With corporate climate disclosures entering the mainstream, many investor relations (IR) and sustainability professionals now must answer new questions from their C-suite, board, and other internal stakeholders:

With corporate climate disclosures entering the mainstream, many investor relations (IR) and sustainability professionals now must answer new questions from their C-suite, board, and other internal stakeholders:

- ‘Are we doing enough on climate?’

- ‘How do we know if our efforts are heading down the correct path?’

- ‘Who is doing better than us?’

To understand where they are in their climate reporting journey, ESG and sustainability functions at companies will often manually benchmark themselves against 10 to 20 sector peers. But what if they could look across an entire sector or market while also benefitting from the superior ability of artificial intelligence (AI) and natural language processing (NLP) to consistently categorize and quantify natural language?

Climate and machine learning experts at Nasdaq have made this possible with the release of a new study into climate disclosures from companies across the S&P 500 and Russell 3000. By combining technology, data and climate expertise, they trained a machine intelligence model to identify different stages of climate reporting and set it to work across 10,000 documents and 30 mn sentences in SEC filings, particularly annual reports and proxy statements.

The research examines some of the most important climate disclosures that are top-of-mind among corporates, including board oversight, risk identification, greenhouse gas measurement, target setting and scenario analysis. Based on their performance, companies were then divided into one of four groups: ‘no disclosure’, ‘starting’, ‘established’ and ‘advanced’.

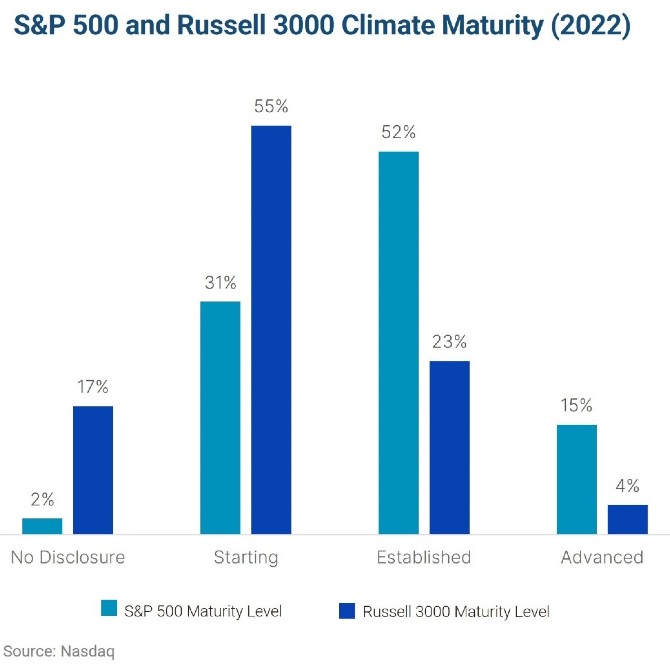

The findings show that, between 2021 and 2022, US issuers significantly enhanced their climate reporting. The number of companies without any climate disclosure fell from 11 percent to 2 percent in the S&P 500 and from 31 percent to 17 percent in the Russell 3000. At the same time, the proportion of companies at the ‘advanced’ stage doubled in both indexes.

‘There was a huge increase in companies at the established and advanced stages of climate disclosure, representing a significant shift to the right of these climate-maturity curves from 2021 to 2022,’ says Emily Menz, senior climate tech analyst at Nasdaq. ‘This reflects the increase in pressure from stakeholders, such as regulators and investors, and climate simply becoming more mainstream.’

Maturity level

To qualify for the ‘advanced’ stage, companies need to report on climate scenario analysis or Scope 3 emissions measurement. The number of issuers in this category remains small, at 15 percent for the S&P 500 and 4 percent for the Russell 3000, notes Menz. ‘It’s hard to do,’ she explains. ‘It requires a lot of resources: dedicated personnel over the course of a year, external consultants and internal buy-in across business units.’

Menz points out that investors do not typically expect companies to be in the advanced stage, but rather that they state their intentions for the future and demonstrate consistent progress. A survey conducted by Nasdaq earlier this year reveals buy-side priorities for climate reporting include Scope 1 and Scope 2 reporting, short-term emissions reduction targets and qualitative disclosures, including TCFD-aligned reports – all of which fall into the ‘starting’ and ‘established’ categories.

‘The best thing companies can do to satisfy their investors is clearly articulate, based on their sophistication stage, how climate relates to their business model, their intentions for the future and how they’re thinking about risk management,’ Menz says. ‘That can be done at any stage of sophistication – companies can start thinking about it right now.’

Sector split

The research also uncovers the climate maturity of different sectors. Unsurprisingly, companies with the highest exposure to transition risk are the most advanced in their climate reporting. Oil and gas companies make up the largest proportion of names in the ‘advanced’ category.

At the other end of the spectrum, biotechnology, software, pharmaceuticals and healthcare equipment are the main laggards. These sectors have shown increased ambition in 2022, with many of the companies moving from the ‘no disclosure’ to ‘starting’ stage of climate reporting.

‘Historically, these sectors have not been impacted much by climate change,’ says Viktor Aghajanyan, ESG research & development specialist at Nasdaq. ‘But that’s changing. For example, healthcare equipment companies often rely on a small number of specialty manufacturers. This puts their business at risk of extreme weather events.’

Turning to where information is usually disclosed, Nasdaq finds that annual reports are the typical location for climate-risk information, while proxy statements tend to focus on climate governance. In the S&P 500, 91 percent discuss management oversight of climate or ESG in the proxy statement, compared with 20 percent in annual reports. By contrast, 83 percent mention climate-related risks in the annual report, versus 37 percent in proxy statements.

Within the Russell 3000, overall disclosure levels are lower but still show a steady upward trend: 56 percent of the index commented on board oversight of climate in the proxy statement in 2022, a jump from 42 percent the previous year.

‘These trends are likely to continue in 2023,’ says Menz. ‘We suggest companies start by formalizing oversight of climate at the board and management level, with clear communication channels and processes for updating the board across all functions, including risk, supply chains, communications, investor relations, product & operations and facilities.’

Above all, Menz and Aghajanyan say Nasdaq’s study is just the starting point for helping internal corporate sustainability and IR teams tasked with climate responsibilities to quickly benchmark their efforts across the whole market, identifying gaps in disclosure or opportunities to demonstrate leadership. ‘We’re excited about combining our knowledge of climate with machine learning to find insights at scale,’ says Menz. ‘It will be a game changer for internal ESG working groups that are tasked with assessing where they are on their climate journey.’

Click here to access the full Nasdaq report, featuring charts and commentary that detail:

- Our key findings

- Climate disclosure maturity trends

- Industry breakdown by maturity level.