Last year Europe scrapped mandatory quarterly reporting, citing the pressure it places on smaller companies and its encouragement of short-term thinking. Could the US ever follow suit?

This article is now available to subscribers as an audio recording too – please see below the "At a glance" section for the playback option.

European firms are enjoying a new-found reporting flexibility after new rules came into effect late in 2015 ending the need for four financial updates a year. In the US, where the quarterly earnings cycle feels hardwired into the capital markets, such a move seems unthinkable – but it has its proponents.

Last August, law firm Wachtell Lipton Rosen & Katz wrote to the SEC calling for an end to quarterly reports. Echoing arguments heard across the Atlantic, Wachtell Lipton said less reporting would help focus market participants on the long term. Calpers’ chief investment officer Christopher Ailman agrees: ‘We are not a fan of quarterly reporting,’ he tells IR Magazine, also tying his view to the broader debate about how to encourage long-term thinking.

Campaigns in the US have tended to focus on earnings guidance rather than quarterly reports. The organization Focusing Capital on the Long Term (FCLT), a consortium of investors from Canada, the US, the UK, New Zealand, the Netherlands, France and Singapore, has been calling for an end to quarterly guidance for some time. Its mission is to ‘develop practical structures to support longer-term behavior in the investment and business worlds’. Some US companies have never issued such guidance, including Google, Berkshire Hathaway and steel company Alcoa, but the investment side is, in general, less than happy with this development.Earning few friends

Like FCLT, other organizations have criticized earnings guidance. A report last year, ‘Ending short-termism’, from the Roosevelt Institute, criticizes quarterly earnings guidance but not quarterly reporting. So does a recent Conference Board publication, Is short-term behavior jeopardizing the future prosperity of business?, one of whose targets is ‘quarterly capitalism’. But both fall short of calling for an end to quarterly reporting.

In fact, one of the leaders of FCLT recently said quarterly reporting should remain in place. Larry Fink, BlackRock’s CEO, said in his 2016 corporate governance letter to CEOs: ‘We believe companies should still report quarterly results – long-termism should not be a substitute for transparency.’

Douglas Chia, executive director at the Conference Board Governance Center, says he has heard some say: ‘Let’s just get rid of the 10Q [the SEC term for quarterly filings], no one reads it anyway.’ But as there are significant legal and regulatory barriers (it is a requirement of both the SEC and stock exchanges), he’s not sure how seriously this statement is meant.

‘While a lot of people are tied into the quarterly cycle, for many, the earnings release (or 8K) is all they care about,’ Chia continues. ‘Only certain people really dig into 10Qs, and often only to check any progress or changes in the ‘legal proceedings’ section. But quarterly filing is embedded, and a lot of folks say more disclosure is always better. It is easy to be sympathetic to that – as an investor, it is always better to be informed, though often what is disclosed in the 10Q is largely repetitive of what’s in the 10K (or annual report filing).’

Little or no comment

Chia says he is pessimistic about an end to quarterly reporting actually happening but that it needs to be discussed. The decision might be to not ditch it altogether but make it more useful. On the other hand, if all companies included the latest balance sheet in their earnings release, there would be a much clearer possibility of doing away with quarterly reports, notes Chia.

‘There is a balance to be struck between quality and quantity,’ he explains. ‘Investors often have their pet line item, so they all are included in case someone protests about the omission. There are also concerns about lawsuits, so everything stays in from quarter to quarter.’

Apart from Chia, there is very little appetite even to comment on an end to quarterly reporting. No one from FCLT, for example, would comment on the issue, nor would anyone from Financial Executives International. Nor would the SEC comment, except to confirm that the rules require quarterly reporting.

But the SEC’s division of corporation finance is reviewing the disclosure requirements for financial statements. For this, it is ‘considering ways to improve the disclosure regime for the benefit of both companies and investors’. This review covers 10Ks, 10Qs and 8Ks. The comment period is still open after more than two years, but none have yet referred to an end to quarterly reporting.

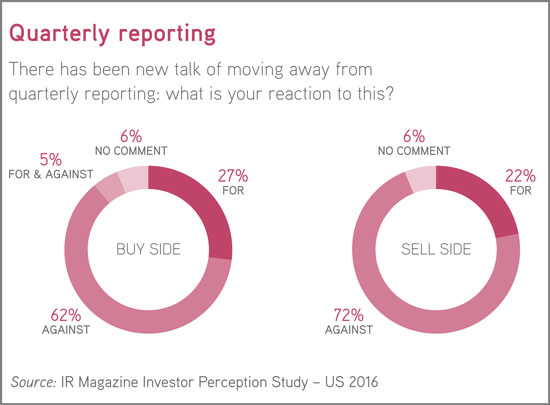

The IR Magazine Investor Perception Study – US 2016 confirms entrenched resistance to the end of mandatory quarterly reporting among US portfolio managers and buy and sell-side analysts; when asked about this prospect, a clear majority said they would be against such a move (see Quarterly reporting, below).

While some had not even heard of the concept, many of the comments voiced in the survey echo Chia’s concerns and comments. More frequent reporting ‘enhances transparency’, ‘less disclosure is not good’, and a lot of respondents call for more disclosure, not less. On the other hand, there is plentiful criticism of short-term focus, and one particularly notable comment that ‘private companies don’t report quarterly and it still works’.

While it’s possible some companies might favor a move to semi-annual reporting, the majority of US investors would, as one source who spoke off the record says, ‘scream bloody murder because it is so ingrained in the system. It’s not going to happen.’This article appeared in the summer 2016 issue of IR Magazine

|

For & against For quarterly reporting Against quarterly reporting |