The former co-founder of the Carson Group talks Victoria’s Secret, Kevin Bacon and the most inspirational IRO he ever met

Funniest, best dressed, most likely to succeed, most likely to get arrested: most of us remember these dubious ‘honors’ inscribed on our high-school yearbooks. But what would your list of standouts look like if you applied the same examination to your company? Or your professional network? Or your own career? These are mine.

Mark Begor: the most inspirational IR professional |

Craziest meeting

That has to be the meeting with Boatmen’s Bancshares, an old-school St Louis bank in the early 1990s. All my meetings that day had run late and long, so I was 15 minutes late for the Boatmen’s meeting. I think a 15-minute grace period is professional courtesy, but this guy didn’t agree.

He said: ‘You’re late. I had a certain amount of time allotted to this meeting and you have run through it, but you are now in the time I have allotted for my cigarette break, so you have the time it takes me to smoke this cigarette to give me your pitch.’

It was a classic power play: he leaned back in his chair and propped his feet on his desk, so I was looking at the bottom of his shoes. It felt demeaning, and I fleetingly considered walking out, but I honestly thought he wouldn’t hold me to those five minutes.

True to his word, though, when his cigarette has been smoked down to a nub, he pulled his feet off the desk, stamped out his cigarette in the ashtray, and said, ‘Son, we’re done now.’ I simply couldn’t believe it.

The only positive is that he also couldn’t believe I stuck it out and said to himself, ‘If that kid ever calls me again, I’m going to do business with him.’ It took me 18 months to call him again, but I did – and he became a client.

Best meeting

My partner and I had been doing a particular type of transactional analysis project for about three years, and it had finally dawned on us the full value and impact of the decisions clients were making from the information we were giving them.

Then we realized that what we were doing was grossly undervalued. We said to ourselves that the next time we did a similar project, we were going to get fair compensation for the effort of the work and, more importantly, for the value of what we were providing.

We had a project opportunity with a major company – which shall remain nameless – for a major merger analysis that had billions and billions of dollars tied up in it. Prior to this point we had never carried out this type of project for more than $100,000. I said to my colleague, ‘We are going to ask them for $1 mn.’

He thought I was out of my mind but we’d been saying for three years that we weren’t being paid a fair price for our work. And the important lesson here is: shame on us – we were not representing the proper value of what we were providing but instead somehow expecting the client to suddenly declare that we deserved to be paid more.

So we got on the call with all the company’s executives and lots of advisers. It’s just as well we were on a conference call because I really don’t know whether I would have had the gumption to do it in person – but we had our ‘phone muscles’ on, giving us a little distance-induced bravery.

We presented the project. They said, ‘We hear good things about you and can’t get you on board fast enough – so how much is this going to cost us?’ I said, ‘We typically do this for about $1 mn.’ You could have heard a pin drop; there was a dramatic pause that was probably less than a minute but felt like an hour. And then we heard, ‘That’s fine. When can you get started?’

That was by far my best ever meeting, not just because of the drama and the victory, but also because it reaffirmed what we already believed about the value of our service.

Nicest gesture by an investor relations professional

I once had an IRO fix me up with her daughter. I was presenting to a Dow 30 company. We had a great meeting with its team about our services. As the meeting was winding down and the rest of her team left, the head of IR asked, ‘Scott, do you date?’ which was just the strangest question I’d ever been asked at a presentation.

Then she started pitching her daughter to me, telling me how she couldn’t seem to meet a nice guy. It was an awkward dilemma because I was a young rookie and I didn’t want to upset the IRO of this big company. All I will say is that the daughter turned out to be a very nice woman.

Honorable mention goes to Ford for providing me with its employee discount to buy my first family car. I had mentioned in passing that I’d just had a baby, was moving to the suburbs and looking to buy my first SUV. The IRO called me up later and said, ‘Would you consider buying a Ford?’ It was a no-brainer.

Biggest missed opportunity

Intimate Brands, which was a client, invited me to lingerie retailer Victoria’s Secret’s very first runway show with backstage passes. It was the firm’s first show so it didn’t have the recognition it has today and I’d been traveling a lot, was tired and needed to get home early that night, so I didn’t go. Of course, after the fact, I found out Tyra Banks was there. And Claudia Schiffer, among others. The analyst who went in my place never let me live down that I’d missed out on meeting all those supermodels.

Worst sales campaign

By far the dumbest gimmick we ever tried to pull off was in the early days of the Carson Group. There were certain IROs we could never get a meeting with; they would never take coffee with us or return our calls, so we decided to bring the meeting to them.

