First study of activism and brand value finds predominantly negative impact on brand value extending long beyond original activist campaign

There has been a lot of research in recent years showing that a specific form of shareholder activism known as hedge fund activism has had an adverse impact on shareholder value, as measured by stock price performance and market cap, in the wake of an activist campaign. Harvard Law School professor Lucian Bebchuk and his associates have questioned the ‘scientific’ validity of this research from varied sources, but he and his supporters are a small minority.

What hasn’t been studied until now, however, is the impact of shareholder activism on corporate brand value. To produce this research analysis, Corporate Secretary partnered with CoreBrand, a natural choice given the latter’s impressive database of nearly 1,000 companies from 54 key industries and more than 20 years’ expertise in studying the elements of brand value and advising clients on how to strengthen their corporate brand and capitalize on their brand value.

Each year, CoreBrand surveys 10,000 business decision makers from the top 20 percent of US businesses with annual sales above $50 million to arrive at scores for familiarity and favorability, which reflect company size/recognition and quality, respectively. Familiarity represents a weighted percentage of survey respondents who recognize the brand being evaluated. Only respondents who are familiar with a brand – knowing more than just the company name – are asked to rate the three dimensions of favorability on a four-point scale: overall reputation, perception of management and investment potential.

Familiarity and favorability scores are then combined into a single BrandPower score and the scores are used to calculate the brand equity value (BEV) – comprising BrandPower, familiarity and favorability – of each company, both as an absolute dollar value and as a percentage of the company’s market cap.

Event-driven impacts

With data extending back to the early 1990s, CoreBrand is able to measure changes in a company’s BEV from a specific event such as a major earnings restatement or a CEO’s removal. This lets CoreBrand determine the magnitude of the impact the event has had on BEV, both as an absolute dollar amount and as a percentage of market cap. ‘Brand is an intangible asset, but it does have value and can be measured [even though] it’s not on the balance sheet,’ says CoreBrand CEO Jim Gregory.

Once CoreBrand has calculated a base level of BrandPower based on a company’s revenue size and quality (as reflected in shareholder value), this expected level of BEV becomes zero for the sake of measuring changes that may result from a particular event, such as an activist announcement. This explains why some companies show dips in BEV percentage and dollar value to negative numbers. Because the corporate brand contributes millions or even billions of dollars to a company’s stock price and market valuation, any changes in it can have a significant impact on stock performance.

Using a list of activist campaigns (provided by FactSet SharkWatch) conducted against S&P 500 companies related to value creation, board seat and CEO/officer removal announced since January 1, 2006, CoreBrand analyzed 66 companies, all but eight of which show a clear inflection point in their familiarity and/or favorability scores in the year of the activist campaign.

‘We’re trying to identify inflection points that start a trend going in one direction or another,’ Gregory explains. ‘It’s not necessarily that activism is driving it – it may not even have caused the direction – but it’s an identifiable point in time that brings attention to an issue, and that attention can continue’ beyond the activist campaign.

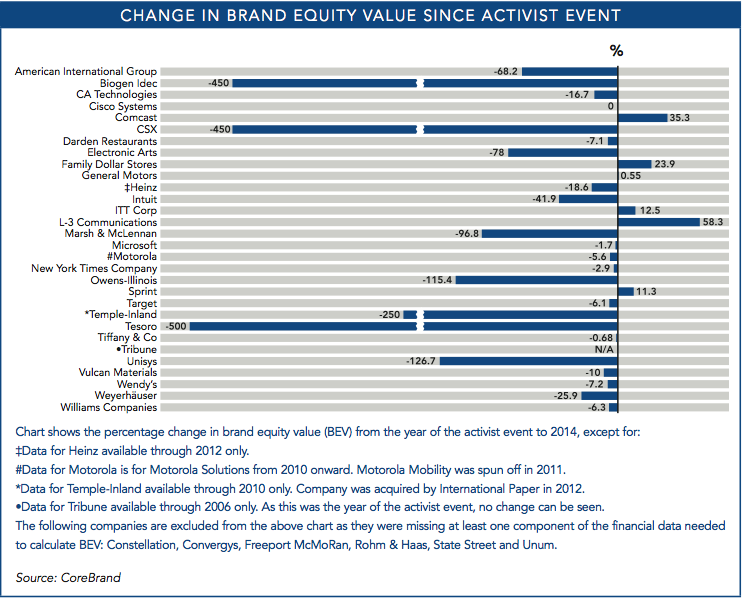

Eight of the 66 companies analyzed proved inconclusive, with insufficient current data to see a trend, leaving a base of 58 companies in the study. Thirty-six (62 percent) of those reflect a major inflection point of their corporate brand in the year of the activist campaign; 15 (26 percent) show a small impact on the corporate brand; and six (10 percent) indicate no impact from the activist campaign.

Based on the results, CoreBrand finds that shareholder activism is likely to have a significant impact on a corporate brand. Of the 36 companies with a large inflection point:

- 19 show significant long-term declines in favorability, indicating perceived quality of the company

- Seven show modest improvement in favorability

- Two show improvement in familiarity, while favorability remains flat

- Eight have mixed results showing short-term gains followed by declines in the corporate brand.

