New guidelines from the International Integrated Reporting Council could reshape the way companies look at their own businesses

In an age when investors are ever more concerned with a company’s holistic performance, corporate reporting is set to take an even wider role in informing shareholders. Last December the International Integrated Reporting Council (IIRC) – a global coalition of regulators, shareholders, accounting professionals and others in 25 countries – set out new guidelines it hopes will make corporate reports more accountable, efficient and effective. Given the growing buzz around integrated reporting, we’ve set out to answer the key questions about the IIRC’s new reporting template.

What is the IIRC’s integrated reporting framework?

|

|

The framework provides a series of guidelines to enable companies to produce integrated reports. It identifies seven guiding principles that should shape how a firm prepares its reporting, informing both the content of the report and how data is presented. It also suggests several overlapping ‘content elements’ – standard methods for representing various parts of a company’s operations.

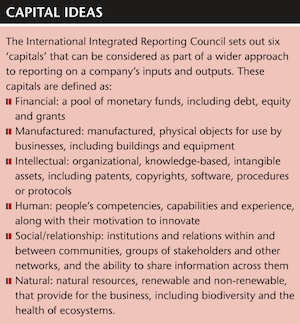

Its aim is to give a more holistic, rounded appearance to a company’s internal reporting through consideration of the wider impact of the resources it uses, the processes it puts in place and the outcomes it provides. Part of this, the document suggests, is an appreciation for a company’s incoming and outgoing business resources (see Capital ideas, right).

The framework does not require reports to structure themselves according to these categories, however, and such ideas should be considered as part of the ‘theoretical underpinning for the concept of value creation,’ the document notes. Nina Eisenman, president of communications consultancy Eisenman Associates, adds that the report is ‘market-driven rather than compliance-driven’ and that each organization should determine how appropriate a measure each form of capital is.

At heart, Eisenman says, an integrated report is about better communication with investors. ‘Specifically, it will help them communicate why their firm is a good long-term investment based on how it creates value over the short and long term,’ she explains.

What does it mean for a company’s reports?

The framework means annual reports remain a vital investor communication tool, points out David Matthews, head of quality and risk at KPMG. ‘The IIRC has been clear that it sees investors as the primary audience for integrated reports,’ he continues. ‘The focus on communicating value created for the organization should align closely with investor assessments of shareholder value.’

At the heart of an IIRC-compliant report, key business capitals give investors leading indicators of a company’s performance beyond the ‘business as usual’ view of financial statements. Though a CSR perspective can itself form a large part of this, it is not the only focus of a wholly integrated report. ‘The current reporting framework allows you to report your people as a cost, but not as having value in themselves,’ explains Jonathan Labrey, the IIRC’s communications director. ‘It allows business to find a measurable and meaningful way to account for the people and ideas it brings into the corporate sphere, for example. It lets businesses tell their story of value creation in context.’

Matthews agrees. ‘Embedding investor-relevant non-financial information into the reporting system should provide a natural base from which the IRO can draw and help to broaden the discussion of shareholder value creation,’ he says, adding that an integrated report will be built around a company’s business story, rather than vice versa.

Another key aim of the IIRC’s framework is to promote the idea of connectivity and prevent businesses from reporting on individual aspects of their offering in a ‘silo-based’ approach. Even if businesses can outline strategies eloquently, says Labrey, disparate reports from far-flung corners of a whole business do not combine well to form an overall report.

What else might it affect?

|

|

Though it might mean more work and wider focus for IROs, Sven Lunsche – vice president of corporate affairs at Gold Fields –says dealing with a new variety of stakeholders, each with its own information demands, means IROs are more closely involved with a company’s overall SRI strategies.

‘That’s why IROs should welcome the advent of integrated reporting,’ he explains. ‘Many investors are already in this space, and we are certainly finding that, at Gold Fields, more and more queries are coming from SRI investors so our IR team has to be geared up to it.’ Fund managers, Lunsche adds, are asking increasingly specific questions about a company’s approach to environmental risks, such as: do you have a social license to operate from neighboring communities? Do you have stable labor relations? ‘A good integrated report is supposed to answer these queries and the IIRC framework provides the tools with which to craft it,’ Lunsche summarizes.

