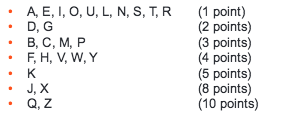

Index based on popular word game created as part of Cass Business School study

A ‘Scrabble Index’ has performed better than more traditional indices over the past 50 years, research has shown.

Researchers at the Cass Business School created an index of the 500 largest US stocks, weighted by the number of points each issuer’s ticker symbol would score in the popular board game Scrabble. Those that scored highest were given a higher weighting, before each was divided by the combined score for all 500 stocks to give weighted values.

Letter values as determined for the Scrabble Index

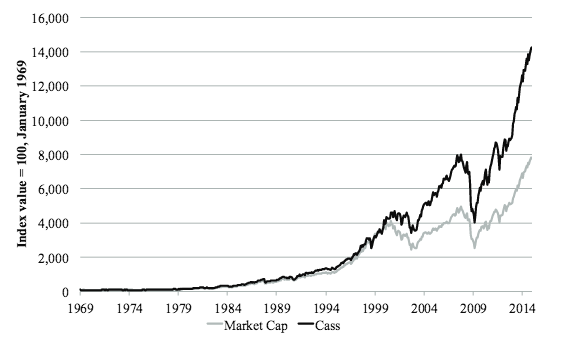

An example given by the researchers shows that AAPL scores six while XOM scores 12, so ExxonMobil should receive twice the weight of Apple in this index. The performance of the Scrabble Index was then compared with a familiar market cap-weighted index of the same 500 shares over a 50-year period.

The results? Well, a $100 investment in Cass’ index would be worth $14,108 today, while the market-cap weighted index would have turned that money into $7,718. This roughly equates to a difference of 1.53 percent every year, although the Scrabble Index does come with slightly more volatility than the traditional model.

The performance of Cass’ Scrabble Index versus a market cap-weighted index

The researchers argue that standard tracker funds, such as those that track the FTSE 100, are tracking stock prices inefficiently because they prioritize past performance. In fact, the report’s authors re-examine data from 2013, when they created 10 million random portfolios (evoking the old adage involving monkeys, typewriters and Shakespeare).

Dubbed ‘monkey-constructed indices’, these portfolios beat a market cap-weighted approach on all but 0.12 percent of occasions, a ‘remarkable result, and one that is statistically significant,’ write the Cass researchers. ‘It suggests we can be almost 99.9 percent sure the relatively poor risk-adjusted performance of the market cap strategy was due to bad design rather than to bad luck.’

Meanwhile, smart beta strategies – increasingly employed by US investors – that screen stocks depending on certain characteristics, such as those that pay a strong dividend, were shown to yield much better results. With the exception of equally weighted and diversity-weighted strategies, smart beta approaches beat at least 90 percent of the ‘monkey’ strategies.

A minimum variance portfolio strategy, meanwhile, beat 99.9 percent of monkey funds. This, Cass researchers say, means we can be ‘99.9 percent sure the risk-adjusted performance of this approach was due to good design rather than good luck.’

They add that hopefully the research will shed light on why cap-size indices could be disregarded in the near future. Just to be safe, though, it might be worth changing your stock ticker to ‘QJZX’ in case the Scrabble Tracker Fund takes off.