The 2020 World Economic Forum in Davos was an inflection point for the field of investor relations, with its theme of ‘Stakeholders for a cohesive and sustainable world’ pointing the way toward a significant shift in focus – and language. Though shareholders will always remain essential to the engine that runs businesses and drives economies, matters of ESG in the eyes of investors and consumers are compelling IR teams to bring ESG and stakeholders into their communications around sustainable investing.

Effective messaging around progress against established ESG goals has become a top priority for IR professionals and brings its own distinct challenges, especially in an uncertain business environment with the possibility of recession looming. The ESG lens has gained importance for individuals and institutional investors because it helps investors assess how companies manage the risks and opportunities created by changes in the marketplace.

Businesses and investors around the world are adopting the principle that when companies create enduring value for all their stakeholders, including customers, suppliers, employees and communities, shareholders also benefit. In fact, ESG performance is now a key factor of influence in investing choices and consumer behavior.

Pressure for companies to provide clear and transparent ESG disclosure together with their quarterly filings and annual reports is growing, especially since the 2020 World Economic Forum in Davos changed the conversation in sustainable investing by shifting the focus from shareholders to stakeholders.

The coronavirus pandemic’s disruption of workplaces and supply chains around the world also exposed the interdependence among stakeholders, the need for businesses to create long-term value and the risks inherent in a narrow focus on short-term shareholder profit. Although international investors have led the ESG trend thus far, American investors are catching up quickly.

Social stands and backlash

In the US, matters are complicated by two opposing trends: demand from consumers and other constituencies for brands and corporations to take stands on social issues such as climate change, diversity and economic inequality, and public trust in other institutions being on the decline. Consider too the backlash against prioritizing matters of ESG from some conservative investors.

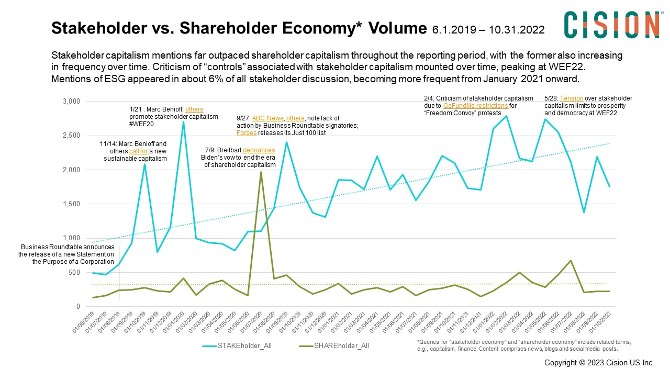

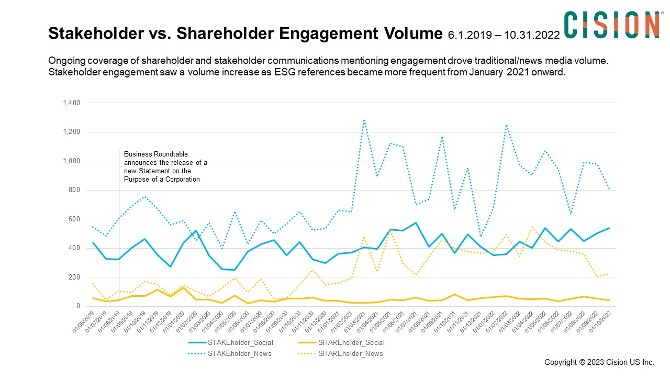

To help IR professionals navigate these trends, the Cision Insights team explored the evolution of sentiment around the terms ‘shareholder economy’ and ‘stakeholder economy’ since the Davos declaration of new stakeholder capitalism metrics for tracking and reporting ESG performance in 2020.

The team analyzed seven years of earnings reports and PR Newswire data, as well as social media conversations both pre and post-Davos, to assess the volume of activity, reactions, and sentiment around terms such as shareholder/stakeholder economy, shareholder/stakeholder economics and shareholder/stakeholder capitalism.

Some key findings

- The terms that resonated most were ‘stakeholder capitalism’ and, to a lesser extent, ‘shareholder capitalism’; the former far outpaced the latter, which also became more frequent over the reporting period – mainly due to a few widely shared tweets.

- Mentions of ESG appeared in about 6 percent of stakeholder content, especially from January 2021 onward.

- Social media posts and op-ed articles critical of stakeholder capitalism became more frequent over time, particularly in 2022 as ESG gained currency.

- Using Google search activity as a proxy for consumer interest, it is notable that ‘stakeholder economy’ has been in public discourse for at least five years and its usage has become far more frequent in 2022.

Cision recommends that investor communications professionals use stakeholder language to appeal more broadly across constituencies and show their organization’s commitments to ESG in quarterly and annual reporting, earnings and profit statements and related digital assets.

But they should also be aware of the growing dissent from a few who claim ESG and ‘woke ideology’ are threats to free market/shareholder capitalism as the former ideas gain currency. It’s also crucial to identify priorities and tailor messaging to each target audience because different ESG issues affect companies’ long-term financial interests differently.

The uncertainty of the widely anticipated upcoming recession adds to the complexity of the situation in financial markets today. That means access to up-to-date, accurate and comprehensive trend and sentiment data is essential for IR professionals to drive effective communications.

Karen Stockert is a client insights manager at Cision Insights

For more thoughts on shareholder vs stakeholder and how to navigate your IR messaging, watch Cision's latest webinar featuring IR Magazine here