Companies are becoming more cautious in their statements, report fund managers in survey

A combination of geopolitical issues and macroeconomic factors has caused investors to lose optimism, according to a survey of 30 global financial professionals by IR research and advisory firm Corbin Perception.

There has been a significant scaling back of investor optimism, with only 6 percent considering themselves bullish in Q2, compared to 26 percent in Q1. Investors calling themselves bears increased from 13 percent to 22 percent.

Source: Corbin Perception

The shift owed to market conditions, including doubts about the US economic recovery, the ongoing European crisis, and market volatility.

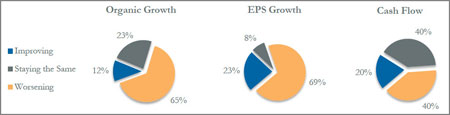

For example, more than half – 56 percent – are more cautious about companies that have exposure to European budget and monetary problems. Overall, the respondents expect EPS and organic growth to worsen this quarter.

Source: Corbin Perception

Another important factor has been a ‘universal’ assessment among respondents that management outlooks became ‘increasingly more cautious to negative’ between quarters.

‘They are definitely more cautious,' one technology investor told Corbin's research team. 'It is hard to say negative because management is never negative and business is always great.'

The institutions that took part in the survey have combined equity assets under management of nearly $834.8 tn.