With its impressive portfolio of nine chains ranging from high-end to casual, everyday eateries, Darden Restaurants offers something for every diner. How are these restaurants faring with the dining segment feeling the effects of economic uncertainty? We take a look at the location intelligence to find out.

With its impressive portfolio of nine chains ranging from high-end to casual, everyday eateries, Darden Restaurants offers something for every diner. How are these restaurants faring with the dining segment feeling the effects of economic uncertainty? We take a look at the location intelligence to find out.

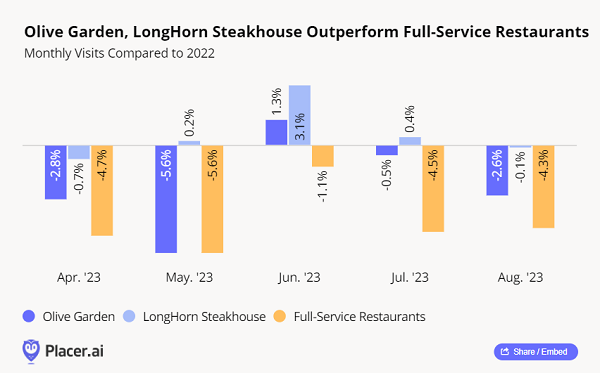

Olive Garden & LongHorn Steakhouse outperforming full-service restaurants

Olive Garden and LongHorn are the two largest chains within Darden’s extensive portfolio. Both brands seem to have established themselves as affordable luxuries, making them particularly appealing during this period when many diners may think twice before dining out.

Both chains outperformed the wider full-service restaurant segment on a year-over-year basis, with LongHorn displaying consistent visit growth and Olive Garden approaching 2022 levels for the period examined. June and July were the strongest months for both chains and, even in August, when consumer spending slowed, Olive Garden and LongHorn continued to outperform the broader full-service restaurant category.

These two brands account for the lion’s share of Darden’s revenue, with Olive Garden generating nearly half of the company’s sales in the fourth quarter of fiscal 2023. Darden’s strategic plans include expanding both LongHorn and Olive Garden, with multiple new locations slated to open in 2024.

Cheddar’s is seeing a Texas surge

Darden’s portfolio also offers a range of mid-priced dining options, including Cheddar’s Scratch Kitchen. Acquired by Darden in 2017, Cheddar’s provides a homey dining experience heavy on comfort foods and affordable prices.

Cheddar’s first opened in Texas in 1979 and has since remained a statewide favorite – year-over-year visits to Texas locations outperformed nationwide visits for all months analyzed. And in a testament to the chain’s popularity in the Lonestar State, Texas visits were less likely to be one-offs, with 30.1 percent of visitors choosing to dine at the restaurant at least twice between April and August 2023.

Texas has more than 50 Cheddar’s locations, with more on the way – more than any other state. This high concentration – and the strong brand recognition that comes with it – may help explain why visits are so robust in Texas.

Yard House: The new post-work hang

Yard House – another mid-priced concept in Darden’s portfolio – operates as a sports bar and restaurant, offering more than100 beers on tap and a laid-back vibe. The California-based chain has also seen positive foot traffic over the past few months, with July and August visits up by 3.9 percent and 0.7 percent, respectively.

Some of these visits may be spurred by the increase in people returning to the office: over the past year, the share of post-work visits to Yard House increased by 34.7 percent.

Similarly, there has been a decrease in the percentage of Yard House visits that are followed by a visit to another food establishment. This trend suggests customers are treating the bar as a place to unwind and enjoy a meal, rather than a stop on their night out.

Darden bets on its fine-dining segment

Darden’s portfolio also includes three fine-dining restaurants: The Capital Grille, Eddie V’s Prime Seafood and, as of several months ago, Ruth’s Chris Steak House. The brand announced the acquisition of the upscale steak chain in May and finalized the sale in June. While these chains make up a relatively small portion of the company’s sales, Darden has recognized the value a fine-dining restaurant offers, noting that fine-dining sales have outperformed relative to pre-Covid.

Examining the visit peaks for these three chains highlights the value they bring to the Darden portfolio. The Capital Grille saw visit spikes around the holiday season, and foot traffic to both Eddie V’s and The Capital Grille jumped on Valentine’s Day, Mother’s Day and Father’s Day, while visits to other Darden brands saw smaller visit increases. Ruth’s Chris experienced visit jumps that were even more pronounced than the other two upscale Darden brands during these occasions, suggesting it is well suited to continue driving visits among Darden’s fine-dining segment.

Dining out is in

The resilience of Darden’s mid-range and upscale concepts highlights that, no matter the economic climate, people want to enjoy themselves. Whether diners are heading out for an affordable meal at Olive Garden or LongHorn, celebrating a milestone at one of the brand’s fine-dining restaurants or enjoying a post-work hang, Darden’s portfolio offers something for everyone.

For more data-driven retail insights, visit placer.ai/blog.

This content is provided by Placer Labs and did not involve IR Magazine journalists. For further information on Placer Labs, please click here.