What did the 1,300 delegates get up to on Sunday and Monday?

After trying out Seattle last year, NIRI returned to the familiar turf of Hollywood, Florida for its 2013 annual conference. While the weather didn’t quite live up to billing, there was plenty to keep attendees busy at the conference center during the day, as well as offsite at night.

The size of NIRI dwarfs other IR events, with 1,300 registrants, more than 70 exhibitors and three full days’ worth of sessions, spread from Sunday afternoon to Wednesday lunchtime. This year’s conference co-chairs – John Chevalier of P&G and Angie McCabe of Health Net – left their mark on proceedings with a few tweaks to the schedule, such as the addition of TED-style talks and more breakout groups.

Beachside: NIRI 2013 was held at The Westin Diplomat Resort & Spa

Delegates who checked the weather forecast in advance would have been concerned to see the first tropical storm of the hurricane season (called Andrea) was due to hit South Florida a few days before the conference. Luckily, the storm passed before the weekend, although it left its mark by dumping water all over town and putting the bunkers out of action for the NIRI Golf Classic on Sunday morning.

Later that day, NIRI held its regular Global IR Summit, where panelists discussed whether you need an IRO based overseas and how to target non-US investors. Then it was on to the Welcome Reception, held in the services showcase so exhibitors could show off their wares.

Sunday finished with a range of parties thrown by sponsors for their clients. AST held its event overlooking the Intracoastal Waterway, which runs past the conference center. Ipreo hired a boat on said waterway and went for a mini-cruise. Meanwhile, Georgeson put on a Cuban show in town, and brought in a man to hand-roll cigars for guests. There were probably more parties but by this time your correspondent was ready for bed.

The IR Club’s Patrick Kiss tweeted this photo of the Ipreo boat

Monday

The conference kicked off officially on Monday morning, with a welcome from the co-chairs followed by a state of the profession address. The theme of the conference was ‘building value’, highlighting how NIRI can help IROs play a leading role within their companies.

‘I see an enormous amount of opportunities out there'– Hulus Alpay, NIRI chairman and vice president of IR for Medidata Solutions |

‘I see an enormous amount of opportunities out there and it’s really what you make of them,’ said Hulus Alpay, NIRI chairman and vice president of IR for Medidata Solutions. ‘And that’s what this conference is all about. It’s building value for your organization: you’ve got knowledge here, you’ve got the ability to network, and you’ve got the ability to make an impact back at your organization.’

During the session, NIRI president and CEO Jeff Morgan gave an update on the push for shorter filing times for institutional investors. Currently, US investors must report their holdings 45 days after the end of the quarter. NIRI, in partnership with the NYSE and the Society of Corporate Secretaries and Governance Professionals, had mounted a big push to get that cut down to just two. Citing opposition from investors, however, Morgan signaled a change of tack.

‘The investment community, as much as it would like to not have any sort of disclosure, said privately that 20-30 days is more realistic, so you wouldn’t see trading dry up around the end of the quarter,’ he explained. ‘Maybe the solution is to come out with some sort of new filing where companies are given information on a 30-day rolling basis… and that is not shared publicly, but shared with you only within the corporate environment so you know who your shareholders are. If Congress gets involved, Congress can make that happen.’

After Morgan and Alpay came a panel discussion intended to set the scene for the rest of the conference, with senior figures from the banking, investor and corporate worlds offering their broad takes on the market.

Tim Ingrassia, co-chairman of global M&A at Goldman Sachs, said deal activity has held up over the last couple of years, once you take ‘big ticket’ M&A out of the equation. But he felt activity would not pick up until boards feel more confidence about what’s coming next.

‘The science of deal making works really well right now,’ he told the audience in the main hall. ‘In fact, for most companies, access to capital is relatively easy and debt is almost free right now, so from that perspective putting deals together works very well. The psychology of deal making – the confidence that lets you go into the boardroom and say, Can I have x billion dollars to do this deal?, that’s very, very difficult when you can’t predict your next quarter with confidence.’

A ‘boring year’, where initial optimism isn’t ‘dashed on the shores of Greece, or wherever the next financial crisis is’, would go a long way to improving confidence, Ingrassia added.

The investor on the panel – Nick Sargen, chief investment officer at Fort Washington – picked out low interest rates and the possibility of central banks ‘tapering’ quantitative easing as his main area of focus.

‘I think the challenge everyone is facing is that, for a while, the winning investment strategy was take risk ‒ that’s what the central banks were willing you to do: go out and… take credit risk, buy equities,’ he said. ‘And now people are saying, Wait a minute, we’re getting closer to the day when we start to see the drugs starting to be taken away – do I have to alter my strategy?’

‘NIRI founder and first NIRI fellow Dick Morrill enjoying #NIRI 2013 conference,’ tweeted Matt Brusch, NIRI’s vice president of communications

Services showcase

For NIRI delegates, there was plenty of food for thought over at the services showcase, too. Exhibitors tend to unveil new products and partnerships at the annual conference, and this year was no different. Ipreo announced that OpenExchange’s video meetings solution would be incorporated into its IR workflow tool, which will further nudge IROs to use videoconferencing for their investor outreach.

Gearing up in a different direction, Georgeson unveiled a new IR workflow platform that incorporates the solicitor’s proxy data, allowing users to dig into investor voting preferences on their own. Georgeson boasts this is ‘the first time this type of data has been syndicated.’ The product is based on the technology behind TMX Group’s ir2020 platform, with Georgeson research and data plumbed in.

Also in the spotlight was NASDAQ OMX’s purchase of the IR, PR and multimedia units of Thomson Reuters, which closed in the week before the conference. Both firms had conducted joint planning in advance of NIRI, and shared a combined booth in the services showcase.

All the corporate solutions businesses owned by the NASDAQ OMX group are being brought together to form a new unit called Global Technology Solutions, which will have more than 10,000 corporate clients. Last week, Demetrios Skalkotos, senior vice president of corporate solutions for NASDAQ OMX, told IR Magazine a ‘very aggressive software development schedule’ is already under way to integrate and enhance the offering.

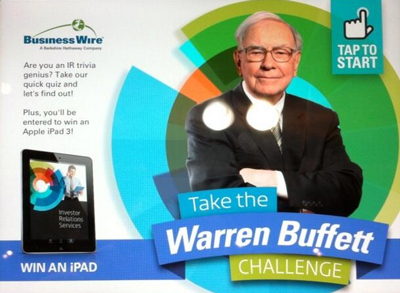

Business Wire’s Warren Buffet challenge offered attendees the chance to win an iPad in the services showcase. Tweeted by Eric Bushkin, SEO specialist and senior account executive at Business Wire

Following a short break at the end of the day, delegates headed to the grand ballroom for the NIRI Signature Event, dubbed ‘An evening in the islands’. After that, those who had managed to bag wristbands for the Liquidnet party boarded buses and headed into town for the most sought-after party of the week.

Click here to read NIRI 2013 round-up: part two