Brazil’s IR veterans dominated at this year’s awards against a backdrop of continuing economic and political woes

Brazil’s IR community is toughing out another fraught year. The country continues to grapple with a deep recession and huge political upheaval. It’s hoped the Olympics, which took place in Rio in August, will bring back the feel-good factor – if only temporarily. There was further feel-good factor in evidence at the IR Magazine Awards – Brazil 2016, held in late June in São Paulo, where investors and analysts got the chance to praise the companies that have remained open and accessible during Brazil’s difficult times.

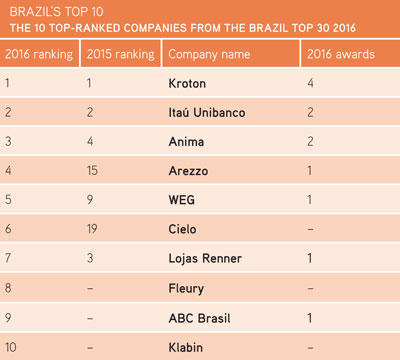

Kroton was the night’s biggest winner, taking home four awards, including the grand prix for best overall investor relations (large cap). The world’s largest private education company also topped the Brazil Top 30, a ranking based on the scores across all research categories, for the second year in a row and the third time in four years.

The list of winners includes other companies that have performed extremely well at the awards over a number of years, such as Itaú Unibanco and Anima, which both won two awards this year. Meanwhile, ABC Brasil, Fleury and Klabin deserve plaudits for climbing into the top 10 despite not making the Top 30 last year.

The results were decided by a survey of more than 100 analysts and investors independently conducted by Eleven Financial Research. To view the full Brazil Top 30 for 2016, please download the free Portuguese-language Investor Perception Study – Brazil 2016 from IRmagazine.com.

View all the pictures from the awards in the gallery on our event mini-site

Grand prix for best overall IR

Mega-cap: WEG

What the investment community says: ‘WEG’s investor relations material is usually very good and diverse, as well as easy to access’ – buy side

Large cap: Kroton

What the investment community says: ‘Kroton has evolved a lot in its relationship with investors. The company has been improving the quality of its events and of the information transmitted’ – sell side

Mid-cap: Metal Leve

What the investment community says: ‘Metal Leve is an easy company to access: it is always open to taking questions and doing events, and it produces good-quality reports’ – buy side

Small cap: Anima

Best IRO

Large & mega-cap: Lojas Renner – Laurence Beltrão Gomes

What the investment community says: ‘Laurence Beltrão Gomes is an outstanding executive who is very transparent and accessible, and helps achieve positive results in a time of crisis’ – buy side

Small & mid-cap: Anima – Leonardo Barros Haddad

What the investment community says: ‘Leonardo Haddad is an IR professional who brings transparency to the market and consistency to what he says and the company’s results, which is key’ – buy side

Best IR by a CEO or CFO: Large & mega-cap: Cetip – Gilson Finkelsztain (CEO)

What the investment community says: ‘Gilson Finkelsztain was key to re-establishing the relationship of the company with the banks and this is what set him apart. He is always close to clients and has created new products, thereby increasing variety’ – sell side

Small & mid-cap: Arezzo – Alexandre Café Birman (CEO)

What the investment community says: ‘Arezzo’s CEO has a great understanding of the business and is more proactive than other chief executives’ – buy side

Other awards

Best performance in a year of crisis ‒ mega-cap: Ambev

Best performance in a year of crisis ‒ large cap: Kroton

Best performance in a year of crisis ‒ mid-cap: CVC Brasil

Best performance in a year of crisis ‒ small cap: ABC Brasil

Most progress in investor relations ‒ large & mega-cap: Hypermarcas

Most progress in investor relations ‒ small & mid-cap: Ser Educação

Best investor meetings: Kroton

Best annual/sustainability report ‒ large & mega-cap: Natura

Best annual/sustainability report ‒ small & mid-cap: Magazine Luiza

Best corporate governance: Itaú Unibanco

Best conference call: Kroton

Best use of technology: Itaú Unibanco