A rundown of important takeaways from the latest IR Magazine sector report

The Energy & Utilities Sector Report 2016, the latest in IR Magazine’s new series of sector-centric research reports, provides a deeper look at IR practice, budgets and team sizes across the two sectors.

The report is free for professional subscribers to download, and there are some interesting takeaways for readers in any industry that demonstrate how both energy and utilities companies communicate with capital markets. Below, we run down five of the top findings.

1. Both sectors give IR a generous budget

Energy companies give their IR teams $532,000 on average to spend; for utility companies, this figure is up to $610,000. Both these average budgets are some way ahead of the overall global average of $491,000 for all sectors and cap sizes.

Regionally speaking, however, it’s European utilities firms that trust their IR teams with a sample-leading $832,000 budget, $305,000 above the region’s average budget for all sectors. Asia’s energy companies give IR teams $501,000 on average, almost double the average budget of $277,000 for the region.

2. Asian senior management puts the most effort in

In terms of days dedicated to IR, senior management teams at energy and utilities firms in Asia are the most committed, giving up 58 days on average to the function, compared with 38 in Europe and 43 in North America. This figure is even higher, on average, if you look purely at Asian energy firms, where senior executives dedicate 83 days to IR.

3. Analysts are most likely to cover smaller companies from either industry

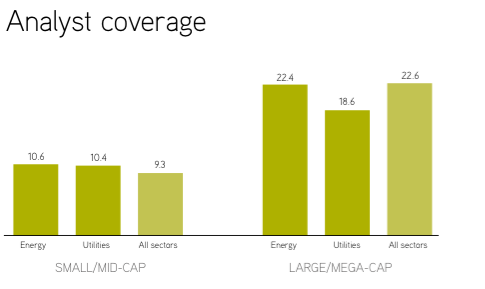

Small and mid-cap firms in both sectors can boast at least one more analyst covering them than is the norm across all industries: smaller energy firms are covered by 10.6 analysts while small and mid-cap utilities companies enjoy the attentions of 10.4, compared with only 9.3 for the average company.

This is not the case at large and mega-cap energy and utilities firms, however, which are both followed by fewer analysts than average: 0.2 fewer for energy firms and four whole analysts fewer for utilities companies.

4. North American teams are least likely to travel

Though energy and utilities firms both travel for roadshows more often than the average for all companies – going on 0.6 and 0.8 more roadshows, respectively, than the average – this figure is significantly lower for companies based in North America. Though the average North American company will go on the road six times in a given year, energy companies manage 0.1 fewer roadshows and utilities companies 1.2 fewer.

5. Energy and utilities firms have some of the world’s best IR teams

Of the top 20 firms in the Euro Top 100, as ranked for the IR Magazine Awards – Europe 2015, six are in either the energy or utilities sector. Three of those – Iberdrola, EDP – Energias de Portugal and RWE – are in the top 10.

Five of the top 20 Canadian companies, four of the top 20 US firms and three of the best IR teams in Asia are also energy and utilities companies, suggesting that these sectors’ IR leads the way across the world.

To find out more, get your copy of the Energy & Utilities Sector Report 2016 here