TD Bank once again walks off with top honors at the IR Magazine Awards – Canada

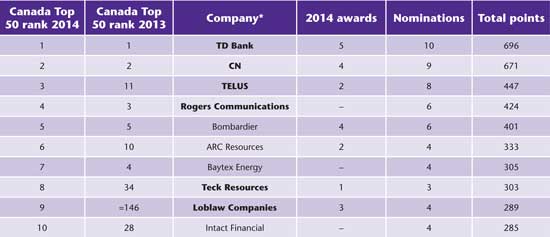

The IR Magazine Awards – Canada 2014 saw the regulars from the Canada Top 50 rankings such as CN, Bombardier and top dog TD Bank joined by four new recruits: Teck Resources, TELUS, Intact Financial and Loblaw Companies. TD Bank continues its reign at the top of the Canada Top 50, however, snapping up five awards on the night – including the grand prix for the best overall investor relations in the large-cap category, as well as accolades for CFO Colleen Johnston and outgoing CEO Edmund Clark.

TD is followed by Janet Drysdale’s IR team at CN, in second place and with four awards, while telecoms firm TELUS climbs from 11th place last year to fill out the top three positions.

TELUS may be the highest-ranked company of the four new top 10 entrants, but it is by no means the highest climber. Led by Janet Craig, Loblaw Companies turned around its investor relations program to rise up the ranks from joint 146th in 2013 to ninth position this year, taking home three awards in the process – including the gong for most progress in IR.

This year also saw nine trophies awarded to firms outside the top 10 and three from outside the Canada Top 50, including the small-cap grand prix for best overall investor relations, which went to gold miner Semafo; the award for best investor relations by a Canadian company in the US market, which was won by yoga clothing company lululemon; and best investor relations for an IPO, which went home with Hudson’s Bay Company.

The IR Magazine Awards – Canada 2014 winners were decided through an independent survey of 267 Canadian investment professionals, the full results of which are available in the IR Magazine Investor Perception Study – Canada 2014. The report also features in-depth interviews with IROs and senior management members from award-winning companies as well as all the award charts, the full rankings and comments from investors and buy-side and sell-side analysts detailing why these companies have impressed them.

*Large-cap companies in bold. Click for a larger image

TD Bank Group

Canada Top 50 rank: 1

Awards

Grand prix for best overall investor relations – large cap

Best investor relations by a CEO – large cap

Best investor relations by a CFO – large cap

Best financial reporting

Best in sector – financials

What the investment community says:‘Wonderfully honest and responsive investor relations from TD Bank. It gets to the core of the matter, whether that’s comfortable for it or not’ – sell side

What the company says:‘The message from management is that IR is important, shareholders are important. And we’re going to do everything we can to make sure [investors] are well informed, that we meet with them in good times and bad times, and that we offer them a high-level service’ – Rudy Sankovic, head of IR

CN

Canada Top 50 rank: 2

Awards

Best investor relations officer – large cap

Best investment community meetings

Best corporate governance

Best in sector – transport

What the investment community says:‘CN has been in the business a long time and knows how to look after its investors’ – buy side

What the company says:‘We’ve always placed a strong emphasis on the strategic role of IR. I have a seat at the leadership table, which provides me with a first-hand view of CN’s strategic agenda and how we execute strategy’ – Janet Drysdale, vice president of IR

TELUS

Canada Top 50 rank: 3

Awards

Best crisis management

Best in sector – technology

What the investment community says:‘All three major telecoms firms colluded successfully against the entry of Verizon into the Canadian market, but TELUS appeared to have the best defense strategy, using share buybacks to protect the stock and generally looking after the company’ – buy side

Bombardier

Canada Top 50 rank: 5

Awards

Grand prix for best overall investor relations – mid-cap

Best investor relations by a CEO – mid-cap

Best use of technology

Best in sector – industrials

What the investment community says: ‘Although Bombardier is a complex business with many different divisions, the IR team is on top of all the information, both current and historical, and the transparency is good’ – sell side

