They say the only thing worse than being talked about is not being talked about. But do companies really want to encourage their shareholders to chat about them in online forums?

There’s been a bit of buzz of late about online shareholder forums. After all, the thinking seems pretty obvious: wouldn’t it be helpful for shareholders if a company provided a facility on the investor relations section of its website to allow them to ask questions and have them answered, to see other shareholders’ questions and answers, and even to chat among themselves? The investors would love it, the theory goes.

‘We are strongly focused on increasing our relationship with our shareholders and, with this new system, we want to meet the requirements of all our investors’ – Ignacio Cuenca, Iberdrola |

But what about the companies concerned – and, more specifically, the IROs, who are responsible for monitoring these online groups, responding to any misinformation posted on them, dealing with legal and other consequences? One company that seems relatively unconcerned about such potential downsides is Iberdrola, the Spanish utility that is often cited as the firm that’s gone furthest along this path with its own version of a shareholder forum, the On Line Shareholders (OLS) system.

Iberdrola is generally well respected by the investment community in investor relations terms. It ranked 23rd among all European companies in the research recently conducted by this magazine to identify the best exponents of IR for the pan-European awards held in London in June (see the IR Magazine Investor Perception Study – Europe 2013). And Iberdrola’s six-strong IR department wins plenty of praise from investors. Take this UK buy-sider, for example, who told our researchers: ‘Iberdrola is outstandingly responsive.’ Or another, who said: ‘You never need worry about Iberdrola’s IR team: it answers your questions and is always friendly.’

Unique approach

The man who leads that team, one Ignacio Cuenca, is justifiably proud of the OLS system, which was launched 18 months ago in January 2012. ‘As far as we know, we are unique in having this kind of system,’ he says. ‘It was developed – and is maintained – in-house by a multidisciplinary team, comprising people from investor relations, communications, all the business lines, internal lawyers, corporate governance and IT.’

And where did the original inspiration come from? ‘The inspiration comes from our belief in taking care of our shareholders – we want to make their relationship with us easier,’ Cuenca adds.

But what exactly is OLS? ‘First of all I want to clarify that this system is not just a forum – it is more than that,’ he says. ‘We are strongly focused on increasing our relationship with our shareholders and, with this new system, we want to meet the legal and personal requirements of all our investors – both retail and institutional – in terms of their right to receive information about the company.’

Cuenca accepts that the legal aspect he refers to may apply only to the annual general meeting – in Spain there is a legal obligation on companies to provide online information in the run-up to their AGM – but he wants to go well beyond the bare requirements of the law. ‘Iberdrola wants to be close to its shareholders and offer them the opportunity to ask anything at any time,’ he explains.

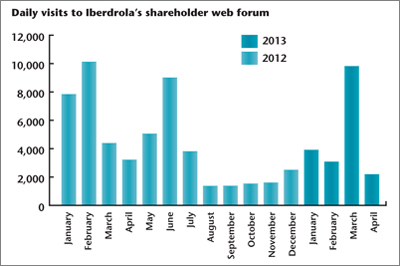

Click on image for a larger version. Source: www.iberdrola.es

Growing impact

So does Cuenca deem the OLS project a success so far? He says any evaluation of the initiative has to take account of the fact that Spanish shareholders ‘are not as active in their contact with the companies they invest in as their counterparts in the US, the UK, Germany, and so on.’ Taking this into account, and despite the numbers not being ‘so impressive’ by comparison with the company’s total shareholder base, he certainly regards the initiative as successful.

By ‘not so impressive’, Cuenca means around 1 percent of the shareholder base, but OLS is used by both institutional and retail shareholders. With a base of around 3,000 visits a day, the level of activity rises during busy times, such as in the run-up to results presentations or the annual meeting, and it has certainly grown during its 18-month-long life.

Source: Iberdrola

Of course, dealing with the system adds to the workload of the IR department, not least because everything has to be reviewed before being published on the site. But the IR people get help from other areas of the business, so Cuenca is not unduly concerned about this. ‘It’s managed by a multidisciplinary team and, although it depends on the time of year, it’s normally no more than an hour a day of any one person’s time,’ he explains.

Iberdrola’s team may be pretty happy with the OLS but most of the company’s counterparts in Europe and North America remain wary of experimenting with online forums. Companies do use them in the run-up to annual meetings but rarely for anything other than that. There are some exceptions – including Intel – but for many companies it’s simply too much trouble or just too risky.

The Wright thing to do

Indeed, of around 20 European IROs contacted by IR Magazine, all but one were at best unenthusiastic. Whether the fact that the only positive one was a gambler – well, Lyndsay Wright, award-winning IRO with UK betting and gaming company William Hill – is a good or bad sign, we’ll leave you to judge.

‘I really like the idea of a shareholder forum,’ says Wright, in her typically upbeat style. ‘It’s not something we’ve come across before but now you mention it, we’re really interested in pursuing it. I think we’d go for a Q&A forum first and then think about enabling shareholders to talk among themselves later if that seemed sensible.’

