Roundtable participants see the potential of social media tools, even if they are not using them yet

Broadly speaking, IR professionals have yet to embrace social media. They remain to be convinced of its value for communicating with investors and analysts. They also have significant concerns about compliance issues. But there is plenty of interest in the topic among IROs and they are actively exploring ways in which social media could form part of their future communications strategies.

That was the message from IR magazine’s roundtable on social media and investor relations, held in November last year in partnership with Hemscott, a Morningstar company that provides a host of online communications services, including the design and build of corporate websites.

A case in point is the use of blogs. One roundtable participant explained how her company has used blogs to reinforce the company’s strategy and answer questions that are being posed repeatedly by stakeholders. This method gives the company a way to push its message, receive feedback and provide answers to frequently asked questions, she said. On the topic of blogs for IR, however, she was hesitant. She had considered the issue and did not yet see the point of developing a blog specifically for the purposes of IR, as it would be hard to say anything interesting that was not commercially sensitive.

Other members of the roundtable also expressed concern about the compliance risks of using social media. This was particularly true of one participant from the financial services industry, who explained how special rules apply to discussions around financial products. ‘Our biggest problem is compliance,’ he said.

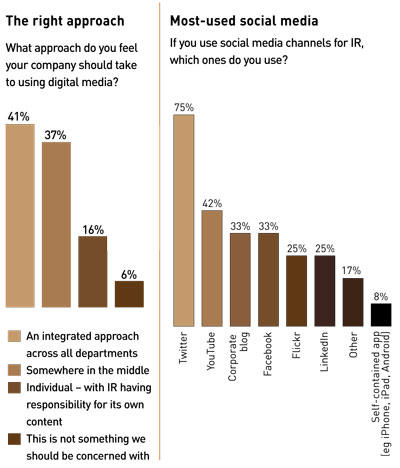

The caution over social media expressed by the participants is mirrored more broadly among IR professionals, according to a survey conducted by IR magazine as research for the roundtable. The survey canvassed the opinions of 50 IROs from Europe, and found 78 percent do not use social media in any form for their investor relations activities. Many of those who answered in the negative say they do not view social media as good for staying in touch with their key audiences of investors and analysts. ‘In IR we reach our contacts through our public statements and an extensive roadshow program,’ commented one respondent from a UK-based oil and gas company. ‘For me the immediacy of social networks is unnecessary, and content would be artificial.’

‘I am doubtful institutional investors have time to follow them and our retail shareholder base is small so it’s not worth the effort,’ said another respondent, this time from a central European electricity firm.

Of the 22 percent of survey respondents who do use social media, the majority (75 percent) say they use Twitter, with YouTube the next most popular, at 42 percent. It’s not surprising Twitter is the most commonly used tool among European IR professionals, given its ease of use and the way it helps drive web traffic to the corporate website.

Over the last couple of years, many companies, including SAP, BASF and Dell, have begun using Twitter to support their IR activities. SAP and BASF use the micro-blogging tool to drive web users to releases on their respective company websites, while Dell tweets headlines and links from its IR-specific blog, DellShares.

Twitter effect

Twitter is also useful for handling crisis situations, as the roundtable participants noted. Increasingly, members of the public are voicing protest about issues that concern them on Twitter, and companies are responding by not only monitoring discussions, but also directly reassuring stakeholders via Twitter.

One participant explained how Twitter had come in useful after an accident at her company left thick smoke drifting over parts of southern England. Members of the public could see the smoke and began tweeting about it on their personal Twitter accounts. By monitoring Twitter, the company could identify and contact individuals concerned and explain to them what had happened and reassure them that they were not at risk.

Again, the question was raised as to what extent this could be useful specifically for IR. One participant said he would prefer if investors or analysts who had problems got in touch directly.

Whether or not companies actively participate in discussions on Twitter, however, the roundtable participants agreed it is vital to monitor what people are saying, either in the IR department or more broadly, via corporate communications.

Meeting requirements

One area where social media could revolutionize IR is the annual shareholder meeting, said one attendee. The AGM takes an enormous amount of time and effort to set up and host, yet many companies find little interest in the event among the investment community.

Participants recalled meetings they have been involved in when the most pressing concern among delegates was how many free products they would get to take home. But the AGM is a great opportunity to interact with investors and analysts, and technology may offer a way for it to fulfill its potential – it could be streamed via social media channels, suggested one attendee. This would raise the number of potential viewers and make it easier for them to submit questions. ‘There must be a better way of engaging at the AGM using technology,’ he said.

Clearly, there is broad interest in using social media for IR, but the case has not yet been made, so most stay on the sidelines, watching what a few firms are trying out. It seems this is just the beginning of the discussion for many IROs.

Roundtable rules

IR magazine hosts invitation-only roundtables throughout the year, gathering IR professionals in an environment where they can discuss hot topics affecting their industry. The roundtables operate under Chatham House rules, so there is only anonymous reporting of what is said. Other recent roundtables covered the healthcare sector and market fragmentation. For more information, please visit www.irmagazine.com/events.