Executive briefing on Asian roadshow trends from the latest IR Magazine research

Two in five Asian companies (44 percent) plan to increase roadshow activity in the next 12 months, making future roadshow outlook in Asia more positive than in North America (31 percent) and Europe (27 percent).

This comes at a time when companies across the world have been going on fewer roadshows in 2012 compared with 2011, as detailed in the Global Roadshow Report 2012, the latest research report from IR Magazine, sponsored by Bank of America Merrill Lynch.

Based on current roadshow activity, Asian companies are below average. They typically conduct six roadshows per year compared with the global average of 8.4.

Yet a year-on-year increase in roadshows and a corresponding decrease in North American roadshow activity has seen Asian firms close the gap on their North American counterparts: Asian companies are now only one behind the annual average of seven roadshows per year conducted by North American companies (compared with 11.5 per year in Europe).

In fact, judging by the number of days spent on the road, Asian companies now spend more time on roadshows than North American companies, although the difference – 17.3 days for Asia and 17.1 days for North America – is only marginal.

Where to go

When picking destinations, companies are strongly influenced by the location of current investment. When it comes to Asia, 58 percent of roadshows by Asian companies are located in Asia, the source of 55 percent of current investment.

Even so, there is evidence Asian companies may be increasingly looking outside Asia for new investment. Twelve months ago, the overall majority of Asian investor targeting (54 percent) focused on Asia as the best prospect for new investment.

That number has dropped to 41 percent – less than the combined figure for Asian respondents targeting new investment in North America and Europe (48 percent). What’s more, IR professionals in North America and Europe have also revised down their expectations for winning new investment from Asia, although not as much as their IR peers in Asia.

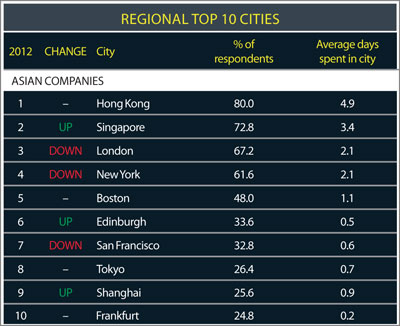

For now, though, Asia continues to host the majority of roadshows by Asian companies and Hong Kong tops the list of most-visited cities as a roadshow destination for four in five Asian companies. Singapore comes second, followed by the overseas contingent of London, New York and Boston.

At number nine, Shanghai is the highest tier one city from mainland China, one place behind Tokyo and one ahead of the German financial center, Frankfurt. Hong Kong is the city where Asian companies spend the most time each year, averaging almost five days throughout the financial calendar, over a day more than the time spent in Singapore, as can be seen in the table opposite.

Beyond Hong Kong’s regional supremacy, Singapore has become the top Asian roadshow destination for global companies touring the region. At number 14 in the list of most-visited global cities, it is a destination for more than a quarter of all companies.

Tellingly, there are no mainland Chinese cities in the top three: Beijing is the highest-ranked city at number 33, closely followed by Shanghai at 36.

When to go

In Asia, the top three months to plan a roadshow are January, July and February – broadly following the global planning trends, as well as the practice in North America and Europe. A third of all Asian companies are planning roadshows during the first month of the year, followed by just over a quarter in July and a fifth in February.

Generally, roadshow planning is spread across the year, but May and October stand out in Asia as unpopular months. In May, in particular, a little over one in 20 Asian companies plan roadshows compared with one in five companies in North America.

September is undoubtedly the favorite month for Asian companies to hit the road. More than half of Asian firms travel during that month, and the global figure is even higher. January and December are the least popular months for Asian companies to travel.

Who to go with

Half of Asian companies take the chief executive on the road at some stage during the year, well below the global average of three quarters. Similarly, 70 percent of Asian companies go on the road with the chief financial officer compared with 84 percent of companies worldwide.

By contrast, almost half of Asian companies (49 percent) take a different member of senior management on the road, higher than both the global average (37 percent) and the equivalent figure for North America (36 percent).

This is equally true when it comes to divisional management: close to one in four Asian companies (24 percent) take a member of divisional management on the road with them, compared with the global average of one in five (19 percent) and the regional average in North America (15 percent).

Did you know?Asian firms typically go on the road with around five different brokers each year. As Asian companies average six roadshows a year, it would suggest companies share the spoils around evenly. Bank of America Merrill Lynch is the most popular broker for Asian companies to go on the road with, followed by JPMorgan Chase in second, and CLSA and UBS in joint third. |

Did you know?Asian companies are the most likely to have a formal method of measuring the success of a roadshow, which subsequently determines future roadshow choices. More than half of them have such a measure in place (58 percent), above the global average of 47 percent and significantly above the North American average of 40 percent. |

About the Global Roadshow Report 2012The IR Magazine Global Roadshow Report details the results of an annual study of non-deal roadshows undertaken by companies across the world. The 2012 edition is based on the responses of 716 IR professionals to a global survey overseen by IR Insight, the research arm of IR Magazine, during the second and third quarters of 2012. |