Tim Human‘s column on the latest tech developments in IR

Derwent Capital shot to fame last year when it launched a hedge fund based on Twitter sentiment. Just a month later – during which period Derwent marginally beat the market – the fund quietly folded and work began on a trading

platform allowing other investors to track social media signals.

That platform went up for sale at the start of 2013 via an online auction. Despite a guide price of £5 mn ($7.7 mn), bids had reached only £120,000 when the auction closed.

For Derwent, the riches supposedly buried in the Twitter stream never materialized. But that hasn’t dampened the mood among other finance professionals about the potential of social media sentiment to guide investment decisions.

Colt Technology, the data management firm, recently completed a survey of 360 UK-based financial professionals, including brokers and heads of trading desks, that finds most believe stock valuation can be ‘directly linked’ to public sentiment on social media networks.

Unlike Derwent, however, most respondents do not view social media as a leading indicator: just 7 percent take this view. A much larger 45 percent regard channels like Twitter and Facebook as lagging indicators for the stock market.

The respondents also note concerns about sentiment-based trading. In particular, they worry about the volume of data, the need to react quickly to mood changes, and the ability of current tools to separate useful information from noise.

‘The technology has got to mature quite a bit more before it becomes the norm,’ says Hugh Cumberland, solution manager for payment and settlement services at Colt. ‘But even then very few people would use it as the sole reason to trade. It will probably be just a supporting piece of information.’

Cumberland points out that the output from social media networks cannot easily be harnessed for real-time trading. ‘High-frequency trading is based on highly structured,highly efficient price data,’ he explains.

‘But we’re talking about huge amounts of data that’s unstructured and in no specific format, so it potentially needs quite a lot of massaging before you can make any sense of it.’

The website’s the thing

Should companies spend more time communicating with the market via social media? Investors and analysts in Asia have offered a clear answer: no.

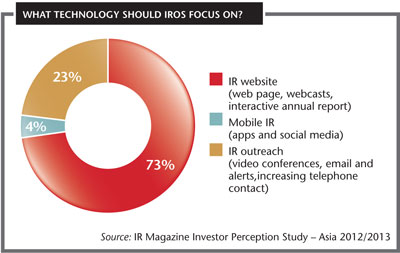

As part of the research behind IR Magazine’s Asia awards program, we asked 100 members of the investment community which technologies they would like IROs to focus on.

Almost three quarters (73 percent) think companies should spend more resources on the website, as well as website-related activities like webcasts and online annual reports, while just 4 percent want more time spent on social media or apps.

One sell-side analyst based in Hong Kong sums up the mood among many who feel basic online information is still too hard to come by in Asia: ‘All I want is quality websites with all the information to hand,’ he says.