What the company says: ‘When Pierre [Beaudoin] took over as chief executive, he asked his senior management team to include IR support as part of its objectives’ – Shirley Chénier, head of IR

ARC Resources

Canada Top 50 rank: 6

Awards

Best investor relations officer – mid-cap

Best in sector – energy

What the investment community says: ‘First-class investor relations department with a first-class head of IR’ – buy side

What the company says: ‘If you look at the support I get at board level and from the rest of our senior team – including the CEO – it really makes it easy when IR is considered to be such an important function’ – David Carey, senior vice president of capital markets

Loblaw Companies

Canada Top 50 rank: 9

Awards

Most progress in investor relations

Best IR during a corporate transaction

Best in sector – consumer goods & services

What the investment community says:‘There has been a noticeable improvement in Loblaw’s IR this year. It really stands out now in terms of transparency and quality of information’ – buy side

What the company says:‘We spent a lot of time engaging with analysts and institutional investors to get their views on what they would like to see from Loblaw, and tried to deliver on that’ – Janet Craig, senior vice president of IR

Cenovus Energy

Canada Top 50 rank: 14

Awards

Best sustainability practice

What the investment community says: ‘Cenovus consistently delivers a clear message and the IR team is excellent’ – sell side

What the company says:‘We recognize the importance of being available and responsive to the investment community, and we make that a priority’ – Susan Grey, head of IR

Cineplex Entertainment

Canada Top 50 rank: 17

Awards

Best investor relations by a CFO – mid-cap

Best in sector – leisure & media

What the investment community says:‘The CFO at Cineplex, Gord Nelson, is simply outstanding, and the way senior management interacts with the investor relations department is highly effective’ – buy side

Semafo

Canada Top 50 rank: =43

Awards

Grand prix for best overall investor relations – small cap

What the investment community says:‘Semafo brings round a group of people – including operations managers – so there is always someone who knows the answer to your question’ – buy side

What the company says: ‘We try to keep our shareholders well informed: since the beginning of 2013 I would say we have met maybe 70 percent of our institutional shareholders’ – Robert LaVallière, head of IR

Interfor

Canada rank: 61

Awards

Best investor relations by a CEO – small cap

What the investment community says:‘Duncan Davies, chief executive of Interfor, has a good story to tell and tells it well. Increased demand for timber products has resulted in two well-handled acquisitions in the US, including Keadle Lumber Enterprises. CFO John Horning is responsible for IR and communicates well’ – sell side

Churchill Corporation

Canada rank: =77

Awards

Best investor relations officer – small cap

What the investment community says:‘Andrew Apedoe of Churchill Corporation [Apedoe left the firm in December 2013] is honest and realistic about the company. However challenging the situation, he has remained helpful and clear in communicating with us’ – sell side

What the company says: ‘I am very happy analysts and investors appreciate the efforts I have made toward providing responsive, clear, non-promotional and transparent communications’ – Andrew Apedoe, former head of IR at Churchill

Tembec

Canada rank: 99

Awards

Best investor relations by a CFO – small cap

What the investment community says:‘Tembec has a major project coming up, and that will determine the face of the company. It has been openly explaining to us why it’s taking longer and will cost more than originally thought. It’s not great news, but it has been well communicated’ – sell side

Painted Pony Petroleum

Canada rank: =121

Awards

Best investor relations by a TSX Venture Exchange-listed company

What the investment community says:‘The guys at Painted Pony do a good job of communicating with us. They are in constant contact. In fact, we talk to them on the phone more than we do any other company’ – sell side

Hudson’s Bay Company

Canada rank: =154

Awards

Best investor relations for an IPO

What the investment community says:‘The CFO of Hudson’s Bay is particularly impressive. To be a new public company already in the market for acquisitions and be able to talk so cogently about the market is exceptional’ – sell side

lululemon

Canada rank: unranked

Awards

Best investor relations by a Canadian company in the US market

What the investment community says:‘Lululemon disclosed on its quality issue right away, it withdrew the product and addressed the impact. It resolved the issues ahead of expectations’ – sell side

What the company says: ‘I think we do a very good job on being quite transparent. We make an effort to be upfront when things are happening’ – Therese Hayes, vice president of communications

