Sin Yang Fong, head of IR, discusses running South East Asia's most lauded IR operation

The global stock market crash of late August, sparked by China’s Black Monday, spooked investors – but not the investor relations team at SingTel. ‘We were concerned with the decline in share price, but rationalized it against similar behavior in the bigger market,’ explains group vice president of IR and corporate communications Sin Yang Fong, who saw her company’s stock fall more than 4 percent on the day.

|

|

The team remained vigilant, watching for any false rumors that might take hold. Aside from that, says Sin, you have to remember that IR’s job is to communicate with the market, not control the share price, advising: ‘In periods of volatility, buckle up and sit tight!’

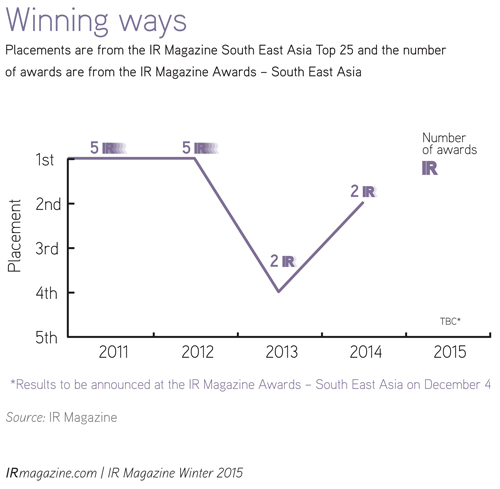

Certainly, you wouldn’t expect Sin or her team to get flustered. Over the years, Singapore’s largest telecommunications firm has consistently marked itself out as one of the top IR performers in South East Asia. A regular winner of IR gongs for a decade and a half, SingTel has, arguably, raised its game to new heights over the last four years.

Since 2011 the group has picked up no fewer than 14 prizes at the IR Magazine Awards in a wide variety of areas, including best reporting, best use of technology and best corporate governance (see Winning ways, below). That’s despite a tricky backdrop of market volatility, currency swings and an ongoing strategic transformation.

Sin traces the origins of this robust template all the way back to 2001, when SingTel completed the acquisition of Optus, one of Australia’s largest telecoms firms. The transaction saw the IR teams of the two firms merge under the leadership of Optus’ Gavin Hurle, although it retained two offices, one in each country. ‘The integration of the two IR teams was a game-changer,’ Sin explains. ‘We became a bigger team with more resources.’

Nevertheless, it was a challenging time for the newly formed IR department. The deal saw parent company SingTel inherit a global range of new institutional investors and vastly increase its free float. ‘We had to deal with a seemingly endless stream of regulatory announcements associated with the acquisition,’ recalls Sin. ‘At the same time, the new investors required a lot of information about SingTel. It was all quite overwhelming.’

Over the next five years, SingTel’s IR team, with Hurle at the helm, won many awards. Sadly, he passed away in 2007. ‘I lost a great mentor,’ says Sin. ‘Gavin embodied all the qualities of an ideal IRO, if ever there was one: a strong communicator, a creative and analytical mind, and a genuine and charming personality.’

SingTel today

Today the company still has IR offices in Singapore and Australia; that’s a sign of how important Optus remains to the overall business – it contributes roughly a quarter of earnings, and SingTel’s investors are always keen to meet with the Australian operator’s management people.

Sin says the plan is to maintain the dual-office structure, despite the company’s decision this year to drop its Australian Securities Exchange listing, a move attributed to low trading volumes. ‘Our twin-location allows us to be more efficient,’ she explains. ‘But we function as an integrated team so investors can pick up the phone to call any one of us.’

Collectively, the IR department conducts around 250 meetings a year, including in-person events and conference calls. International travel is a key part of the schedule, with up to two trips to both Europe and North America per calendar year, plus one visit to Malaysia (see SingTel’s IR calendar, below). Indeed, investors outside Asia make up a sizable proportion of the shareholder base (more than a quarter), though the biggest holder remains Singapore’s sovereign wealth fund Temasek, which owns a 51 percent stake.

