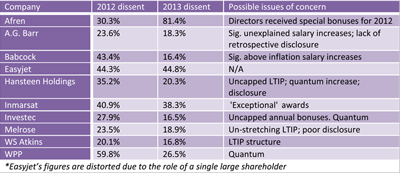

Ten British companies named and shamed over excessive pay and ‘exceptional’ awards

Despite receiving a warning from shareholders last year, investor revolts have dragged on for 10 FTSE companies, with each receiving more than 15 percent dissent over pay in the 2013 proxy season, according to research from the National Association of Pension Funds (NAPF).

These include FTSE 100 firms Babcock International and WPP, as well as Afren – the only company to have its remuneration report voted down by its shareholders so far this year. Along with Babcock and Afren, satellite communications firm Inmarsat received a special mention for failing to respond to the ‘quiet diplomacy’ seen at other companies.

‘Babcock International totally rejects the unfounded and arbitrary claim by the NAPF that the company ‘ignores shareholder concerns’,’ says a spokesperson for the firm, which saw 43 percent of investors abstain or vote against its remuneration report in 2012, dropping to a still notable 16 percent this year. ‘Babcock consults regularly and closely with its investors,’ she adds.

Afren saw dissent rise from 30 percent last year to a hefty 81 percent in 2013. The Daily Mail quotes chief executive Osman Shahenshah as saying: ‘We will continue to consult with our shareholders to ensure their support for remuneration policies that win their approval at the next AGM.’

The paper also quotes an Inmarsat spokesperson: ‘Following the significant vote against in 2012, Inmarsat undertook a widespread shareholder consultation. These meetings were helpful and have contributed to the planning of our future remuneration structure.’ But with 38 percent of shareholders voting against its remuneration report, compared with just under 41 percent last year, it seems little has changed.

The NAPF, which represents 1,300 pension schemes with assets of around £900 bn ($1.4 tn), says the firms are among ‘a few’ that have not ‘listened and learned’ from the 2012 shareholder spring.

‘We hope that highlighting the few companies where shareholders have felt compelled to give the company another reprimand will cause [the firms] to reflect, listen to shareholder concerns and introduce changes next year,’ says Joanne Segars, NAPF chief executive, in a press statement.

The group also says there are ‘encouraging signs that investors are directing their attention toward other important issues, such as the audit.’

The other firms named by the NAPF are AG Barr, easyJet, Hansteen Holdings, Investec, Melrose and WS Atkins.

Source: NAPF 2013 AGM season report. Click for a larger image