Not all companies were equal in communicating how the US subprime crisis affected them, and there's a lot to be learned from the best and worst of the crisis

IR in the financial sector isn’t a job for the faint-hearted. How many people could withstand the pressure to explain and defend how the subprime crisis hit their books? Plenty of IROs faced this task. And they did it with an audience of analysts and investors trained on their every move.

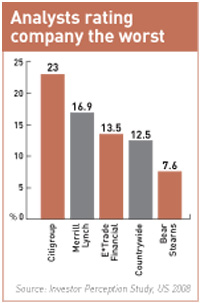

We asked for the views of those analysts and investors as part of our development of the Investor Perception Study, US 2008, a survey of 1,427 respondents. In this section, respondents were asked to rate the 17 financial sector companies, excluding GE, listed on the Wall Street Journal's ‘subpar earnings’ scorecard, which catalogs firms that have reported the impact of their subprime exposure. These are some of the responses.

WORST

Citigroup

A convincing majority of respondents to our survey identified Citigroup as the least effective in disclosing its exposure: 23 percent of them rated it worst. Nor were critics just responding to the size of the losses (in Q4 alone, the bank took over $18 bn in write-downs and losses on subprime holdings); they didn’t like how they were getting the news, either.

In anecdotal comments, analysts described Citigroup’s reporting as ‘piecemeal’ and ‘opaque’, leaving them confused and needing to place a cautious watch on the company.

At the time, the bank was adjusting to new CEO Vikram Pandit after the resignation of his predecessor, which seems to have affected Citigroup’s IR efforts.

One respondent reports being astonished by the bank offering just a two-page press release to explain $60 bn in exposure to structured investment vehicles.

The overall feeling was that Citigroup revealed too little, too late. ‘Citi didn’t have a grasp of the magnitude of its exposures,’ wrote one respondent. ‘It provides limited data, hides behind fair disclosure rules and is arrogant with investors. It’s amazing that after the Q3 earning results, it came back so quickly with larger losses.’

Whether Citigroup didn’t know the full extent of the problem or was attempting to minimize it is an open question. In any case, Pandit promised better in the Q4 earnings call: ‘We will be candid with you today and in the future so you can fully understand our decisions.’

WORST

Merrill Lynch

Merrill Lynch was in the unenviable position of being the first major bank to report subprime losses in an earnings call last fall. The initial $8 bn write-down was epic, with subprime errors wiping out the firm’s entire pre-tax profit.

CEO Stan O’Neal, soon to be ousted, faltered badly, preannouncing losses of $4 bn only to have to double the figure a few weeks later. O’Neal made appropriate apologies, saying, ‘We got it wrong by being overexposed to subprime.’ But while the CFO said Merrill was offering an ‘extraordinarily high level’ of disclosure, analysts in our survey disagreed. The market for subprime assets was so uncertain there may not have been much Merrill could say. But that didn’t stop investors from heaping blame on the firm. Respondents said confidence in Merrill’s figures eroded to nothing as figures changed. Critics took particular exception to the about-face when Merrill said there was ‘no problem’. ‘Then: bang! Big problem,’ as one investor noted.

The market for subprime assets was so uncertain there may not have been much Merrill could say. But that didn’t stop investors from heaping blame on the firm. Respondents said confidence in Merrill’s figures eroded to nothing as figures changed. Critics took particular exception to the about-face when Merrill said there was ‘no problem’. ‘Then: bang! Big problem,’ as one investor noted.

WORST

E*Trade Financial

There was much wrath directed at E*Trade Financial, mostly from respondents wondering why an online brokerage firm would be heavily invested in subprime mortgages in its own portfolio.

As sell-side banks contemplated the disaster of a potential bankruptcy filing, E*Trade seemed to stumble on the IR front, failing to quantify the losses in its holdings. ‘Management blindsided (asleep at the switch?), answers kept changing, stopped returning phone calls,’ reported a respondent.

It had to hurt when E*Trade’s closest competitor ran this advertisement in some prominent places: ‘Simply put, TD Ameritrade doesn’t own subprime or structured investment vehicle market-related securities, period. The bottom line: you can concentrate on your investments. Not your brokerage company.’

E*Trade may have made amends when it published a supplemental portfolio disclosure and business update before its Q4 and year-end earnings call just after the conclusion of our survey.

BEST & WORST

Bear Stearns

It’s not news to anyone that Bear Stearns had it worst in the subprime debacle. It was the first to feel the rumblings of the credit crunch when two of its internal hedge funds focused on subprime holdings collapsed last summer. It ended eight months later when Bear Stearns made a deal to sell itself to JPMorgan Chase at a bargain price.

Interestingly, opinion is almost evenly split on whether the firm’s IR during this time was adequate. Those who took a positive view commended the bank for ‘timely’ ‘expedient’ and ‘detailed’ disclosure. And it got bonus points for having to confront the issue early on. ‘For all Bear Stearns’ struggles, it was one of the first to assess and identify the crisis,’ one respondent said.

Detractors also had plenty to say, complaining that Bear Stearns’ management was arrogant and distracted during this time, failing to go beyond ‘very basic and inadequate information’. One respondent even said the firm ‘knew there were big problems, but kept dumping exposure onto clients.’ Federal prosecutors are investigating this allegation.

BEST

JPMorgan Chase Securing top marks in our survey, JPMorgan Chase was praised for getting out in front of the subprime issue early, being straightforward and having a strong CEO in Jamie Dimon leading the way. Thirteen percent of respondents said it presented the clearest picture.

Securing top marks in our survey, JPMorgan Chase was praised for getting out in front of the subprime issue early, being straightforward and having a strong CEO in Jamie Dimon leading the way. Thirteen percent of respondents said it presented the clearest picture.

Reports say the bank’s exposure to subprime and collateralized debt obligations is just $2.7 bn compared with some $37 bn at Citigroup, so JPMorgan has an advantage. Analysts recognize this, noting that it is ‘easy to be honest when your risk management functions more effectively than that of your peers.’

These perceptions helped begin a coronation of Dimon even before he stepped in to bail out Bear Stearns and calm the markets. He was ‘talking about the problems in the credit markets even before they happened,’ respondents said.

BEST

AIG

Financial giant AIG has already been hit with a shareholder derivative suit in California arguing that it didn’t fully outline its subprime exposure, but analysts in our survey report getting a good picture. Nearly 12 percent of them rated the firm best at subprime communications, just behind top-ranked JPMorgan Chase.

In their anecdotal comments, analysts described AIG as ‘an open book’, noting the extensive amount of time and disclosure the firm offered in an attempt to put numbers around its problem.

AIG held five major conference calls and investor meetings from May 2007 to February 2008 focused on the subprime and collateralized debt obligations turmoil, says spokesperson Chris Winans. The firm started things off with a half-day global view of its potential exposure featuring presentations from 14 executives. The Q2 earnings call featured a detailed tutorial by AIG’s chief risk officer. And a December investor day originally slated to cover AIG’s foreign life insurance segment was reformatted to make room for another subprime update.

AIG also added five to 12 pages of subprime-related data to financial supplements to its Q2, Q3 and Q4 earnings statements and had numerous other interactions with shareholders, Winans says. With this kind of depth, it seems fitting to find analysts saying AIG ‘always seemed up front with communications’ and ‘doesn’t seem to be hiding anything.’

The full results of the survey are published in IR magazine‘s Investor Perception Study, US 2008.