Majority of Canadian investors say governance is their first concern, finds IR Magazine research

Corporate governance issues are most important to Canadian investors when making a financial decision, while sustainability and ESG concerns are increasingly prevalent, finds the latest IR Magazine research.

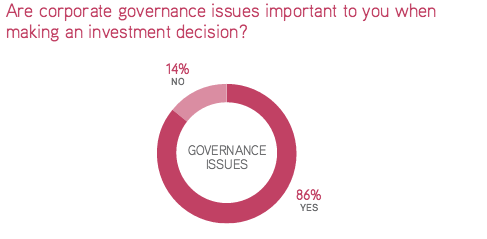

Of the members of the Canadian buy side interviewed as part of the IR Magazine Investor Perception Study – Canada 2016, 86 percent say corporate governance is a crucial factor when making investment decisions.

Those saying this cite a number of reasons: the majority of respondents feel weighing up the impact of good or bad corporate governance is a responsibility that falls to them. ‘It is an important factor to consider in terms of what the management plans to do with the company,’ summarizes one buy-sider. ‘It’s second only to business advantages.’

What issues in particular are at the top of investors’ and analysts’ lists? Many respondents mention a good long-term strategy, succession planning and the separation of chairman and CEO roles as crucial considerations. And if companies are lacking in these areas they will be passed up, no matter how good the potential return on investment, writes one respondent: ‘Maybe it’s old-fashioned but these are our principles and we stick to them.’

Perhaps more interesting is the 14 percent of respondents who are not immediately governance-focused. Most make the point that they take a view on individual topics rather than governance as a whole, or pay attention when a specific issue arises. ‘Proper board representation is important,’ writes one buy-sider. ‘But I’m not sure most investors spend more than five minutes thinking about governance.’

The survey also asked buy-siders to consider the impact of activism on long-term shareholder value. Though the majority of respondents – 55 percent – say it is generally good for a company’s value, 30 percent note that it is difficult to say or depends on each situation, and 15 percent say it is unequivocally bad for shareholder value.

Most who appreciate activism note that the best investors will want to work with –rather than against – a company from the get-go, and will operate in a ‘measured’ or ‘controlled’ manner. ‘It’s a way of reminding management who owns the company and who the management team is answerable to,’ summarizes one respondent.

Of the relatively small number who reject shareholder activism, most complaints center on the potential for short-termism and the speed with which some withdraw their investment. ‘If they are in it for a quick buck, it can generate problems,’ writes a buy-sider.

‘It depends on the activists,’ writes another respondent. ‘Recently there has been a lot of destructive activity where [activists] have taken down the model and forced management to destroy the balance sheet, which I don’t like. But in other cases, like when a company has become complacent or is family-owned, the voting shares can be very good for getting in fresh blood and making positive changes.’

To find out more about the IR Magazine Investor Perception Study – Canada 2015, or to order your own copy, please click here.