The second conclusion reached by the research is that the impact of investor activism on the corporate brand appears to be long term. Third, the impact can be significant and longer-lasting on the downward side, while the upside of investor activism tends to be modest or short-term in nature. Fourth, even when there is modest upside impact, the long-term trend is often negative.

Long-term decline in favorability

CoreBrand provided three case studies to exemplify various insights about the impact investor activism has on brand equity value. Two of the companies – Electronic Arts and Marsh & McLennan – are from the group showing long-term declines in favorability, while the third company, Family Dollar Stores, is from the group where there was modest improvement in favorability.

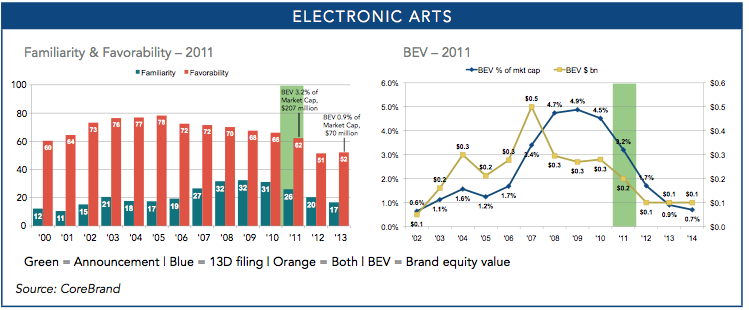

For Electronic Arts (see below), BEV as a percentage of market cap declined from 3.2 percent to 0.9 percent and the value of the brand plunged from $207 million to $70 million between 2011 and 2013. These changes mirror declines in favorability and familiarity, as well as revenue, even as the company’s market cap grew from $6.6 billion to $7.1 billion over the same time period.

Declines in perception of management and overall reputation in 2006 overrode an essentially flat investment potential between 2006 and 2010 to initiate the overall decline in favorability. Erosion in Electronic Arts’ brand from 2011 to 2013 identifies a failure of management to see an opportunity to increase enterprise value by adjusting through brand, CoreBrand concludes.

The name Electronic Arts has very low familiarity for a company whose major brands, EA Sports and EA Games, are so widely known. The company could have created billions of dollars of shareholder value by simply changing its name to EA as early as 2006, according to CoreBrand. It’s the corporate brand that matters when companies confront a proxy battle, Gregory emphasizes.

Unfortunately, the details of the proxy battle announced in May 2011 by Relational Investors in pursuit of a board seat don’t seem relevant to the drop in Electronic Arts’ brand value, which had already begun in 2009. It could be that Relational, having witnessed a $641 million loss in the fourth quarter of 2008, layoffs of 17 percent of the workforce in late 2009 and other signs of trouble, saw weakness in management that it believed it could exploit to win a board seat, though why it waited two years is unclear.

The proxy fight, however, was reportedly undisclosed until a settlement had been reached with Electronic Arts’ board, giving Relational the option to place one director on the board. It’s unlikely the activist campaign by itself caused the brand value’s continued decline from 2011 to 2013, so there were probably other factors.

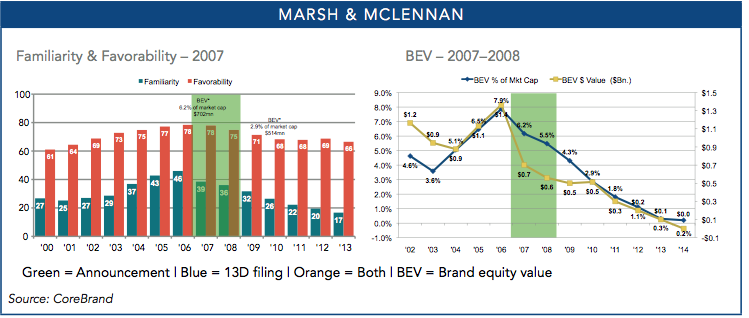

Elsewhere, Marsh & McLennan’s revenue declined slightly between 2007 and 2010, while market cap increased from $11.3 billion to $14.9 billion (see above). Both familiarity and favorability dropped and, as a result, the BEV percentage of market cap fell from 6.2 percent to 2.9 percent.

Along with the decline in BEV percentage, in dollar terms, brand value fell from $702 million to $514 million between 2007 and 2010, despite a 31.9 percent rise in market cap. Had familiarity and favorability not declined and had the company maintained its BEV at 6.2 percent of market cap, the value of the brand should have climbed to $924 million in 2010. Marsh is a case of creating shareholder value at the expense of brand health.

