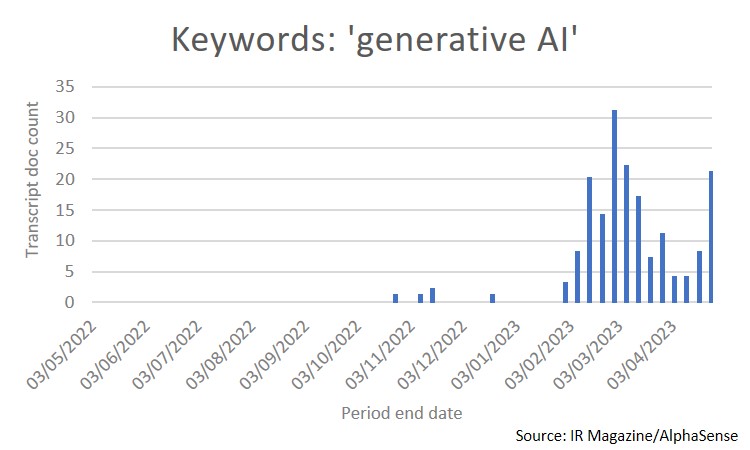

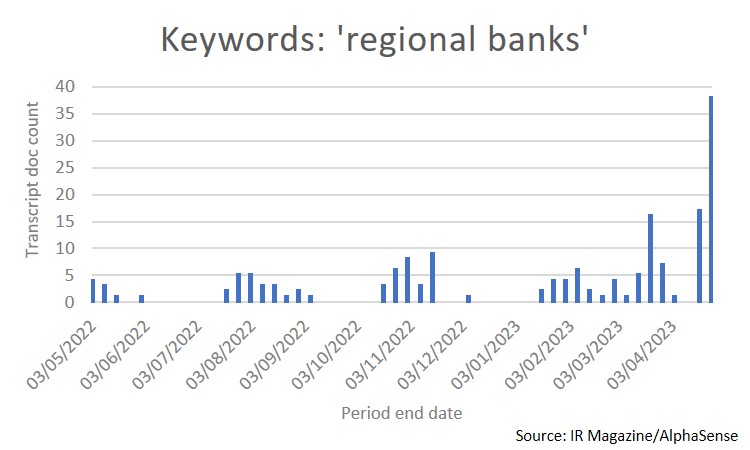

What are executives talking about this earnings season? Generative AI and regional banks are, unsurprisingly, seeing a surge in mentions on earnings-call transcripts, according to data from market intelligence platform AlphaSense.

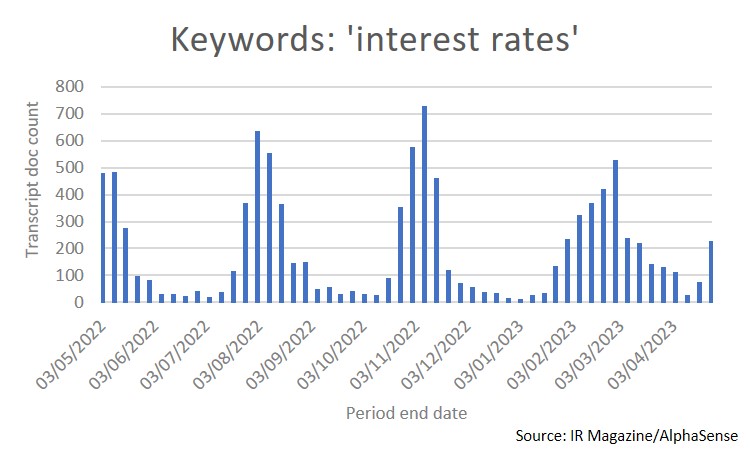

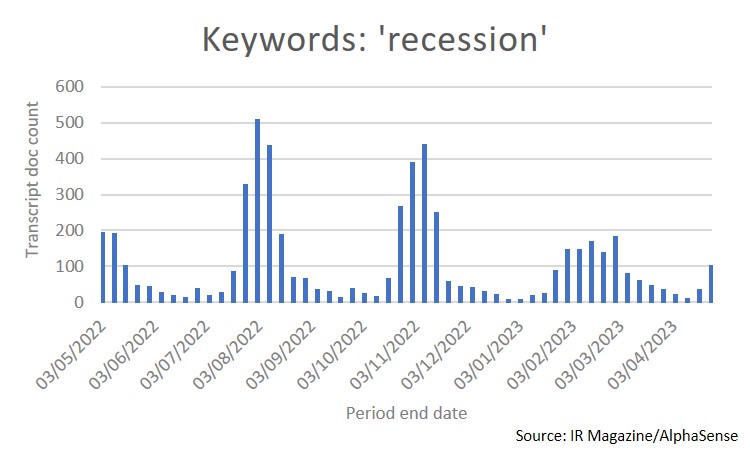

Interest rates, recession and layoffs, meanwhile, continue to get a significant number of mentions, as companies and investors discuss the uncertain economic outlook. The use of 'recession' is trending down notably, however, which suggests this is becoming less of a concern.

