network with roughly 200,000 users, and Seeking Alpha, the stock market blogging community, underlines the popularity of online channels for investment news and debate.

While social media have long been on the minds of IR teams, Berick says too much focus has been put on whether or not to engage.

‘It occurred to me the hole in the discussion is that very few people are talking about listening – whether you talk or not, you should be aware of what’s being said,’ he concludes.