NIRI is pushing for institutional investors in the US to reveal their holdings more speedily

Which single regulatory change in the US would help the country’s IROs do their job better? For NIRI CEO and president Jeff Morgan, the answer is making investors reveal their holdings more quickly – and he’s now pushing to make that idea a reality. NIRI, along with the NYSE and the Society of Corporate Secretaries and Governance Professionals (SCSGP), has submitted a petition to the SEC requesting that it shorten the disclosure deadline for institutional investors.

Under the current rules, in place since 1975, institutions can wait up to 45 days after the end of each quarter to reveal their hand, by which time the information contained in the filing is often out of date. The signatories are asking for that to be cut to just two days. Morgan says shortening the delay has been the key regulatory issue since he joined the institute.

‘NIRI has been talking about this for the last five years,’ he explains. ‘Since I’ve been here, this has been the number one regulatory issue. As part of my advocacy work we’ve been going out and trying to get some partners interested in this. With the SCSGP joining in, the NYSE then approached and said it would be interested in joining the effort, so a strong partnership was formed.’

The background

The push for change comes a year and a half after the SEC indicated it would look at this area. Mary Schapiro, the commission’s former chairman, stated in a speech in late 2011 that the SEC intended to review the beneficial ownership reporting rules.

NIRI’s petition calls for this review to include a look at the 45-day delay, arguing that investors and public companies should have access to institutional holdings data on a more timely basis. The reporting rules were put in place to provide the market with useful information about institutional investments, it notes, but the delay means filings are not fulfilling their intended purpose.

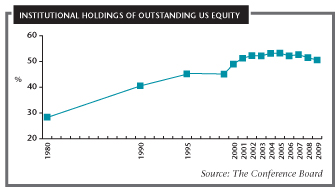

Supporters of the petition say the current approach is out of date given changes to the market over the last 30 years. For a start, the existing rules appeared at a time when institutional ownership was far lower than it is today. According to figures from the Conference Board, institutional ownership has risen from 28 percent of US equities in 1980 to 51  percent in 2009.

percent in 2009.

What’s more, the ability of investors to swiftly report their holdings has dramatically increased. This argument is used by Paula Ciprich, general counsel and secretary of National Fuel Gas Company, in a comment letter to the SEC. ‘In an era of high-frequency trading, highly sophisticated computer algorithms and other tools, and advanced recordkeeping technology, the idea that sophisticated managers actually need 45 days to make their required disclosures under section 13f is laughable,’ she writes.

Timothy Quast, president of ModernIR, the market intelligence firm, says the rise in stock turnover is another reason to support the petition. ‘The average institutional holding period by many estimates now is about four months,’ he says. ‘Under current rules, institutions file 13fs 45 days after quarter-end. Technically, then, the reporting period is longer than the holding period. If what we want is transparency and fairness in capital markets, this would seem cognitively dissonant.’

Quast also points out that other filings are delivered far more quickly in today’s market. ‘Why should one form of investment activity furnish a daily record, and another form a record roughly every four months? It’s like Morse Code in a smartphone world.’

Out-of-date information

For public companies in particular, one of the central arguments is that waiting 45 days to find out who your shareholders are is simply too long for effective IR, a situation made worse around key events like the annual shareholder meeting, which requires companies to stay close to their shareholder base.

To support this view, the petition cites a 2010 report from NYSE’s Commission on Corporate Governance that highlights the ‘critical importance’ of transparency to good governance.

‘The information you receive after 45 days is outdated,’ says Morgan. ‘You can have a huge changeover of your investors during the 45-day period, so the information, when we get it, is very stale. That means that, ultimately, we don’t know who our shareholders are.’

Investors, as you would imagine, are not all so keen on the petition. One of the central arguments against it is that shortening the disclosure period would ruin an investor’s chances of gaining an edge. And Mortimer Buckley, managing director and chief executive of the Vanguard Group, a US investment company, says long-term investors would suffer the most.

‘We submit that the NYSE petition’s proposed two-day reporting period is not in the public interest because it primarily benefits short-term traders at the expense of long-term investors, including mutual fund shareholders,’ he writes in a comment letter to the commission.

When quizzed on reaction to the petition, Morgan says the number of issuers throwing their weight behind it is encouraging. ‘We certainly have rising numbers of issuers [coming on board] and agreement is growing,’ he notes. ‘Clearly it has started some conversation in the institutional investing community. I think people can see quite clearly why we want to see a change, while others are afraid it will give away their strategy for investing.’

According to Morgan, there is no set timeline for the progress of the petition and it could take anywhere from six months to two years for a decision to be reached. He emphasizes that the important thing for now is just to get the conversation going.

Quast agrees that the petition should help kick-start debate, and hopes it will lead to greater issuer involvement in rule making more generally. ‘This is the first step in awakening the beast, so to speak: getting public companies actively involved in setting rules in markets for their equity,’ he concludes.

Proposed revision to paragraph (a) of rule 13f-1Every institutional investment manager that exercises investment discretion with respect to accounts holding section 13 (f) securities, as defined in paragraph (c) of this section, having an aggregate fair market value on the last trading day of any month of any calendar year of at least $100 mn, shall file a report on form 13f with the commission within two [currently 45] business days after the last day of such calendar year and within two [currently 45] business days after the last day of each of the first three calendar quarters of the subsequent calendar year. |