Survey explores IR practices beneath the much-analyzed FTSE 100

Investor relations budgets at UK mid-caps appear to be stabilizing, although IR teams still have tough decisions to make about how to allocate their resources next year, according to new research.

The findings are based on a survey of FTSE 250 companies by King Worldwide Investor Relations, the IR and communications services group, aimed at exploring the practices of those just outside the much-analyzed FTSE 100.

Just 12 percent of respondents anticipate a budget cut in 2013, roughly half the 23 percent who saw a decline this year, reports the survey, which received 31 responses. No IROs expect an increase next year.

The survey reports a tight spending environment with no wiggle room for decision makers. Around two thirds (65 percent) of respondents say they have enough money to buy the services they need, but nothing to spare.

Roughly a fifth (19 percent) say they have everything they need plus ‘some contingency’, while 15 percent complain they can do only the bare minimum with what they get and would like to do a lot more.

‘One clear observation is that the rate at which IR budgets are being cut is falling, as only half the number of IROs who had their budgets cut in 2012 expect to see a reduction in 2013,’ says Charles Hamlyn, director at King Worldwide Investor Relations.

‘A possible explanation for this is the fact that a large majority of respondents claim to be ‘running hot’, with only just enough funds to cover essential services. This implies the downward pressure on IR budgets of the last few years has found a floor at some companies.’

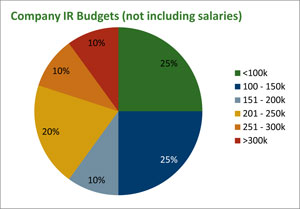

The average IR budget among the respondents, excluding salaries, is £210,000 ($337,000) a year. There are large variations, however, with departments mostly falling within a range of £50,000-£300,000.

Source: King Worldwide Investor Relations

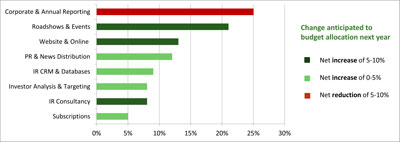

With most budgets set to remain flat, focus will turn to how existing resources are reallocated next year. The spend on corporate and annual reporting looks most at risk, with 25 percent of respondents saying they plan to cut investment in this area by 5 percent-10 percent next year.

Turning to expected increases in investment, more than a fifth (21 percent) plan to spend 5 percent-10 percent more on roadshows and other events, while 13 percent want to increase spending by the same margin on websites and related online services.

Source: King Worldwide Investor Relations / Click to enlarge

A problem could arise from the fact that desired areas of increased spending appear to outweigh the planned cuts to corporate reporting, the survey notes. ‘The anticipated savings made in corporate reporting do not appear large enough to compensate for the increases that are hoped for elsewhere,’ it states.

The survey also queried respondents about their ‘relationship’ with their BlackBerry or other smartphone, to find out to what extent IROs are tied to the job outside of working hours. Worryingly, just over a quarter (27 percent) characterize their smartphone use as ‘intense’, continuing even when on holiday.

The majority of respondents (46 percent) are only slightly less attached, stating they work on their smartphones ‘most evenings and weekends’. The full report is available on request from King Worldwide Investor Relations.