Superior IR showcased at the IR Magazine Europe Awards 2011

BASF has been on an eight-year journey. The share price is up 346 percent since 2003, market capitalization has nearly trebled to €63 bn ($90 bn) and a once domestic shareholder base is now predominantly international. The start of this transformation coincided with a decision by senior management to enhance communications with the capital markets on a global basis, writes Magdalena Moll, head of IR at BASF, in a guest article published in IR magazine’s latest European investor perception study.

There is no question this journey has brought about great success, both for the company and its IR department. Definitive proof of the latter came at this year’s IR Magazine Europe Awards. The evening event held in London at the end of June undeniably belonged to BASF: six awards in total, including four pan-European awards – one IR trophy for every member of the BASF team sitting in the 400-plus audience at the Hilton Hotel on Park Lane.

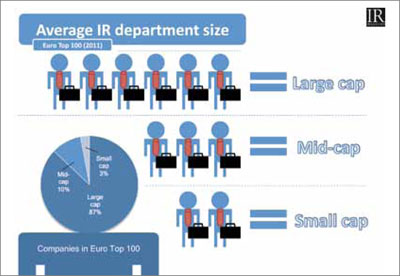

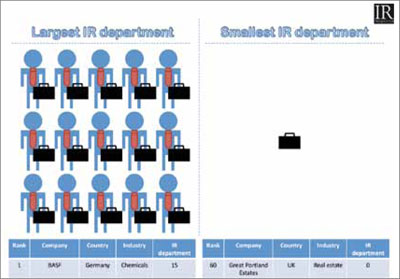

The IR team – numbering 15 in total – took home the large-cap grand prix for the second year in succession and Moll walked away with the best IRO large-cap award, looking genuinely overwhelmed after finishing fourth in 2010.

Lanxess was another big award winner on the night. The younger, smaller German chemicals company picked up three pan-European awards, including the grand prix for best mid-cap company and best IRO for head of IR Oliver Stratmann. Best IR by a small or mid-cap CFO went to Matthias Zachert, who has since moved to Merck, leaving behind the team he set up at Lanxess seven years ago after the company was spun out of Bayer.

The list of award winners tells only part of the story, however. Some companies hit the headlines by winning one award while others perform generally well across all the awards categories and leave with nothing. A good example of this is Novartis, the Swiss pharmaceuticals manufacturer.

On paper, Novartis featured on four short lists but left the awards dinner empty-handed. Overall, the company scored nearly 200 points more than, for example, Konecranes, the Finnish maker and servicer of cranes and lifting equipment, whose CEO, Pekka Lundmark, won the pan-European award for best IR by a CEO in the small or mid-cap category (jointly with Toby Courtauld of Great Portland Estates).

Chart toppers

This year, the picture is completed with the launch of the Euro Top 100, included in the Investor Perception Study, Europe 2011 as a formalized ranking of the firms in Europe with the best IR.

The rankings, which IR magazine has for many years been tallying in silence, are determined by the number of votes companies receive from the investment community in the 10 award categories that are open to all companies, such as best IRO and best IR by a CEO. The awards that are not contested by all companies – like best IR during an IPO – are not counted here for the sake of fairness.

This gives Novartis, at number seven, the distinction of being the highest-ranked company in the Euro Top 100 not to win an IR Magazine Europe Award.

Consistency of story, transparency and company performance is a crucial consideration for Novartis’ head of IR, Dr Susanne Schaffert. Looking forward to the second half of 2011, she says the expiry of two important drug patents will require her team to demonstrate to the market that recently launched products can compensate for those losses.

Winning trends

The Euro Top 100 is intended as a badge of distinction for each of the IR teams in the list: whether that be Novartis at number seven, or Konecranes at joint 91st. In all, a total of 451 companies are ranked in the Investor Perception Study, Europe 2011, and many more unranked companies fail to make the cut.

Tracking the yearly performance of companies, sectors and regions in this way should reveal trends and isolate the factors that contribute to IR success. It also tests whether an investor relations approach has a natural cycle or lifespan, akin to a company’s strategy or the ups and downs of the capital markets. In 2011 four of the top 10 companies are German: utilities companies E.ON and RWE complete the German quartet, alongside Lanxess in sixth place, up 13 places on 2010, and BASF in first place for the second year in a row.