In North America, it’s the business of Broadridge to be upbeat about such forums. The company offers two versions of its systems for online interaction with shareholders: virtual shareholder meetings, which dozens, maybe hundreds, of companies have taken up and which they use in the run-up to AGMs; and virtual shareholder forums, which are much more like the Iberdrola idea, and which are used by fewer than 20 companies, mostly those with a high retail shareholding.

So in North America, despite an off-the-shelf facility being readily available, it seems companies are simply not using electronic shareholder forums. They worry about breaching regulations, especially the risk of selective disclosure, and generally fear it’s all a bit like a Yahoo! investor chatroom.

‘Shareholders can send emails or post questions on social media’ – Andrea Wentscher, BASF |

Back across the Atlantic at BASF in Germany, Andrea Wentscher, who has chief responsibility for her company’s retail IR and social media activities, sees no need for such a service. ‘Shareholders can send us an email, call us or post their questions on the different BASF social media platforms but we don’t want to give them a way to talk among themselves – certainly not via our own website,’ she observes.

‘Our experience is that institutional investors prefer email, direct telephone calls or meetings. Retail shareholders, too, contact us mainly via email, phone and during the presentations we give within Germany.’

Pointless exercise

At EDP – Energias de Portugal, head of investor relations Miguel Viana makes his lack of interest in electronic shareholder forums even plainer. ‘We are not interested,’ he says. ‘We do not see much value-added in this, and it could cause us some regulatory problems, so there’s no need for us to discuss it. Also, we don’t have any spare IR resources and this would require us to carry out a lot of monitoring.’

But on the other side of the Iberian Peninsula, in Spain, Elena Avila of travel technology firm Amadeus is less dismissive. ‘It is indeed an interesting question,’ she comments. ‘We have discussed it in the past and the conclusion was: not yet.’

Avila cites two main reasons for this conclusion. First, informal conversations with investors have indicated that ‘our usual suspects – who have direct access to us, of course – don’t seem to be overly excited about the opportunity. It’s more popular among the smaller investors, or even retail holders, which we don’t have. But even there I’m a bit skeptical. I think investors prefer firing off their questions directly to my inbox, or the Amadeus IR one.’

Stretched resources

‘Investors prefer firing off their questions directly to my inbox’ – Elena Avila, Amadeus |

Another consideration for Amadeus relates to the resources needed to support ‘an ongoing channel, with appropriate and timely responses’. Avila says her IR team is already stretched as it is, ‘and it would require significant time from someone – and not necessarily someone all that junior – to provide a quality service.’ In short, ‘it would require quite a bit of effort for not a great deal of interest – or, rather, interest only from a very small base of clients.’

Sarah Levy, IRO at the UK’s Kingfisher, echoes Avila’s sentiments about the demand from shareholders and the drain on IR resources. ‘Our feeling is that no one would use it apart from maybe private individuals (a tiny proportion of our register) because institutional investors know us so well they just email or call us directly,’ she maintains. ‘We give plenty of disclosure already and have a very active IR program so this is not something I have ever heard asked for.

‘Someone would also have to monitor activity and I have a very small team, and if we had negative or potentially offensive comments we’d have to take them down, which could be deemed to be selective in nature.’

Chris Hollis, head of IR at LVMH in France is also put off by the call such a forum would make on IR resources. ‘If we were to set up such a forum, we would need to do it properly,’ he argues. ‘This would mean increasing resources, setting up procedures, justifying the investment, explaining the benefits.... And that probably would not be possible.’

No demand

Hollis’ skepticism goes further, however: he doubts the very desirability of company-specific forums, even from the investors’ point of view. ‘Forums already exist – StockTwits, Boursorama, and so on – where several stocks are discussed,’ he points out. ‘If you are an investor, do you want to just concentrate on one stock?’

Hollis certainly agrees it’s important to monitor what is being discussed on the internet about one’s company, ‘but I am not convinced a forum is the best way to hear all that is being said, nor the best way to respond.’

Finally, like other naysayers, Hollis has concerns about the legal risks. ‘As you know, we cannot give any type of confidential information to any investor because that is illegal; and all the publicly available information should be on the website and readily available for all to read anyway.’

Yet none of this appears to be of any concern to Iberdrola, where the IR team remains gung-ho about the use of new kinds of technology for IR. ‘In 2012 we also created a microsite for shareholders, called Shareholders Guide,’ explains Cuenca. ‘In it we included some new tools to allow investors to calculate lots of useful ratios.

Right now the team is working on a web redesign with the primary goal of ‘making it more friendly’. And as IR Magazine went to press, the team was preparing to launch a new shareholder app available in both English and Spanish for iPads, iPhones and Android systems. ‘We are always improving all the information channels for Iberdrola,’ Cuenca concludes.