Click here for larger version

Sin points out that SingTel does not set targets based around the geographical split of the shareholder base. ‘Rather, our targets are for a desired mix of shareholders by tiers,’ she explains. ‘We would like to see a share register well represented by big holders as well as mid-sized investors.’

Investors and analysts who vote for SingTel in the IR Magazine Awards surveys mention a wide variety of areas where the company excels in investor relations. One company event that is often singled out, however, is the group’s regular investor day, which offers access to a wide variety of C-suite members, directors and regional managers.

‘Each year, we host the SingTel Investor Day, where senior management people from the different business units and associated companies (from the emerging markets of India, Indonesia, Thailand and the Philippines) update investors and analysts on their businesses,’ says Sin. ‘It is a full-day event and we are very heartened by the turnout: more than 50, and most of them stay till the end. Perhaps it is also a rare chance for them to receive the latest news on several South East Asian telcos and markets in one go!’

One vital element of any successful IR effort is strong support from the top brass – and SingTel is no exception. Sin says the company is blessed to have a ‘highly enlightened’ senior management team that puts aside plenty of time for investor meetings and helping to shape the IR message. How much time? The group CEO, CFO and chief corporate officer all spend two to three weeks a year traveling for roadshows and conferences. The CEOs of business units also commit to one or two weeks on the road, alongside local obligations in Singapore and Australia.

‘If you add them all up, that amounts to a lot of face time with investors,’ observes Sin. ‘We can also count on other senior management people, such as the head of HR or networks, for discussions on ad hoc issues such as compensation and mobile network investments.’

New businesses, old problems

Sin and her team have spent much of the last two years discussing SingTel’s push into such growth areas as cloud computing, digital marketing and cyber-security. In a sign of the group’s ambition, 2015 saw it make its biggest non-telecoms acquisition to date: the $810 mn purchase of US cyber-security firm Trustwave.

‘My role as the IR officer is to ensure investors understand SingTel’s strategy and the rationale and size of the opportunities in our digital business,’ comments Sin. ‘This has to be supported by continuous news flow about the new business, as well as site visits and demos to better illustrate our work.’

The group has also had to deal with currency headwinds. China’s economic slowdown has hit the value of the Australian dollar, subsequently knocking Optus’ contribution to profits. ‘For FX-related questions, we explain the relative contributions from the different currencies and our strategy to mitigate the effects on our debt and cash flow,’ says Sin. ‘Besides the Australian dollar, we also have earnings in Indonesian rupiah and other Asian currencies.’

A more traditional challenge faced by SingTel is dealing with industry regulators, whose regular market interventions can play havoc with corporate strategy. An IR professional at one of SingTel’s telecom peers in Singapore has a saying: the regulator can devalue the stock faster than management can mismanage it.

Telco valuations are extremely sensitive to regulatory intervention but this is not a situation peculiar to Singapore, as Sin points out: ‘In the emerging markets where we operate, we have witnessed first-hand how adverse regulations have affected the level of investment in the telco sector for prolonged periods.’

Close contact

Sin has noticed investors and analysts want more direct contact with regulators and, ever the supportive IRO, has helped them set up meetings. ‘They want to understand the regulators’ policy objective: is it to promote consumer welfare? Attract infrastructure investments? Ensure efficient allocation of resources?’ she explains. ‘Sometimes, they may seek our help to speak to the regulators and we are always happy to assist.’

Given this supportive disposition, does Sin have any advice for other IR departments in South East Asia, or beyond, about meeting the needs of investors and analysts? Her advice reflects the actions her team took during Black Monday. ‘Keep your ear to the ground and check whether there is any particular news affecting your company or your industry,’ she recommends.

‘Do you need to make any clarifications to alleviate concerns in the markets? If you have been practicing good disclosure and regular IR access, now is a good time to keep calm and stick to what has worked for you. For us, we believe in telling a simple, credible and consistent story.’

This article appeared in the Winter 2015 issue of IR Magazine