Everything you ever wanted to know about green issues

Copenhagen

Expect investor scrutiny to crank up on carbon emissions and their cost to the bottom line, regardless of what ultimately happens at the UN’s climate change summit in Copenhagen in December.

Several countries and regions are pushing ahead with emissions trading schemes on their own: the European Union is now on to the second phase of its cap-and-trade system, while US President Barack Obama made emissions trading and US-wide targets a plank of his election campaign in 2008.

‘Over time, these moves could lead to greater costs of carbon. Therefore you need more relevant disclosure to allow judgments to be made,’ Emma Howard Boyd, fund manager at Jupiter Asset Management, told IR magazine earlier this year.

Hopes of a binding agreement on emissions reduction were dashed by comments from Obama around a month before the summit was due to begin. With dozens of world leaders attending the summit in Copenhagen, however, there is renewed hope a broad political agreement could pave the way for firm global emissions targets in 2010.

UN Principles for Responsible Investing

The United Nation’s guidelines have been much criticized. They are open to asset owners, investment managers and related service providers, with the aim of integrating environmental, social and governance (ESG) issues in investment decision making.

From just 20 institutional investors in 2005, there are now around 650 signatories with just over $18 tn in assets under management. There is no obligation for signatories to comply with any of the six principles, however – which may well be why the project has proved quite so popular.

Amid this criticism, the UN is trying to toughen up its act. In August 2009, it de-listed five signatories for the first time. They were removed for failing to complete the annual reporting and assessment process, which has been made mandatory. The six principles are available to read at www.unpri.org.

Philanthropy

Corporate philanthropy remains popular among big business, despite objections from SRI fund managers. In a recent example, Goldman Sachs launched a $500 mn fund to help small businesses, chided no doubt by criticism including the now infamous description of the bank as a ‘vampire squid wrapped around the face of humanity’ by Rolling Stone journalist Matt Taibbi.

But fund managers focused on ESG dislike such gestures. They tend to view philanthropy as a waste of shareholders’ money that does little except fan the egos of management. Fund managers at SRI shops like Boston Common Asset Management prefer to see ESG issues tackled by changing business practices.

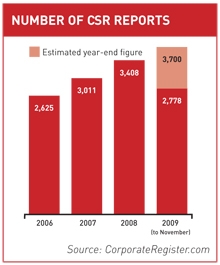

CSR reports The number of CSR reports continues to grow, according to data from CorporateRegister.com, which stores and reviews such publications. For the purposes of IR, CSR reporting is critical if you want to be picked up by one of the many SRI funds.

The number of CSR reports continues to grow, according to data from CorporateRegister.com, which stores and reviews such publications. For the purposes of IR, CSR reporting is critical if you want to be picked up by one of the many SRI funds.

The best-received reports focus on how ESG issues are incorporated into a company’s business model, as opposed to marketing gestures like philanthropy and environmental gestures like tree planting. Much more useful is info such as who on the board is responsible for sustainability issues, according to Zoe Riddell, head of the investor division at the Carbon Disclosure Project.

Number of CSR reports (right) records the number of printed CSR reports. But online versions are just as popular – if not more so – with investors. Firstly and most obviously, they save paper; secondly, the content can be updated as and when necessary throughout the year.

Global Reporting Initiative

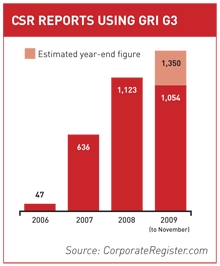

In 2006 the Global Reporting Initiative (GRI) launched its third generation of guidelines, known as G3, to help issuers report on sustainability issues.

The new guidelines aim to make the GRI applicable to all corporations, whether small cap, multinational giant or non-governmental organization. As we can see from CSR reports using GRI G3 (right), the GRI guidelines continue to grow in popularity. Paul Scott of CorporateRegister.com expects more than half of all CSR reports to use G3 by the end of 2009.

As we can see from CSR reports using GRI G3 (right), the GRI guidelines continue to grow in popularity. Paul Scott of CorporateRegister.com expects more than half of all CSR reports to use G3 by the end of 2009.

But the framework has been criticized by some fund managers for its complexity – a factor, they say, that may put off some issuers from reporting at all. An alternative is to create your own reporting framework, picking out your sustainability policies and initiatives, recording how they impact on the companies’ performance and reporting around those areas.

More information and an executive summary of the G3 are available at www.globalreporting.org.

Assurance

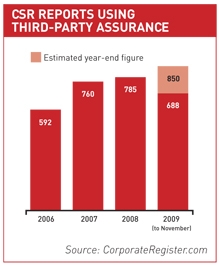

With mandatory emissions reporting close at hand, issuers are going to be under more pressure to accurately report around ESG issues. One way to achieve this is through third-party assurance (see CSR reports using third-party assurance, right).

This is where sustainability reporting is scrutinized in a similar way to financial reporting. The big four accountancy firms all offer CSR assurance services, as do many smaller, specialist players. Just over a quarter of global CSR reports are assured by third parties, with the majority of assurance taking place in Europe.