The framework itself has scope beyond this, however, and offers more than just a template for producing CSR-minded financial reports. Labrey is keen to emphasize this. ‘It’s about a process leading up to the publication of the report, what we call integrated thinking,’ he explains. ‘It’s about understanding the different interconnections between different business units within a company, some of which offer risks and others opportunity. It’s about getting a grip on how value is created in a sustainable manner.’

For the past two years, the IIRC has run a pilot scheme for the framework with various bodies, from public sector organizations like the UK’s National Health Service to large listed companies like Microsoft. One thing the IIRC concluded from the scheme, says Labrey, is that the framework can apply to almost any firm. ‘Some aspects of it are potentially more or less appropriate for some businesses than others, but the principle of measuring the right things that enable you to shape your strategy and create value is right for any business,’ he explains.

‘It’s particularly attractive to organizations looking to shift their investor dialogue beyond short-term measures of performance to a more complete perspective on how shareholder value has been developed and protected,’ suggests Matthews. He goes on to say the framework’s ‘broader perspective’ might redress any narrow focus on short-term operating costs over future, long-term benefits.

For Eisenman, whose firm advises other companies on appropriate communications and IR strategies, there is a range of companies for which it is immediately appropriate: organizations that already use the Global Reporting Initiative’s framework, those aiming to attract investment from funds that adhere to the Principles for Responsible Investment guidelines or those that are already strategically aligned with a centralized idea. ‘The primary target audience for integrated reporting is providers of financial capital,’ she says. ‘Firms that require financial capital from external investors, including publicly traded companies, should consider adopting the framework.’

What role might IR and IROs play?

‘IROs could have a key role in understanding and articulating what the strategy of the business is externally, but also in appreciating and potentially driving interconnecting units in their organizations,’ suggests Labrey. Investors will want to know how the different parts of a business can be broken down and value determined, he adds.

IROs may also have a role in adopting the IIRC’s approach in the first place. ‘Applying the framework will require a cultural shift from asking, What are we required to report? to What do we need to report in order to explain our management of shareholder value?’ says Matthews. ‘Report preparers will probably need help in understanding what information is relevant to an investor’s assessment of shareholder value.’

|

|

Eisenman suggests the move could also give IROs an opportunity to contribute more directly to their business’ strategic decision making. ‘Those who seize the opportunity have a chance to gain a seat at the C-suite table and help lead their company to a more sustainable future,’ she expands. ‘There has been a lot of discussion and action taken – at least in the US – toward internal alignment within companies. The time is ripe for IR professionals to use integrated reporting to become more active players in shaping their companies’ strategies and futures.’

Labrey echoes this idea. ‘IR is no longer just about looking at the share price and communicating some of those factors to investors,’ he explains. ‘It’s much more about recognizing the factors that contribute to the value of the business. Through that, further strategic initiatives can be formed and play a role in creating long-term value.’

What difficulties might become apparent?

‘Non-financial reporting systems have typically not had the same focus on scope and quality that financial information systems have had,’ explains Matthews. ‘Fixing these gaps will often take longer than a single reporting cycle.

Eisenman also suggests IROs will need to engage and collaborate with organization heads throughout their businesses – and key shareholders – to determine what should be reported on. ‘Their diplomacy skills will be called into play as they ask people to do the additional work of collecting and reporting on the required data,’ she says. ‘Firms in the pilot program told me this process was challenging but ultimately yielded so many benefits it was well worth the effort.’

Lunsche, who was responsible for implementing integrated reporting at Gold Fields, identifies the biggest issues he came across as getting data pertaining to sustainability up to the standard of previously reported-on financial statistics. The change ‘required a significant investment in human resources, capturing technology as well as databases to collate and analyze the data,’ he says.

Finding themes that persisted across financial, operational and sustainability reporting, too, was a challenge but avoided creating three disparate documents. Gold Fields concentrated on the central themes of optimizing operations, growing Gold Fields and securing the firm’s future.