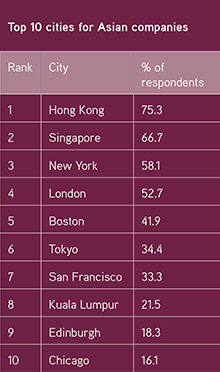

Hong Kong has held onto its crown as the top roadshow destination among Asian firms – a position it has held since IR Magazine first began tracking global roadshow trends in 2011.

Singapore also maintains its second-place spot, while London has been replaced by New York to round out the top three, according to the Global Roadshow Report 2017. No new cities have entered the top 10 rankings for Asian firms going on the road.

|

Top 10 roadshow destinations |

But there have been movements, with New York, Boston and San Francisco all rising in popularity, while the two UK cities on the list – London and Edinburgh – dropped down the rankings. London slides into fourth place while the Scottish capital moves from sixth to ninth.

‘For Asian companies, Hong Kong and Singapore are the leading players in the market because you have a lot of global fund managers in both those locations managing emerging markets funds,’ Vivek Aranha, CEO for Asia at Orient Capital, tells IR Magazine.

‘Hong Kong may have more hedge funds than Singapore – maybe that’s why it leads the Asian cities,’ he continues. ‘But it would be interchangeable in that if you’re in Southeast Asia you’d probably go to Singapore more often, and if you’re in north Asia you might visit Hong Kong. However, I think in terms of Asian cities, those two will always lead.’

Jeannie Ong, award-winning head of IR at Singapore-headquartered StarHub, tells IR Magazine that she doesn’t roadshow in Hong Kong but does attend two conferences in the city each year – the Credit Suisse Annual Investor Conference in March and the CLSA conference in September.

‘What makes Hong Kong such a great city? I suppose it is the crossroads between the East and the West,’ she says. ‘For us at StarHub, the two conferences [we attend] are well organized and, more importantly, they attract big funds from all over the world, so they are conferences not to miss. That said, the two big conferences in Singapore – the Deutsche Bank conference in May and the Morgan Stanley conference in November – are big draws for major funds all over the world too, so they are a must for every IR calendar, in my view.’

Ong says she is surprised by Edinburgh’s drop in the rankings, adding that StarHub did a non-deal roadshow in the city in November and ‘didn’t notice anything amiss.’ Aranha, however, notes that the August 2017 merger of Standard Life and Aberdeen Asset Management could have had an impact.

Ong says the city remains in StarHub’s 2018 IR calendar, as do London and the US, with the company usually doing non-deal roadshows in Europe, the US and Canada. ‘As for the other cities, such as Tokyo, Kuala Lumpur and Bangkok, we usually attend the conferences organized by the brokers,’ says Ong. ‘We find them sufficient for our needs.’

Both Kuala Lumpur and Tokyo feature in the top 10 list for 2017. Kuala Lumpur entered the list in 2015 in ninth place and has climbed one position to sit in eighth place. Tokyo dropped down one spot in the Asia rankings, but the Japanese capital made it into the global top 20 list for the first time.

Scandinavia was also added to Ong’s travel plans in recent years. ‘I urge my peers to include the likes of Denmark, Copenhagen and Stockholm in their IR calendar,’ she says.

Diverse destinations

The Asia top 10 is a far more diverse list of cities than those most visited by North American or European firms. In the North American top 10, the only city from outside the region is London, while the European list features three North American cities – New York, Boston and Chicago – but again no Asian cities make the list.

Aranha says Orient Capital rarely gets requests for roadshows from companies outside Asia. ‘I’m not sure how many of the funds here have mandates to invest in the US and Europe and that might be part of that,’ he adds.

‘From an exposure standpoint though, it is always good to meet new investors in other parts of the world if time and budgets permit. But if you don’t have a fund that’s specifically investing in European or US entities, you’re going to be viewed from a global standpoint, and outside of the really large brand names, you’re going to need more exposure or more consistent messaging to these investors.’

Mifid in Asia

Aranha also notes that Asian companies are starting to see some impact – albeit in the early stages – from the European Mifid II regulation.

For large caps, he says there has been an increase in meeting demands, something IROs are having to spend more time managing, as well as increased work when it comes to roadshow logistics.

‘In the past, if management was interested in doing a roadshow in the US [for example], companies could call up the broker and speak to the corporate access team, who are quite helpful, particularly if they find the company to be of interest. [Now] companies will definitely have to step up that game because they’ll have to go by themselves more or have restricted access depending on the broker they have chosen,’ he explains.

And although he echoes the general view that small and mid-cap companies are likely to be hit hardest by Mifid II, Aranha says that many in Asia have a strong retail base that could insulate them somewhat. ‘When you look at the small to mid-cap space in Asia you can have a big retail component as well,’ he says. ‘These companies might not go to the US or to Europe to meet investors so unless they’re meeting global funds, there might not be so much change for them.’