Stocks outperform S&P 500 after dissident investors leave shares behind

Shares targeted by activist investors outperform the S&P 500 by an average annualized 4.3 percentage points after dissidents exit the stock, according to research from Activist Insight.

While the activist is involved in the company, stocks largely track the market, returning an annualized 4.1 percent on average compared with an average annualized return of 4.5 percent from the S&P 500 Index (as of May 2, 2013), says Activist Insight. But shares are further boosted after dissident shareholders exit the stock, the firm adds, ‘suggesting activists imbue a lasting positive effect on shareholder value at the companies they leave behind.’

Citing Starboard Value’s campaign at small-cap healthcare company SurModics as an example of the dissident effect, Activist Insight says the Minnesota-headquartered firm experienced an ‘impressive’ 119.1 percent increase in its share price in the 22 months after Starboard first publicly disclosed its holding in November 2010, ‘owing in part to a successful share repurchasing campaign led by the activist.’

But growth has continued in the seven months since Starboard’s exit, with the company enjoying another 29.4 percent increase in its share price – and outperforming the S&P 500 by 18.5 percentage points.

As impressive as this may seem, it’s large-cap companies that see the biggest gains, according to Activist Insight, outperforming the S&P 500 by an average 13.1 percent following the exit of a dissident shareholder.

JANA Partners’ push for a spin-off at Marathon Petroleum in late 2011 is a good example of how well companies can perform after sparring with an activist investor. While Marathon saw a 22.4 percent increase in its share price ‘between the activist’s Schedule 13D and its exit three months later’, the NYSE-listed firm’s stock jumped a further 72 percent in the 15 months after JANA’s departure – 53 percentage points above the S&P 500.

‘While it is difficult to fully attribute the outperformance of stocks since an activist’s exit to the work achieved by the activist during its involvement with the company, the data certainly offers an argument against the outdated notion that activists seek only short-term value extraction, and instead suggests activists may help companies to create long-term value for shareholders,’ says Kerry Pogue, Activist Insight managing director, in a press statement.

‘An appreciation of the potential enhancement to long-term shareholder value created by activist investors may lead more company boards to engage activists positively,’ he adds.

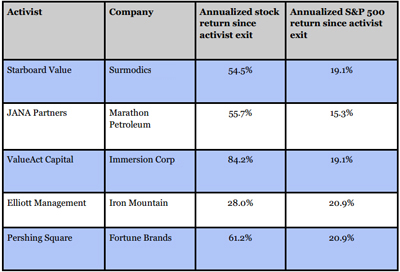

Share performance after activist shareholders exit stock:

Source: Activist Insight. Click to enlarge