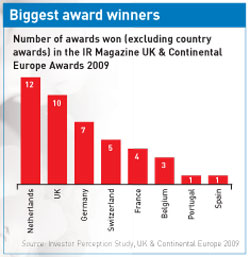

Dutch companies outperformed their peers at the IR Magazine UK & Continental Europe Awards in 2009. IR leaders such as KPN and Akzo Nobel reach out to their investors and operate with a high degree of transparency.

Demonstrably home to some of the world’s tallest people, the Dutch are famous for everything from clogs, tulips and bicycles to a liberal attitude to sex and drugs.

A perhaps lesser-known fact, and one that may be of interest to readers of IR magazine, is that Holland is also home to some of Europe’s finest investor relations departments. Dutch companies put in a remarkable performance at this year’s IR Magazine UK & Continental Europe Awards in London, winning more awards than firms from any other nation in Europe. Companies from the Netherlands won 12 awards, compared with 10 for the UK and seven for Germany. With 42 gongs in total up for grabs (excluding individual country awards), Dutch firms took more than one in four of the trophies going.

Companies from the Netherlands won 12 awards, compared with 10 for the UK and seven for Germany. With 42 gongs in total up for grabs (excluding individual country awards), Dutch firms took more than one in four of the trophies going.

Companies from the Netherlands were also short-listed 28 times, compared with 23 times for Swiss companies and 26 for French companies. All this is pretty impressive given that only 15 Dutch companies were large enough to make it into the FTSE Eurofirst 300 – equating to just 5 percent of Europe’s largest companies – when the awards survey for 2009 was conducted. UK companies comprise around 21 percent of the Eurofirst 300, and German companies around 12 percent.

Companies from Holland have been punching above their weight, especially when you consider the relative size of the stock market in Amsterdam. Dutch companies comprise 20 percent of NYSE Euronext’s Euronext 100 index, which includes the largest companies listed in Belgium, Paris, Portugal and the Netherlands. Factoring in the relative size of Germany’s Deutsche Börse and the UK’s London Stock Exchange makes the Dutch achievement all the more surprising.

Early adopter

So what’s Holland’s secret? Well, firstly, when it comes to public companies, Holland’s colonial legacy gives it a head start. As home to the world’s first stock exchange and first multinational – the Dutch East India Company – Amsterdam has been a leader in the trading of public stocks since its bourse was founded in September 1602.

Secondly, as Veerle Berbers of IR consultancy firm Berbers Consulting notes, the Dutch market’s relatively small size does not seem to preclude its larger players from making a name for themselves on the global stage. ‘Relatively speaking, there aren’t many companies in the Dutch market, but the larger ones are truly global,’ she says.

Kirsten van Rooijen, Dutch account manager at Georgeson, thinks Holland’s openness as a financial center also contributes to its success with international investors. ‘Larger Dutch companies are widely held by large institutional investors in both the US and the UK, and shareholders in Dutch companies are mostly foreign – around 70 percent to 80 percent. That probably helps improve the quality of IR because IROs have to get out there.’

Getting together

Multiple IR Magazine Award-winning Dutch telecoms company KPN is a case in point. Around two thirds of its investors hail from the US and the UK – the US-based Capital Group is the firm’s largest shareholder. Consequently, KPN spends a significant amount of time traveling to meet fund managers. ‘We travel to the UK regularly, meeting our investors and attending investor conferences,’ says KPN IRO Christiaan Schieven. ‘Citi and Merrill Lynch both have two-day London conferences that we attend, and we also travel to London in Q2 and Q4 with the chief executive and CFO. We attend telecoms conferences in other European cities and make between 10 and 20 IR-only trips per year to various locations.’

‘We travel to the UK regularly, meeting our investors and attending investor conferences,’ says KPN IRO Christiaan Schieven. ‘Citi and Merrill Lynch both have two-day London conferences that we attend, and we also travel to London in Q2 and Q4 with the chief executive and CFO. We attend telecoms conferences in other European cities and make between 10 and 20 IR-only trips per year to various locations.’

Gerbrand Nijman, chair of the Dutch IR society NEVIR and head of IR at Aegon, thinks the lively networking scene in Holland helps the nation’s IR community to stay at the top of the game. ‘I think the attitude in the Netherlands is: let’s share ideas. I remember back in 2002 when CFOs from the large and mid-cap firms got together to agree on best practice IR, including rules on closed periods.’

Talking points

Nijman has been a member of NEVIR for some years and credits it with helping to get IROs talking. The association has around 120 members, with around two thirds coming from the corporate community and the remaining third from consultancies.

Nico van Geest, a sell-side analyst at Keijser Capital, thinks there has been a considerable improvement in IR at Dutch companies over the past year. ‘Broker presentations are now often put on the company website – we are seeing increasing numbers of firms putting their debt presentations online, for example,’ he points out.

The past year has provided no shortage of topics for conversation, either. ‘We benefit from being pretty cosmopolitan – we have quite a few international companies listed on the NYSE,’ Nijman notes. Like KPN, Aegon has a significant level of international buy-in. ‘We are 40 percent held by US institutions and we have about 25 percent in the UK,’ says Nijman.

He thinks the international element helps keep Dutch IR at a high level. ‘Dutch firms are often listed on multiple stock exchanges, and senior management generally takes IR seriously,’ he concludes.

A different approach

‘The Dutch approach in general is pretty open and straightforward. I think the Dutch don’t tend to be overly negative or positive,’ comments Huib Wurfbain, corporate director of IR at Akzo Nobel. ‘If you look at the handling of the credit crisis, for example, we have been consistently realistic rather than saying that the world is coming to an end. The Brits probably have a similar outlook, whereas the Germans have tended to be very gloomy.’

Transparency of reporting in the Netherlands is also rated highly by investors. Wurfbain thinks best practice in Holland makes company disclosures easier to understand.

‘When I analyze my peers in the US it can be very difficult to read between the lines and find out the real story from the disclosures,’ he explains. ‘I usually have to wait until the analyst call before I can get a clear picture. In my experience US disclosure is much more boilerplate and geared toward earnings per share; it tends to skirt over the why, what and how.’

Wurfbain points out that there was a concerted effort made by Dutch practitioners to ascertain exactly what the financial community wanted to achieve through the adoption of the Transparency Directive. ‘We saw it as an opportunity to improve transparency rather than just following a prescriptive approach from Brussels – it was a more pragmatic approach,’ he recalls.

Bigger picture

The news isn’t all bleak for IR practitioners in the rest of Europe, however. German and Swiss companies still featured in the IR Magazine UK & Continental Awards, and received some of the highest accolades in this year’s Thomson Extel Survey Awards. Notably absent from the Thomson line-up, however, were the Brits: they were scarcely present on the winners’ rosters.

One thing is certain – performance in the IR Magazine UK & Continental Europe Awards can’t be attributed to the macroeconomic state of the nation: as IR magazine went to press, the Dutch economy remained in recession.