Chinese companies are returning to US stock exchanges – but how have things changed since 2011’s accounting scandals?

‘Chinese brains are just as good as theirs and this is the reason we dare to compete with the Americans,’ Jack Ma, founder of Alibaba, one of the world’s largest e-commerce firms, is seen telling employees in the 2012 documentary Crocodile in the Yangtze. ‘If we’re a good team and we know what we want to do, one of us can defeat 10 of them.’ The 1999 speech, showcasing the executive chairman’s competitive drive, ends with him telling his comrades: ‘The goal is Alibaba will [have its] IPO in 2002.’

Jack Ma, Alibaba

‘Chinese brains are just as good as theirs and this is why we dare to compete with the Americans’

He might have missed that deadline by a decade or so, but the former English teacher has hardly been idle. Since founding the company in his Hangzhou apartment, Ma has grown Alibaba into a behemoth offering everything from online auctions to messaging and payments. And now, after almost a year of flirting with a listing in Hong Kong, Alibaba is set to go head-to-head with those American brains in a US IPO. [At the time of writing, no date or stock exchange had been finalized.]

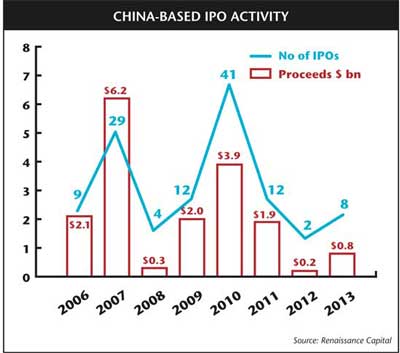

Alibaba's March announcement that the much-anticipated mega-listing – expected to raise at least $20 bn and be the biggest since Facebook – will take place on US soil cements the firm’s status as the jewel in the comeback crown of Chinese companies going public stateside. Last year saw eight Chinese companies list in the US, up from just two in 2012 following a series of accounting scandals that saw many firms de-list, and an IPO suspension by Chinese regulators.

New beginnings

This encouraging return to the market saw companies including online sports lottery site 500.com, app developer Sungy Mobile and auto information website Autohome list in the US at the start of 2014. Other big hitters such as JD.com, China’s second-biggest e-commerce company after Alibaba, and China’s microblogging site Weibo have also filed plans for IPOs in the US.

‘Non-US companies are attracted to the US IPO market for its greater trading depth, understanding of technology companies’ business models and, given the significantly better performance of the US stock markets compared with the Hong Kong and London stock markets, more investor enthusiasm for growth equities in the US,’ explains Renaissance Capital co-founder Kathleen Smith, noting that some might see this investor enthusiasm as ‘a bubble’.

The IPO research firm’s 2013 annual review of the US listings market makes reference to Chinese IPOs staging a ‘comeback’ in the second half of 2013. ‘Chinese companies listing in the US returned in the second half of the year, with eight companies raising $800 mn and producing a whopping average return of 79 percent,’ reads the report. ‘With the exception of LightInTheBox, which traded up 22 percent on the first day but has since plunged after reporting two disappointing quarters, all eight ended the year in positive territory.’

As fears of fraud and issues surrounding accounting practices linger, however, activity levels remain well below 2010, when 41 companies went public and raised $3.9 bn, Renaissance adds.

A fluctuating market

Carson Block, short-seller and founder of Muddy Waters Research, agrees with Smith’s suggestion that enthusiasm over Chinese stocks could be seen by some as a bubble. ‘Internet stocks and, in particular, Chinese internet stocks, are quite frothy – even bubbling in pockets,’ he explains. ‘Enthusiasm can wane just as quickly as it has waxed. I believe positive sentiment toward Chinese internet companies will likely peak with the Alibaba IPO.’

In fact, by mid-April, Smith says the ‘strong performance’ seen at the start of 2014 ‘had started to fade’, causing IPO investors to be more disciplined about upcoming IPO pricings. ‘Last week 16 IPOs were scheduled to price and only 10 were done – of which seven are trading below the IPO price,’ she said on April 15.

‘Recent Chinese IPOs are performing poorly, perhaps additionally affected by recent news of slowing growth in China. IT education center operator Tarena International, the first Chinese IPO priced in 2014, is trading 6 percent below its IPO price. Private medical center operator iKang Healthcare, the second Chinese IPO to price this year, priced at the high end of the range and is now trading below its IPO price.’ At the time, Smith added that Renaissance would wait to see ‘some sustained outperformance’ of its IPO exchange-traded fund ‘before the IPO window will open again’.

While the tech and internet stocks coming out of China might fluctuate, the country’s online retail market by transaction volume continues to boom, jumping 42 percent last year to ¥1.85 tn ($330 bn), according to figures from iResearch, which predicts the country’s online retail sector will surpass ¥4 tn by 2017.

Lessons learned?

As well as the rise and fall of the IPO market, Chinese firms looking to list in the US – and investors looking to get a slice of the Chinese pie – have other issues to consider: the accounting problems mentioned by Renaissance haven’t quite disappeared, for example, and have even become the focus of a regulatory row between the SEC and Chinese authorities (see Washington vs Beijing, below). Block, well known for his outspoken stance against a number of Chinese companies listed in the US, says that despite the attention, these problems are yet to be adequately addressed.

‘The Chinese government has taken extraordinary measures to make it harder to do due diligence on these companies,’ he points out, adding that the companies involved in the 2011 accounting scandals had not been ‘meaningfully’ penalized. ‘With due diligence harder to conduct than before and fraudsters operating with virtual impunity, it is hard to see how or why the newer IPOs would be substantively better. The quality of these IPOs might be better than before – but it is incredibly difficult for investors to know for sure.’

Another corporate governance issue is the widespread use of variable interest entities (VIEs) by Chinese companies. While the structure allows Chinese firms – including big names such as Weibo – to circumvent onerous foreign ownership restrictions applied to certain sectors such as e-commerce, access to profits without actual ownership makes VIEs contentious.

‘Because of this structure, US investors often don’t even own the operating company,’ explains Block. ‘Instead, they own firms that, by contract, are supposed to receive regular payments from the operating companies. The problem is that virtually every listed Chinese VIE is in breach of these agreements.’

Alluring prospects

The temptation to tap into Chinese growth – even a slowing growth – could well outweigh investor concerns, however. Some top-end estimates suggest as many as 30 Chinese companies could list in the US this year – just topping 2007 numbers, when 29 companies raised $6.2 bn, according to Renaissance figures.

Any accounting concerns directed at smaller Chinese companies – and even corporate governance issues such as the use of a VIE in Weibo’s offering, or the weighted share structure chosen by Alibaba – are equally unlikely to affect interest in the big players. This is especially true when backed up by financials such as Alibaba’s 66 percent spike in sales to $3.06 bn in the last three months of 2013 compared with a year earlier.

As Alibaba’s IPO draws nearer, more attention will be placed on the firm’s outspoken founder. Ma has talked in the past about the day he was first connected to the internet.

‘I invited friends and TV people over to my house,’ he told the New York Times in 2005, and, on a very slow dial-up connection, ‘we waited three and a half hours and got half a page. We drank, watched TV and played cards, waiting. But I was so proud. I proved the internet existed.’

Last year Americans spent $1.9 bn online during Black Friday and Thanksgiving, according to Business Insider. In China, the equivalent Singles Day saw three times that spent across just two Alibaba sites – Tmall and Taobao – where more than $5.75 bn was processed, while Alibaba now powers four fifths of all Chinese online consumer shopping. It seems Ma has indeed proved the internet exists.

|

Washington vs Beijing |

|

One share, one vote |