Visitors to IRmagazine.com offer their thoughts on post-Mifid II corporate access services

The impact of Mifid II on investor relations departments remains a topic of much speculation.

The new rules, due for implementation at the start of 2018, will change how investment firms pay for equity research and could also affect the provision of corporate access services.

Small and mid-cap companies are viewed as particularly at risk from the changes, as brokers focus their attention on larger – and more lucrative – corporate clients.

The actual impact on listed companies remains to be seen, however. Some brokers hope to carry on offering corporate access services along the lines they always have, but in a way that complies with the rule changes.

In addition, any change is likely to be gradual. Changes to corporate access services are likely to take months and years to feed through to the corporate community as brokers adjust to the new regulatory regime.

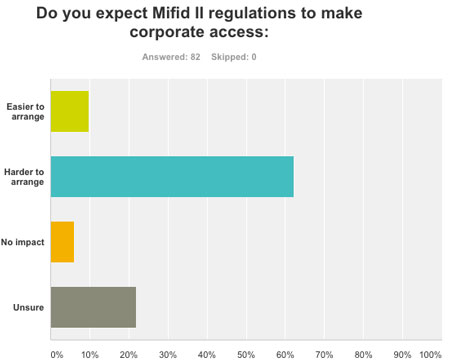

Amid this speculation, we asked visitors to IRmagazine.com what impact they think Mifid II regulations will have on corporate access.

Of the 82 respondents, a clear majority of almost two thirds expect events will be harder to arrange. One in five say they are unsure and few respondents selected the other options.