Improvement in favorability

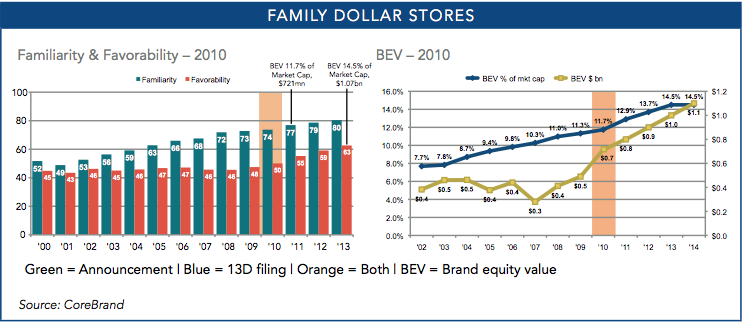

The third case study, Family Dollar Stores, demonstrates one of the few examples where brand value improved as the result of an inflection point in the year of an activist campaign. In March 2011 Trian Fund Management made an unsolicited takeover offer for Family Dollar. The company rejected the offer of $55-$60 per share and quickly adopted a poison pill to protect itself from hostile bids. It later granted Trian one board seat in exchange for a cessation of its takeover efforts.

Family Dollar’s favorability score had begun to trend up from being flat at 46 in 2007 and 2008 to 48 in 2009 (see opposite), at least a year and a half before Trian made its move. But the uptrend became more pronounced in 2011 after the hostile takeover bid and poison pill, with favorability rising from 50 to 55 and continuing its ascent to 63 by 2013. Similarly, familiarity – which had been inching up one point per year between 2008 and 2010 – rose three points to 77 in 2011 and extended its gradual increase through 2013.

Looking at a breakdown of the three dimensions of favorability, CoreBrand notes that investment potential had been gradually rising from 2003 while overall corporate reputation, and perception of management in particular, flagged. It’s possible that Trian’s 2011 announcement may have spurred subsequent growth, although the chart indicates that the other two attributes were already in an extended uptrend by 2010.

Mirroring the favorability trend, Family Dollar’s BEV percentage, in a steady uptrend since 2003, had an inflection point in 2011, when the uptrend steepened and kept rising until 2013 before flattening out at 14.5 percent. BEV rose from $721 million to $1.07 billion in the same period. Family Dollar appears to be a case of well-managed shareholder activism, where lethargy in favorability was ‘activated’ by what seems to have been a well- orchestrated effort to create value and ultimately sell the company, according to CoreBrand.

Rival discount retailer Dollar Tree offered to buy Family Dollar on July 28 this year for an enterprise value of almost $9.2 billion, or $74.50 per share, a 23 percent premium over the closing price on Friday, July 25. The Wall Street Journal reported that the offer came amid veteran activist investor Carl Icahn’s push for a sale of Family Dollar and threats to replace the board after CEO Howard Levine overhauled the sales strategy earlier this year.

Other effects

There are cases where BEV changes for a company don’t clearly track its favorability trend. Marsh’s favorability stabilized at 68 points in 2010 after falling from a peak of 78 in 2007, the year KJ Harrison & Partners submitted a proposal for the 2008 annual meeting recommending that the company spin off the Kroll and Mercer units to enhance shareholder value. But BEV percentage continued to decline, from 2.9 in 2010 to 0.2 in 2014, which suggests an even longer-lasting adverse impact on brand equity value than the favorability change indicates.

While favorability had stabilized, the continuing decline in Marsh’s familiarity score from 26 in 2010 (compared with 39 in 2007) to 17 in 2013 seems to account for the continued drop in brand power, according to CoreBrand.

Weyerhaeuser’s BEV percentage continued to drop from 2006 to 2014, even as favorability bottomed out in 2010 before rebounding by 2013 to above its 2006 level. In 2006, Franklin Mutual suggested the timber company modify its corporate structure to become more tax-efficient by converting to a real estate investment trust. Like Marsh, the subsequent decline in Weyerhaeuser’s BEV percentage appears to have tracked along with familiarity, with the increase in BEV percentage in 2011 corresponding to a rebound in familiarity that same year.

A company’s familiarity score may fall after an activist event if, as a result of the event, there are enough changes in corporate structure or assets that business leaders surveyed are no longer certain what transpired, says CoreBrand.

Fifteen activist campaigns for 12 companies led to proxy fights. CoreBrand calculated average changes in familiarity, favorability, BEV percentage and BEV dollar amounts for four groups of companies according to the outcome of the proxy contest – management win, dissident win, split and settlement/concession. Most of the averages indicate declines in all scores. The only average gain is in BEV percentage change for companies that settled with dissident shareholders.

Biogen Idec was one of the few companies that had declines in familiarity and favorability after the activist campaign announcement, which may indicate the company stopped communicating after the activist event. That’s one option a company can choose, especially if it lacks confidence in its story – ‘but it’s a self-fulfilling prophecy,’ warns Gregory. ‘If you don’t communicate, a negative will fill that vacuum’, ensuring a decline in brand equity value.

More companies are paying attention to their CSR positioning, but Gregory sees those efforts being wasted when companies don’t take care to nurture their brand. Not only is that potentially costing them customers and market share, but it’s also having an impact on employee morale and media coverage. When corporate brand value is being preserved, ‘you’re getting more positive stories from the media, and not having to spend as much on PR,’ he concludes.

This article originally appeared in Corporate Secretary