Industry performs well but standing in financial community remains low

Global investors see private equity (PE) as offering a better risk/reward ratio than other assets, as the overall performance of PE firms has improved since 2010, according to new research from Gracechurch Consulting.

The industry’s reputation remains broadly poor, however. ‘While investors believe the PE industry adds value to the economy as a whole, their opinion of participants within it is less positive,’ says Ben Bolton, Gracechurch CEO, in a press statement. ‘In the last two years, there has been a decline in ratings given by respondents regarding the caliber of partners and portfolio managers within PE. The key issues driving this negativity center on the perceived lack of integrity around the deal process and a lack of alignment around the objectives of the deal.’

This is despite the Private Equity Principles issued by the Institutional Limited Partners Association (ILPA) in a bid to introduce best practices to the industry. ‘Investors feel the ILPA principles have made little difference to the investment choices of PE firms,’ notes the Gracechurch research.

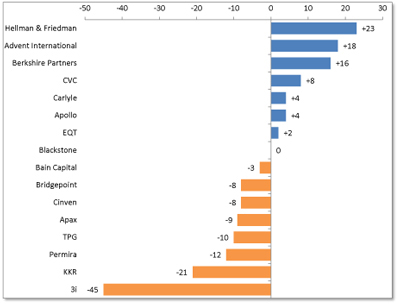

Collecting more than 2,000 individual company ratings from investors – asking them to rate firms from 0 to 10, where 0 is ‘poor’ and 10 is ‘excellent’ – Gracechurch then converted the responses to its net promoter score (NPS). It says ‘the overall opinion of private equity firms is low when compared with many other industries.’ For example, legal advisers score 13 percent on the positive NPS scale, while commercial insurers score 8 percent. Private equity firms score -3 percent.

Overall opinion of the leading private equity firms – net promoter score (NPS):

Source: Gracechurch Consulting

‘The fact that PE scores less well in terms of NPS than other industries, such as law or insurance, illustrates that many firms are simply not getting their message across to investors,’ continues Bolton. ‘But there are strong performers whose scores show that some are getting it right in this area.’

The research also notes that PE firms are seen as being quite poor at communications. Gracechurch asked investors to rate named firms from 0 to 10 on how effective their communications are. Blackstone takes the lead, though with its underwhelming top-ranking average of 6.6, it’s clear how badly some other firms score in this area.