Generative AI

Since ChatGPT burst onto the scene late last year, companies have been scrambling to explain how generative AI tools could boost their prospects, as well as address the existential threat to some jobs and industries posed by the technology.

- 'A number of organizations are using our generative AI large language models across Google Cloud platform, Google Workspace and our cybersecurity offerings' - Sundar Pichai, CEO, Google (Q1 2023 earnings call)

- 'The recent industry breakthroughs in foundation models and consequently in generative AI applications present exciting opportunities for us' - Chi Ping Lau, executive director & president, Tencent Holdings (Q4 2022 earnings call)

- 'Unlike its predecessors, much of the latest generative AI is trained on copyright material, which clearly violates artists' and labels' rights and will put platforms completely at odds with the partnerships with us and our artists and the ones that drive success' - Lucian Grainge - chairman & CEO, Universal Music Group (Q1 2023 earnings call)

Regional banks

The US regional banking crisis is demanding airtime on earnings calls as investors seek to understand how exposed different companies are and what risks remain in the system. Underlining the sense of fear, First Republic shares dived this week following news that customers withdrew $100 bn in deposits in March.

- 'We will not have material direct exposure to the impacted regional banks and we do not expect the events in that end-market to materially increase the risk to our financial guidance in 2023 or to the medium term targets we laid out at our investor day' - Douglas Peterson, president, CEO & director, S&P Global (Q1 2023 earnings call)

- 'Credit tightening from regional banks will have the most acute impact on construction loans and smaller private developers' - Jon Cheigh, chief investment officer & head of global real estate, Cohen & Steers (Q1 2023 earnings call)

Interest rates and recession

Turning to other topics, interest rates and recession still feature heavily on earnings-call transcripts, although the number of mentions has trended down in recent months, especially for the latter, which adds to the sense that fears of a major economic downturn are easing.

- 'Corporate bank revenues in the first quarter of €2 bn ($2.2 bn) were 35 percent higher year-on-year, driven by increased interest rates and continued pricing discipline' - James von Moltke, president & CFO, Deutsche Bank (Q1 2023 earnings call)

- 'The increase in interest-related revenues driven by short-term interest rates drove significant earnings growth over the prior year' Paul Reilly, chairman & CEO, Raymond James Financial (Q2 2023 earnings call)

- 'Our current volumes reflect that we are in a mild recession and that we're uncertain about how deep or how long it will go on' - Tracy Robinson, CEO, Canadian National Railway (Q1 2023 earnings call)

- 'I have a higher degree of confidence that the Fed will land the plane reasonably well and that we're not going to have a deep dark kind of recession' - Christopher Nassetta, CEO, Hilton Worldwide Holdings (Q1 2023 earnings call)

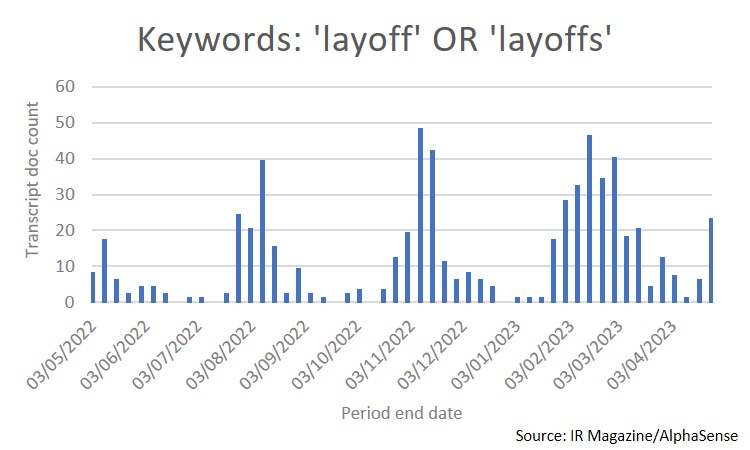

Layoffs

Finally, mentions of layoffs have risen steadily over the last 12 months, driven by rounds of cost-cutting – particular in the tech sector – and discussion about what high employment rates mean for interest-rate decisions. With many predicting a softening of jobs data soon, this subject is set to remain of high interest on earnings calls.

- 'So far we've gone through two of the three waves of restructuring and layoffs that we have planned for this year in our recruiting and our technical groups' - Mark Zuckerberg, founder, chairman & CEO, Meta Platforms (Q1 2023 earnings call)

- 'While there may be some uncertainty about the economy, including increasing layoff announcements, as I said previously, we are not seeing this impact our day-to-day operations' - Michael Manelis, chief operating officer, Equity Residential (Q1 2023 earnings call)