At the time it seemed ingenious: we made a tape of our 20-minute basic introduction, then we got a bagel with cream cheese, a banana and a Thermos of hot coffee. At that time in New York City, 9.30 pm was the latest FedEx cut-off so at 9.00 pm we poured the hottest coffee known to mankind into Thermoses, put it all into FedEx boxes and shipped them to our top six hard-to-get prospects. We thought they’d see us as so creative and innovative, they’d have to meet with us, and we got into work the next morning all excited to get the calls that were sure to come.

Sure enough, at 8.30 am the phone rang – and a woman was screaming at me. The Thermos had broken, the coffee had scalded her legs and ruined her dress. Five minutes later a similar call came in from a guy demanding we pay his dry-cleaning bill. It turned out that three of the six Thermos flasks had broken, and in 10 years we never got any of those three people as clients!

Most impressive IRO

I’ve had the privilege of working with a lot of great IROs over the course of my career, but I’m especially impressed by IROs who become CEOs.

There was a guy called Tom Waltermire, who was the IRO of BF Goodrich. The firm spun off a chemical company called Geon, and Tom became the IRO, then the CFO and finally the chief executive. That doesn’t happen all that often. He was very impressive; the moment you met him you just knew he was really on the ball.

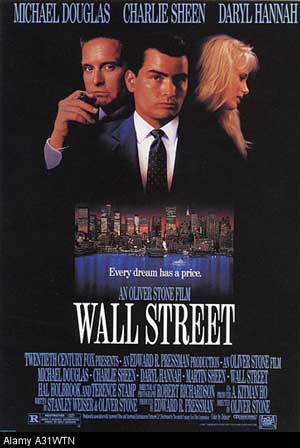

Wall Street filmed a scene in the Carson Group’s offices |

Best IR celeb connection

I was pitching Scios Nova, a biotech company in California, and its director of IR was called Kira Bacon. I have always felt it’s generally pretty rude to take a call in the middle of a meeting; IR professionals are usually very good about that unless it’s something really big like Fidelity or your CFO is on the phone, or there’s something going on with your kids, which I understand.

But Kira got a call to say her brother was on the phone. I asked if I should leave and she said no. I was thinking, ‘Your brother doesn’t make my top five of people who can interrupt a meeting, and how important can it be if I don’t even need to leave the room?’ It got worse when the entire call seemed to be about some TV program they were going to watch: ‘What time is it on? Did you tell mom? OK, make sure our sister knows…’

So when she hung up I couldn’t help but ask what was so important on TV that night. She laughed and said, ‘That was my brother – Kevin Bacon?’ He was going to be on Johnny Carson’s show that night promoting Apollo 13. Once I caught on, the family resemblance was really obvious. Kira became a client, so I can truthfully say I have only two degrees of separation from Kevin Bacon.

My other brush with fame was that the movie Wall Street was filmed in our offices at Carson. The scene where Charlie Sheen is waiting out in the lobby for Gordon Gekko with a box of cigars was shot in our lobby and then he walks past our analyst cubes. We got to be there in the background, which was exciting. The craziest part, however, was that we were actually still working. It’s pretty tough to be an analyst trying to track shares and film crew members are yelling, ‘Quiet on set!’ That’s a little bit of a problem when your client is on the phone and you need to tell him what’s going on with his stock!

Most pivotal career moment

It was 1988 when I became truly hooked on the business of shareholder identification and market analytics. I was helping out a colleague with a Chicago-based railroad company called Itel that was having what was believed to be a hostile accumulation. There were rumors that Sam Zell, who later became a famous billionaire, was out buying Itel’s stock.

In doing the analysis, I noticed that Zell was representing his share ownership as only so many shares, but there were another 12 to 15 accounts simultaneously buying with him. They weren’t technically Zell’s accounts, but every time Zell bought, they bought, too.

I showed our chief executive that Zell was in control of a much more substantive amount of shares than it appeared; he immediately got on the phone with the lawyers defending the situation, and I was pulled in to present to a host of bigwigs working on the case. It was incredibly exciting for me to be that young kid who had figured out something so critical to the situation and to be able to see the value I was bringing to clients through my analysis.

An analyst’s job is to bring insight and value to clients every day, but every once in a while there comes that kind of sensational story. For all of us who have been in this business a long time – market intelligence, stock surveillance, shareholder analysis – the reason we do it for so many years is for those sensational days, where you know you’re figuring something out that brings extreme, game-changing value to your clients. It’s cool stuff.

Most inspirational IRO

Mark Begor once told me that the GE way is this: if you’re not moving forward, you’re moving backward. To this day, I still haven’t 100 percent figured out whether that’s really the case, but I’ve been motivated to keep moving forward ever since.

Scott Ganeles is chief executive of Ipreo and former co-founder of the Carson Group