Such dominance by BASF at the top of the table looks assured, but a look back at previous winners suggests its pole position is by no means guaranteed. Only two years ago, the story in the Investor Perception Study, UK & Continental Europe 2009 was all about the Netherlands. The telecommunications company Royal KPN picked up the large-cap grand prix as well as the most points overall. The following year we even looked into the reasons why companies from the Netherlands do so well at IR.

Since then, Netherlands companies have had a less noticeable presence at the awards. True, Royal KPN collected a sector and country award this year, but at the same time the leading Dutch IR team has fallen from being in first place in 2009 to 15th in 2011. This is by no means a cause for concern for KPN but it is evidence that investor favor can ebb and flow while other companies with rival investment stories to tell ensure strong competition at the top.

Similarly, there are consistent threats to BASF’s crown: top 10 stalwart Nestlé is only 40 points behind in second place, while fourth-placed Unilever is led by CEO Paul Polman, this year’s highest-scoring individual. At the same time, there are lesser-known companies racing up the rankings, poised to unsettle the current European IR establishment. Swedbank is one such company. It jumps to ninth place from joint 116th last year and in doing so becomes the highest-ranked bank or financial services company – the most represented sector in the Euro Top 100, with 15 companies overall.

Johannes Rudbeck, head of IR at Swedbank, attributes his successful IR program to top management’s attitude toward the importance of investor relations. This includes a willingness to be transparent and allow IR full real-time insight into all financial and business developments. Michael Wolf and Erkki Raasuke, the bank’s CEO and CFO, respectively, both received individual praise from investors this year.

Title chasers

Then there are the bright young things like Tullow Oil. The UK oil and gas company celebrated its 25th anniversary earlier this year. That makes it a relative youngster compared with BASF, founded back in 1865 and Nestlé, which began life in 1867. (The average age of a company in the top 10 is 123 years.)

Tullow’s 12th place this year improves on its joint 124th position in 2010 by more than 100 places; in 2009 it was ranked 251st. Chris Perry, head of IR and corporate communications, set up the investor relations function in 2005. Since then, the market capitalization has gone up from a few hundred million pounds to between £12 bn and £13 bn ($19.5 bn and $21 bn), and the share price has more than quintupled. Management closely supports the IR team and the company has made big leaps in internationalizing its investor base.

The percentage of US investors has increased from 7 percent to 20 percent and a similar spread has been achieved in continental Europe. There are also a growing number of African investors on the Tullow Oil share register: what began with the acquisition of Energy Africa in 2004 has recently been expanded with a secondary listing in Ghana. The offering in July of this year added 10,000 Ghanaian retail and institutional investors to Tullow’s investor base. In a press release, the company said the market capitalization of the Ghana Stock Exchange had more than doubled overnight.

Diversifying the investor base in this way is a shrewd exercise in a country where Tullow has significant operations, especially in view of the importance of CSR nowadays. ‘Everybody recognizes that Tullow is now a part of the Ghanaian economy,’ Perry says, explaining the reasons for the secondary listing. ‘The listing gives Tullow an opportunity to create shared prosperity so that every Ghanaian has the chance to participate in Tullow’s share performance.’

Growth and demand

Of course, share price growth year on year not only attracts investor interest from all over the world, but also increases demands on IR. Tullow’s coverage has doubled from 17 to almost 40 analysts in the space of five years.

This explosion of interest in Tullow presents Perry and his IR team with the challenge of servicing demand. He believes accessibility to IR and executive management is a strong driver of positive investor sentiment and that IR team size is an important part of this equation. A previous in-house benchmarking exercise against BG Group – the much larger, UK-based oil and gas company, which finished joint 10th in the Euro Top 100 – concluded that the main difference between the two was the larger firm’s bigger IR team.

The development of the IR story at Tullow is perhaps one or two years behind those current stars of European IR, BASF and Lanxess. BASF, in particular, is the undisputed leader in terms of the IR Magazine Europe Awards and the Euro Top 100 rankings, not to mention IR resources and team size. Still, there is every reason for IR watchers to keep an eye on emerging companies like Tullow over the coming year, the second half of which will be particularly exciting, says Perry, as a number of high-impact wells are being drilled. ‘Whether or not they are a success, there will be some challenges in how we explain them to the market and how we move forward from success or potential failure,’ he says.

To order copies of the Investor Perception Study, Europe 2011, please contact Jonathan Cardle at +44 20 7107 2566 or email [email protected].

This article appeared in the September print edition of IR magazine.