East goes West as Japanese companies station IROs in the US and Europe

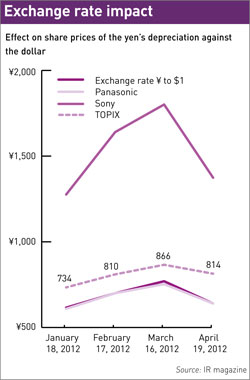

The first signs of the Japanese spring showed early promise: a March market rally saw the TOPIX, the index of leading stocks listed on the Tokyo Stock Exchange (TSE), jump 20 percent from its position at the beginning of the year.

Foreign money rushed into the island nation as the hitherto strong yen depreciated against the dollar.

Hiroko Carvell, the London-based investor relations manager at Panasonic, has long been aware of the significance of overseas investors to Japanese companies: she has been Panasonic’s sole IR representative in London since 2004.

The company is listed on the TSE and the NYSE and more than 20 percent of its investor base is non-domestic, the majority being in the US, closely followed by Europe.

‘At the beginning of this year, the Japanese stock markets really recovered and this was largely due to overseas investors,’ Carvell explains.

Alas, April was less kind to the Japanese stock market. By the end of the month, the TOPIX had lost close to half its 2012 gains and was back to being down roughly 5 percent, year on year.

The dollar, meanwhile, subsequently fell back against the yen. Panasonic’s stock, a TOPIX constituent, enjoyed a similar March rally before dropping back in April (see below).

The brief spring bounce comes after a tough year for Panasonic. A strong currency combined with last year’s natural disasters at home and in Thailand culminated in the company posting one of its worst quarters in history.

‘For many Japanese companies at the moment, it is very difficult to do IR because the stock price is so low,’ observes Carvell.

But the roadshows must go on, and for Carvell the big dates in the IR calendar are when senior management travels to Europe twice a year.

The president and the CFO take it in turns to visit the UK, spending three days with the company’s top 5 percent of shareholders in London, Edinburgh and York.

At all other times the job falls to Carvell to convince European investors that the stock has bottomed-out.

The growth story for Panasonic envisages it becoming a global rival to Samsung and LG, while concentrating heavily on the environment. ‘What we are focusing on now is eco-friendly and energy-saving products we can sell globally,’ Carvell explains.

The 10-person IR team at Panasonic’s head office in Osaka is responsible for orchestrating the global IR message, which is communicated to Carvell and her IR colleague in New York, mostly by email.

Budget constraints have seen an end to regular European travel by the IR team in Osaka, although Carvell still returns to Japan once a year.

Uphill battle

The same year Carvell was hired by Panasonic in London, fellow Japanese electronics giant Sony relocated Justin Hill from Tokyo to New York.

Sony has had an IR presence in New York ever since it listed on the NYSE in 1970, but until 2004 the IR representative was always a Japanese national.

One reason behind the move was a desire to get closer to the institutional investors in the US and Canada. Overseas investors account for nearly 40 percent of Sony’s investor base, although that number has dropped by 5 percent in the last two years.

After eight years in New York, Hill has his work cut out to replace those investors. At the beginning of April, Sony revised down its forecast for year-end March 31, 2012, predicting the company’s worst ever loss.

The announcement followed news that 10,000 jobs would be cut from the company’s global workforce, and Sony’s stock finished the financial year down 35 percent.

Hill’s IR mandate for now is to engage investors new and old in Sony’s music and film businesses – but shifting shareholders’ focus to an image of the company as a filmmaker is proving a challenge.

‘We’re not trying to change the perception of Sony as an innovative consumer electronics hardware maker, but we want to encourage investors to take a look at our entertainment assets and see the opportunities there,’ he explains.

Adding to the challenge, Hill and his New York team are targeting a relatively shallow pool of North American institutional investors, which in any given year have to be both willing and able to invest in Japan.

What’s more, the strength of the yen is often the initial determining factor for these investors when they make their Japanese investment decisions.

By way of example, Hill mentions two big institutions he has dealt with off and on for the last 11 years. Before the yen’s depreciation in March, they had told him bluntly: ‘Call us back when it depreciates and we’re interested.’

Hill initially joined Sony’s Tokyo office in 2000. The people he was working with back then are now senior at the company, he says, which helps with the flow of information between the US and Japan.

One of them now heads up the office in London, where Sony is also listed and has IR representatives.

And it helps that some of the 19-strong IR team in Tokyo have either rotated through the New York office or hope to do so, providing Hill with multiple points of contact inside Tokyo HQ.

Mobile IR

Curtis Schenck arrives at the Park Avenue offices of cellphone operator NTT DoCoMo (DoCoMo) around 7.00 am each day – at a similar time, he says, to many of the traders on the Japan equity sales desks at Wall Street investment banks like Morgan Stanley and Bank of America Merrill Lynch.

Early as he is, however, Schenck is already too late for market close in Japan, but he likes to read the news and email traffic that has come in from Japan overnight.

Schenck is one of a four-person IR team in New York but the only one who does IR full time. He says he was drafted in to inject some ‘American-style’ (more proactive) IR into the New York program.

His primary job is investor outreach, as all of DoCoMo’s sell-side analysts are based in Japan. ‘Basically, I know where all the significant investors are; I have the targeting map burned into my brain,’ he declares.

Nearly half the firm’s overseas investors are located in North America and all together overseas investors account for 14 percent of DoCoMo’s investor base.

That figure amounts to almost half of the free float, however, as parent company Nippon Telegraph and Telephone continues to hold more than 60 percent of the stock.

From Schenck’s viewpoint, the biggest barrier to winning over prospective investors is the perception that Japanese stocks are undervalued for a reason.

New approach to IR

Back in the mid-1990s Schenck worked on the agency side of IR in Japan. During that time he remembers pitching IR services to Japanese corporates and being turned down because a roadshow conducted by a rival company failed to result in an immediate bounce in the share price. Much has changed about Japanese IR since then, he explains.

‘As the market meltdown in the 1990s continued into the next decade, a lot of Japanese corporates realized they couldn’t effect a recovery by clicking their heels and saying, There’s no place like home,’ he says. ‘So they started to adopt more western-style IR and they started to reach out more.’

Since returning to the US, Schenck has noticed that a lot more Japanese companies have IR representatives in New York, with Nidec, Mizuho Financial and Honda joining the likes of Sony and Toyota.

These days, however, the Japanese approach to overseas IR is far more than simply putting feet on the ground – as Schenck found out when he took up his current position in 2008.

‘When I first came to DoCoMo, I noticed that it was already doing a lot of the right things, IR-wise,’ he says. ‘It was just a matter of revving it up and doing a little fine tuning.’