Survey also finds good disclosures include sustainability information and actual cash flows

Though it might sometimes be hard to work out what to include in an earnings release, researchers suggest some reports may not even be based on factual information.

According to a survey of 375 CFOs published recently in the Financial Analysts Journal, executives believe as many as one in five companies intentionally misrepresents its earnings, using ‘discretion within [GAAP]’. Such misrepresentations are significant – about 10 cents on every dollar, the report authors estimate – and though most result in the overstatement of earnings, a third of companies intentionally lowball their earnings.

The study’s authors also interviewed several CFOs to gain insight into how earnings mismanagement can remain undetected and when such activities cross the line into fraud. One CFO quoted in the report believes ‘the chance that an analyst would spot an occasional instance of earnings management is low and only persistent abusers have a high chance of being detected.’

Respondents were quizzed about the motivation behind misrepresenting earnings, too, with most CFOs saying pressure from Wall Street to keep earnings consistent is the greatest driver. Other contributing factors include influencing executive compensation, avoiding violation of debt agreements and dodging adverse career consequences on the back of disappointing performance.

CFOs also give advice to analysts in the form of ‘red flags’ to look for in order to catch misrepresentation: of these, a lack of correspondence between earnings and cash flow is the most common answer, closely followed by deviations from peer and industry norms.

There’s a warning, too, for companies that would persist in touching up their earnings releases. ‘Most of the CFOs we interviewed believe the consequence of poor quality [of earnings], once discovered in the marketplace, is an increase in the cost of capital and/or a decrease in stock price,’ reads the report. Investor confusion and reduced trust are also direct consequences, say other respondents.

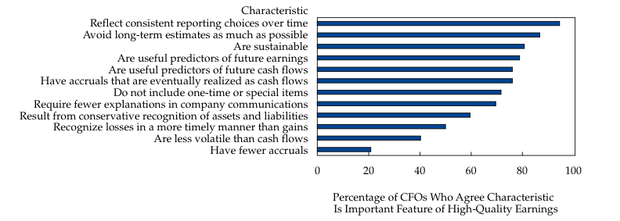

On a more positive note, the CFOs interviewed pick out the characteristics of high-quality earnings releases. Maintaining consistent reporting choices and avoiding long-term estimates as much as possible are the top two choices, with sustainable earnings the third option – all factors that the report authors summarize as ‘sustainable and predictable earnings’.

Source: Financial Analysts Journal, volume 72, number 1

The study was carried out by Duke University professors Ilia Dichev, John Graham, Campbell Harvey and Shiva Rajgopal. It targets 169 CFOs at public companies and 206 at private firms, and was carried out online with a sample provided by Duke University and CFO as part of the Global Business Outlook survey.