Swedish fund managers face external demands to focus on CSR

Fund managers are feeling the CSR pressure, according to research from Swedish communications and finance firm Box IR.

Almost 60 percent of Swedish fund managers say there is increased pressure to consider CSR issues, despite its importance when assessing a company increasing only marginally over the last year.

Mikael Zillén, co-founder and partner at Box IR, says that although Sweden has seen ‘a few big issues lately’, the 185 fund managers, analysts and brokers surveyed say the importance of CSR issues in assessing a company has increased only slightly since 2011.

These ‘big issues’ include high-profile stories such as that of telecom operator TeliaSonera, ‘which for some time has been questioned about how it has acquired mobile licenses in some former Soviet states, especially Uzbekistan’, and oil company Lundin Petroleum ‘and the discussion of its involvement in the Sudanese Ogaden province,’ explains Zillén. ‘The financial pros are feeling a stronger pressure from their customers but mainly from media.’

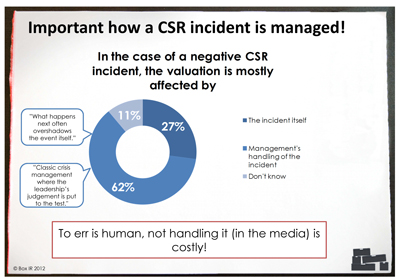

According to Box IR’s Financial Market Survey 2012, however, it is not the negative CSR incident itself that has the biggest impact on a company’s valuation. Sixty-two percent of respondents say the management’s handling of an incident is of the greatest importance, with only 27 percent citing the incident itself. ‘To err is human, not handling it (in the media) is costly!’ says the report.

Box IR also conducted an investor relations survey, covering 100 NASDAQ OMX Stockholm-listed companies, and including 51 CEOs and CFOs. Its findings highlight the goals of the Swedish IR community over the coming year. Top of the list for 2013 is boosting interest in the company, increasing share liquidity and analyst coverage and getting a fair valuation for company shares.

But Zillén points out that only 16 percent of survey respondents regularly conduct perception studies. ‘Not using a perception study to find out why things are as they are or, to a minor extent, actively work with their shareholder base,’ makes these IR goals more difficult to achieve, says Zillén. ‘It’s hard to get one without doing the other