Other sector winners

| Forest products | Domtar |

| Materials | Teck Resources |

| Real estate | RioCan REIT |

| Utilities & pipelines | Enbridge |

Lifetime achievement award: David Carey, ARC Resources

For someone who ‘sort of fell into IR’, David Carey, senior vice president of capital markets at Calgary-based oil & gas company ARC Resources, has certainly excelled in the profession. As the veteran IRO again took home the best investor relations officer award in the mid-cap category – something he’s won four times since 2009, and been short-listed for twice more – Carey was also awarded an additional accolade: a lifetime achievement award, recognizing his dedication to investor relations. This commitment has resulted in ARC Resources maintaining a top position in the IR Magazine Canada Top 50, climbing from 14th place in 2012 to enter the top 10 in 2013. This year, Carey’s team comes in sixth. ARC Resources has also taken home seven IR Magazine Awards over the last five years, as well as being short-listed for many more.

David Carey

'A big piece of it is the commitment from the top'

Carey is gracious about his success, saying that even the award for the best IRO represents a cohesive effort throughout his organization. ‘A big piece of it is the commitment from the top, and that allows us to do some different things,’ he explains. This support, which comes from every level of ARC’s upper management, including the CEO, highlights the importance of investor relations to the company – and makes Carey’s job far easier. His policy for producing happy shareholders involves being as knowledgeable as possible while remaining responsive, transparent and consistent. This method means ‘shareholders are happy talking to you, as they’re getting the same answers they would be if they were talking to the CEO’, while also freeing up more time for top management to focus on key company issues.

ARC’s stock is known for its stability, and this is reflected in the 50 percent or so retail shareholders that make up the company’s investor base. ‘Our typical investor is someone who appreciates a boring stock – I’ve been told that by quite a few investors,’ Carey says wryly. ‘I’ve heard us referred to as an investment that never causes shareholders to stay up late the night before our quarterly call wondering what the hell is going to be in our release.’

That doesn’t mean Carey and his five-strong team haven’t faced some IR challenges in the past year. The company introduced a new chief executive in the form of Myron Stadnyk, previously chief operating officer at ARC. ‘We spent a lot of time and effort doing as much as we could to make certain it was smooth, and it paid off – we’re really pleased with it,’ says Carey of the transition process.

Then there’s the way in which Canadian oil & gas stocks are seen by investors, particularly those in the US where the sector’s Canadian firms have underperformed by comparison with their US counterparts. ‘We’re going to have to continue the fight for relevance, if you will, and make certain investors worldwide continue to see the Canadian oil & gas space as a relevant and safe bet, and one that is important to invest in,’ Carey says.

But with a lifetime achievement award winner – not to mention probably the only IRO ‘who’s both worked on the crew of an exploration vessel in the Gulf of Mexico and actually spent time on a drill rig in the Gulf of Suez’ – at the helm of its IR team, ARC Resources is clearly well positioned to win that fight.

– Adapted from a longer interview in the IR Magazine Investor Perception Study – Canada 2014.

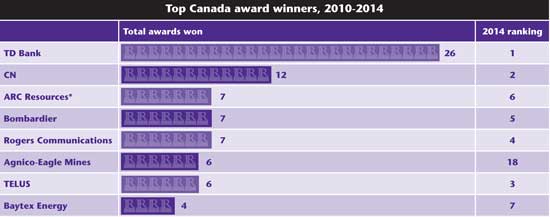

Top Canada awards winners, 2010-2014

*Does not include lifetime achievement award. Click for a larger image

Many of this year’s top 10 Canadian companies also rank among the top award winners of the last five years: TD Bank takes pole position with an impressive haul of 26 awards during that time. The nearest rival to the 2014 leader in terms of awards won is CN, which also holds the number two spot – as it did last year.

The only company to have performed well over the years but to be outside the 2014 top 10 is Agnico-Eagle Mines, which fell from its seventh-place high in 2012 to 23rd place last year, only to climb again slightly to 18th place in the rankings in 2014.