PwC survey reveals widespread lack of faith in current regulatory structures and procedures

Almost half of investors and two thirds of directors have raised a skeptical eyebrow over recent regulatory and enforcement initiatives, finds a PwC survey, with most bemoaning a lack of increased investor protection.

Sixty-four percent of directors questioned by the firm’s survey say existing legislative, regulatory or enforcement initiatives have improved protection for investors ‘not very much’ or ‘not at all’; 47 percent of investors agree. Very few – 4 percent and 2 percent, respectively – believe the initiatives have helped ‘very much’.

Nearly 30 percent of directors also report that they have spoken more with institutional investors in the past 12 months, with nearly the same proportion of shareholders saying they have been contacted more often. About 20 percent of both investors and directors indicate the same increase in their respective communications with proxy advisory firms and regulators.

A substantial portion of directors – 39 percent – claim they never speak to institutional investors, however, and almost half say they don’t speak to proxy advisory firms or regulators.

Though Reg FD may have come to limit interactions with shareholding institutions, the report suggests, directors may also believe ‘such communications are most appropriately handled by company management.’

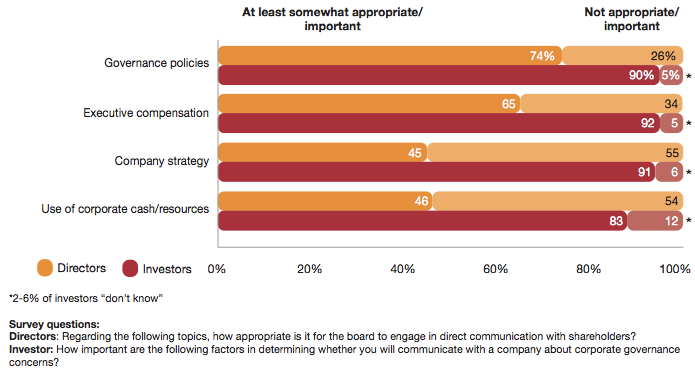

PwC also quizzed directors and investors about what topics might be appropriate for communication, with both groups agreeing that governance and executive compensation are fitting discussion points. Though 91 percent of investors say the opportunity to talk about company strategy is ‘somewhat important’, only 45 percent of directors believe it appropriate to discuss this.

Source: 2013 Annual Corporate Directors Survey and 2013 Investor Survey

The report further explores current feeling toward director compensation, and the factors that come to determine exactly how much executives are paid.

Four in 10 investors and directors consider compensation consultants ‘very influential’ over remuneration decisions, while one in five believes institutional investors have the same sway. Investors, however, are more likely to believe the CEO has a significant effect on such decisions.

Mary Ann Cloyd, leader of PwC’s center for board governance, says she hopes the report can help readers ‘identify areas where viewpoints are shared or differences exist’ between investors and directors. ‘We hope this information helps directors, investors and management teams better understand where their views are similar and where they differ,’ she adds.

The study collects the results of two surveys conducted in summer 2013, which canvassed opinions from 934 directors – 70 percent of whom serve on the boards of companies with more than $1 bn of annual revenue – and 65 institutional investors.