A third of IROs are promoted to role from within company, finds survey

Arriving at a role in investor relations is not always a straightforward path: for a discipline that requires mastery of several different skills, successful IROs can originate across a range of different careers and sectors. Data from a recent IR Magazine study, conducted alongside specialist communications recruitment firm Taylor Bennett, goes some way to investigating where IROs are made.

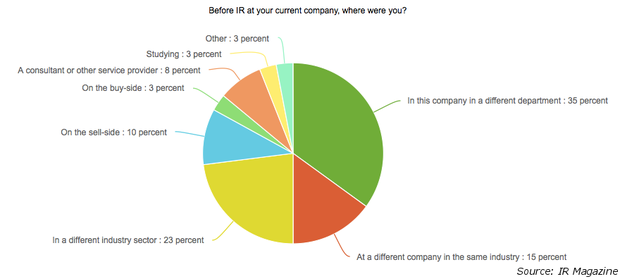

Of the 1,700 respondents to the survey, 35 percent report that prior to their current position in IR they were in a different department at the same company. This figure is significantly higher among IROs – 42 percent – than heads of IR, of whom only 28 percent say they moved internally.

The remainder of the respondents worked at a different company in the same industry (15 percent), in a different sector (23 percent), on the sell side (10 percent), on the buy side (3 percent) or with a service provider (8 percent).

Perhaps unsurprisingly, it is also far more common for respondents at mega-cap companies to move to IR from elsewhere in the company, with just over half (54 percent) saying they moved between departments, compared with 39 percent of large cap, 30 percent of mid-cap and 20 percent of small-cap IROs.

Asian IROs are also slightly less likely to move internally than their US and European counterparts, with 29 percent of respondents from the region saying they came from a role in a different department.

IROs were also asked to describe the job they held before their IR role, if it was at the same company. As might well be expected, 54 percent come from a finance role, while 14 percent had a position in marketing or communications. Only 7 percent were formerly part of the treasury function and 2 percent arrived in IR from a legal role. These figures are largely consistent for both IROs and heads of department, too.

Regionally, there is some variation in where IROs begin their tenure with their current company. A slightly smaller-than-average proportion of Asian respondents, only 44 percent, come from a financial background, though are more likely than IROs from other countries to come from a legal or communications background (7 percent and 22 percent, respectively).

Cap size, too, appears to have some effect. Large and mega-cap IROs are much more likely to have moved to the function internally – 39 percent and 54 percent of respondents, respectively, report this. Almost double the average proportion of small-cap IROs (26 percent) move to IR from marketing or communications rather than finance or other areas, reflecting the changed priorities for smaller or more junior companies.

Next week, we will investigate the professional background of external IRO hires, and by which methods they are most likely to find a new job.

For the purposes of this study, small-cap companies are defined as those with a market cap of less than $1 bn, mid-cap as those with between $1 bn and $5 bn, large-cap as those with $5 bn to $30 bn and mega-cap as those with a market cap of more than $30 bn.