A break down of the data from IR Insight’s latest survey of the IRO community

Twice a year, IR Insight, the research arm of IR magazine, surveys the IRO community, asking for information and opinion on practices and topics relevant to investor relations.

During Q4 2011 and Q1 2012, the second round of our biannual global IRO survey took place. In this round we asked respondents a number of questions related to technology, in particular their use of smartphones, tablets and social media.

Nearly 800 IROs responded to this survey and 762 answered questions relevant to the issues covered here. The full dataset for the technology section of this survey, including breakdowns of the data by geographical region, industry sector and market capitalization, is available to professional subscribers to IR Magazine.

IR Insight would like to thank all readers of IR magazine who took part in this survey. Our latest survey round is currently under way and we hope for the participation of as many IROs as possible. If you have yet to receive an email invitation to this survey, let us know and we will ensure you get one.

Tech take-up

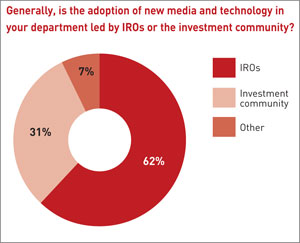

On the one hand, this shows IROs are prepared to take the initiative when it comes to the adoption of new media and technology. On the other hand, it may show the investment community just isn’t that bothered and is disinclined to become an early adopter.

Model choices

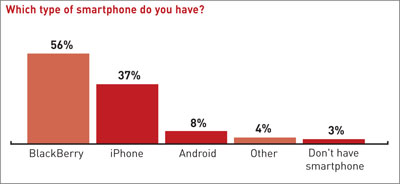

For a long time, the BlackBerry has been the indispensable tool for IROs, but now the iPhone is fast catching up as the smartphone of choice. The business-like appreciation for the BlackBerry (‘I don’t know what I’d do without it!’) is being replaced by the doe-eyed infatuation of the iPhone user (‘I love my iPhone!’). The figure for Android use shows Google has a lot of catching up to do in this market.

BlackBerry remains dominant in North America, but in Asia the iPhone has become the main smartphone for IROs, used by 53 percent compared with BlackBerry’s 40 percent. Among the sectors, IROs in the energy & utilities and materials sectors are still largely BlackBerry users (69 percent and 65 percent, respectively), while in real estate more IROs use iPhones than BlackBerrys, and in the TMT sector it is evenly split (43 percent each).

Taking tablets

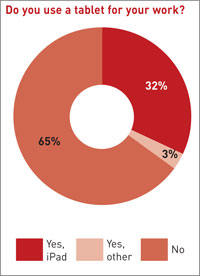

The figures show that either adoption of tablets by IR professionals is at an early stage, or that IROs do not view tablet use as likely to be a necessary part of their work. Among those who do use tablets, it’s all about the iPad.

Critical analysis

Click to enlarge

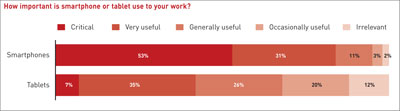

Here we can see how important IROs deem smartphones for their work, with a majority saying the devices are critical and just 5 percent viewing them as occasionally useful or irrelevant. The information here is a record of the opinions of users, which means the views of the majority of respondents who do not use a tablet for their work are not included in the tablet figures, nor is the tiny minority who don’t use smartphones included in the smartphone figures.

We can see that among IROs who have taken to using tablets for their work, they are generally viewed as useful but not essential. Indeed, more people in this group view them as irrelevant than critical to their work.

Platform views

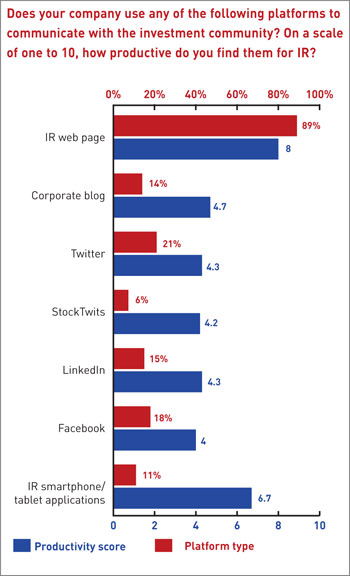

Both in terms of use and perceived productivity, the dedicated IR web page is still the dominant medium for IROs to spread their message. Around a third of respondents use social media in some form, with Twitter being the most popular (21 percent). Again, the views expressed here are from users only. All social media platforms are viewed among users as having low productivity when compared with the dedicated IR web page.

What is noticeable is that, while only 11 percent of respondents have dedicated IR smartphone or tablet applications, those who do have them give them a comparatively high productivity rating (6.7). This suggests such apps could well take off as a medium for communication with investors.

Communication contacts

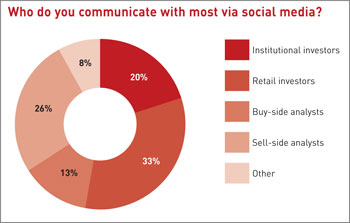

A common expectation here would be to see a heavy focus on social media engagement with retail investors. While it is the area of greatest focus, however, it is not dramatically so. Regionally, the focus is greater in North America (39 percent), while in Asia it is third-placed behind sell-side analysts and institutional investors.

Small and mega-cap companies have a much greater focus for social media on retail investors (46 percent and 48 percent, respectively). But this figure drops dramatically to 27 percent for mid-cap companies and to 22 percent for large-cap companies.

Value-added

In context, measured against other aspects of IR, websites and social media score the lowest. But does this give an accurate representation of their importance to IR practice? Quality of website and social media operations should not necessarily be considered by their intrinsic value, but rather by the way in which they aid and assist the more crucial aspects of IR performance identified here. Contrary to Marshall McLuhan’s idea, when it comes to IR, the medium is not the message.