Asian roadshows, the shareholder spring, IR planning and tackling short-termism were all discussed

IR Magazine think tanks operate under Chatham House Rules so all quotes from the event are anonymous.

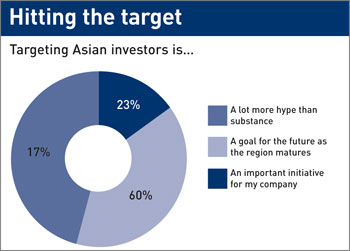

Asia: Playing the long game

‘If the optimists are right, and Asia moves very quickly, you don’t want to be behind the curve. At the moment, however, meeting Asian investors is more missionary work for the IRO. If you take your CEO or CFO, try to avoid too many questions about the wider set of economic issues in Europe’

- Be careful which broker you go with, even down to details like having someone along who speaks the local language

- A whopping 85 percent of the funds in Asia are invested in Asia, so management shouldn’t expect an immediate return on its efforts

- ‘It is important not to think of Asia in terms of converting people into buyers, but rather in terms of building the profile of your company and its relationships for the long term’

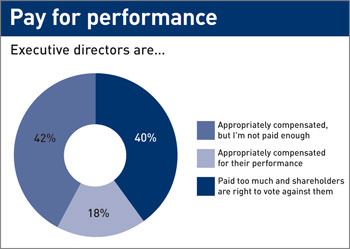

Will spring last forever?

‘Whenever there’s a fall in the markets, you see an increase in activity among investors. The difference this time is that there’s a far more proactive interest in what fund managers are doing, as well as a more heated public debate and a great interest from policy makers’

- ‘The idea there’s a market-wide problem with executive remuneration is more the creation of the press and politicians than a rooted concern in the investment community. It’s actually a small subset of the market where we have real concerns’

- On the European Securities and Markets Authority’s discussion paper on the role of proxy advisers: ‘The jury is out on what the findings will be. Proxy advisers and investors will be watching with great interest’

- ‘In continental Europe and the UK, it can be tricky to figure out the right point of contact at companies’

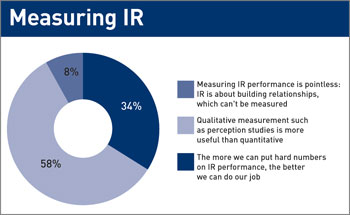

Quants versus the rest

‘When I started our investor relations program, our management’s approach was to measure it as it would any other business unit. It was pretty daunting to come up with quantitative measures but I have found that they focus our approach’

- At one end of the shareholder base there’s a rise in indexed, passive quant funds. At the other, it’s hedge funds. The part of your shareholder base you can actually influence may be shifting; it follows that your expectations should too

- ‘We haven’t won any awards recently but I’m more proud of what we have achieved in investor relations in the last two years than ever before’

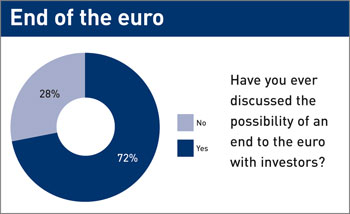

Debt crisis: ask how bad it can get and hope for the best

‘We have had lots of discussions with investors about what would happen if one or two countries left the eurozone. We talk about Russia five years ago, or Argentina 10 years ago, or the Asian crisis in the late 1990s, and how our business can survive and even prosper despite difficult circumstances’

- ‘As a long-term fundamental investor, we spend most of our time now stress-testing our analysis. We go straight to the firms, share our models with them, and ask, How bad could it get?’

- ‘A lot of fund managers haven’t thought through all the ‘what-ifs’, so you can help them focus on your company, your industry, the metrics and the drivers’

IR Magazine Think Tanks are free, invitation-only events for select groups of corporate IROs. Find out about upcoming think tanks in New York, Toronto, Chicago, London and Palo Alto at www.irmagazine.com/events.