Highlights from the IR Magazine Canada Awards 2011

February 2 this year was significant in Toronto for two reasons: it was the first time in more than 10 years that all the city’s schools had been closed because of snow (or rather the fear of snow), and it was the night of the 14th IR Magazine Canada Awards.

Was there a relationship between the two? Perhaps only in the view of those who still think IR is about hyping stocks, rather than presenting the truth about a company and accurate forecasts of its future performance. That’s because dire media predictions of a massive snow storm expected to dump more than 30 cms of the white stuff were contradicted by the reality of a couple of inches. Never mind.

(More videos from the IR Magazine Canada Awards 2011 can be found on IR TV.)

It gave MC Amanda Lang the chance to joke that the ‘snowmageddon’ predicted by the press had turned out to be a case of serious ‘snoverkill’. Others conjectured that the whole thing was cooked up by a conspiracy of journalists frustrated by a slow news day and children seeking a well-earned rest from the rigors of daily education.

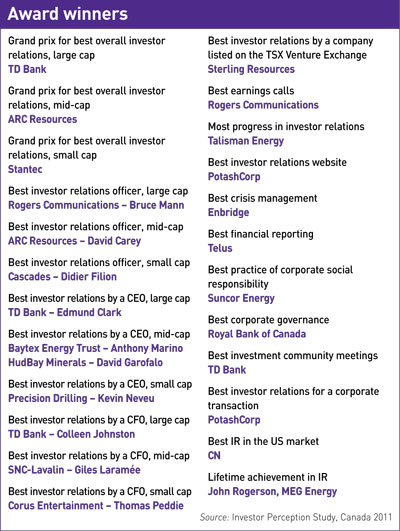

Whatever the reason, it did little to dampen spirits at the awards evening in Toronto’s sumptuous Fairmont Royal York. Indeed, apart from a handful of no-shows by people from Saskatchewan (the multi-award-winning PotashCorp) and New York (the award-sponsoring MuncMedia, which has just launched OnDemand IR), things went pretty much according to plan. More than 400 guests cheered their way through a ceremony that saw some 20 companies cited for the quality of their investor relations.

The research undertaken to identify the winners, most of which took the form of in-depth telephone interviews with members of the Canadian investment community, was carried out once again by Mary Maude Research of London. Views were garnered from around 250 analysts and investors, who talked not only about which companies provide them with the best IR service but also about the challenges they and the Canadian companies they follow are currently facing.

Hard times

Those challenges include today’s unpredictable macroeconomic climate, especially volatile currency around the world, and – particularly for many Canadian companies – the huge fluctuations in global commodity prices. Respondents also talked about the importance of corporate governance considerations in investment decision-making. Some 61.7 percent of them agreed that governance is of fundamental importance, but that left nearly a quarter for which it is not a critical factor.

As usual in Canada, and regardless of which side of the fence they were on, respondents made their views clear. ‘If you don’t trust the management and board you have no business investing in them,’ declared one. ‘Corporate governance is indeed important but CSR is total nonsense,’ said another.

The award for best corporate governance went to Royal Bank of Canada, which regularly does well in the IR Magazine Awards and whose IRO and CFO were both singled out for special praise by respondents. Interestingly, the two runners-up for the governance award were also banks: Scotiabank and TD Bank.

Overall, TD Bank was the big winner of the night. It won the grand prix for best overall IR by a large-cap company and the awards for best investment community meetings, best CEO at a large cap, best CFO at a large cap, and the sector award for best IR by a company in the financials sector. It was also short-listed for the awards for best IRO, best earnings calls and, as already mentioned, best corporate governance.

Comments about TD from respondents underlined the extent to which IR is a people business. ‘Ed Clark, CEO, is the best communicator,’ said one. ’He is direct and tells it like it is.’ Another said of the CFO: ‘Colleen Johnston is forthright and available… She calls up shareholders to explain and discuss issues when they arise.’

Rising to the challenge

Other companies managed to build their scores as a result of the kind of events that don’t come around on a regular basis: corporate crises, including the crisis created by a bid. For example, had its team not been prevented from attending by the snow in Saskatoon, PotashCorp’s IRO would have collected three awards in person and heard the company’s name cited as a short-listed company on four other occasions.

The awards were for the company’s IR website, its handling of the bid from BHP Billiton, and for having the best IR in the materials sector. The citations were for financial reporting, CSR, investment community meetings and for the best IR by a CFO at a large-cap company.

Interestingly, Potash won the award for best IR in the US market last year but slipped to fourth in that category this time. Presumably this was an acceptable side effect of the company’s successful bid defense, which included firm promises to its Canadian stakeholders.

Just under half its shareholders are Canadian; 38 percent are US-based. During the bid battle Potash pledged to relocate its IR department from Chicago back to Saskatchewan, and the IRO, who in the past devoted two thirds of her time to US investors, switched to a 100 percent Canadian focus.

Enbridge’s opportunity to display its credentials – and win one of its two IR Magazine Awards this year – arose out of a full-blown disaster: the rupture of one of its pipelines resulting in 19,500 barrels of oil being spilt into the Kalamazoo River in Michigan. Determined to avoid the kind of reputational damage suffered by BP, the company executed a coordinated crisis strategy and included IRO Guy Jarvis in its crisis management team.

Indeed, the whole IR team was available after all media calls and issued a release after each one, summarizing the key points. All this made its impact, at least on the investor who, when asked which Canadian company had the best IR, said: ‘As Enbridge has done such a magnificent job of managing the pipeline situation, I am going to nominate it for best overall IR.’

Many more individual Canadian companies, as well as their CEOs, CFOs and IROs, were singled out for warm praise in this year’s research. By and large, domestic investors and analysts are happy with the quality of service IROs are providing and, in at least one case, their brethren south of the border are even happier. ‘Canadian IR professionals are superior to [those at] US companies,’ said a respondent from New York. ‘That’s one reason why we invest in so many Canadian companies. Information is more readily available, IROs are more helpful and the people are nicer.’

The Investor Perception Study, Canada 2011, which contains the research the awards were based on and takes a 360-degree look at Canada’s successful IR programs, is available to professional-level subscribers to IR Magazine.