1. What has been the biggest change in IR during the course of your career and how has this shaped IR?

For me the biggest change was the anonymization of trading. Until the late 1990s stock trading took place on the trading floor of the stock exchange only. Traders received orders by telephone (not smartphone!) and knew both sides: buyer and seller.

With the introduction of electronic trading platforms like Xetra (a descendant of KISS), both transaction partners remained anonymous. This was introduced for good reasons, but for IR it obviously made the world less transparent. When you called your broker he wasn’t able to tell you who the seller was, who the buyer was or if there was maybe more to come.

Some years later dark pools were introduced. They represent the next stage of the development of trading and opacity.

2. What have been the most positive changes you have seen in IR?

The Neuer Markt in Germany and the IPO boom around the turn of the millennium led to more hype for the IR profession. Maybe it was a little too euphoric, but it was generally positive and the number of IROs grew enormously and investor relations became more professional.

3. What have been the most negatives changes you have seen in IR?

Sometimes I feel that in the minds of more and more C-level representatives, IR is actually less of a strategic function and more of an administrative role.

4. What advice would you give someone coming into IR today?

Stick to your convictions and always be consistent, professional and fair. Good IR is an important factor for the success of a company – not the only one, but the only one you can influence.

5. How has technology changed IR as a job? Has this been for the better or worse?

Technology often helps to make life easier, and that’s what it does for day-to-day IR. Just think of email, websites, CRM systems, social media, smartphones, webcasts, the IR Club…

6. What change or changes would you like to see in IR, and why?

I would like to see a little less regulation by authorities and more self-regulation by the market.

7. What do you envisage being the most important change the IR industry will face in the future, and why?

Quantitative trading will gain even more importance, something that is already ongoing. A potential change could take place with the demographic development globally. Maybe we will see completely different roadshow destinations like Delhi, Lagos or Kinshasa when IR Magazine turns 50.

8. What has been the most important advice you have been given in your career, and why?

The mantra of IR: always underpromise and overdeliver – never the other way round.

9. What has been the most overrated?

The promotion of videoconferences as a replacement for real meetings.

10. How has the relationship with investors changed during your career?

I don’t see a real change. It’s still trustful, fair, objective, respectful, interested and – often enough – humorous.

11. If you could pass on one IR lesson from your career, what would it be?

The most difficult situation I experienced was a call from a totally distressed private investor on a Friday evening who told me about a disastrous investment in another company. He was completely bankrupt and told me that he wanted to commit suicide. I wasn’t prepared for a crisis of that kind, but I managed to convince him to allow me to arrange advice from his bank and a professional debt counselor – which wasn’t easy on a Friday evening. The lesson I learned was that there are human fates behind all the numbers, which is something to keep in mind.

12. How has regulation shaped IR over the years?

Ha, well it’s not in good shape: it’s really bulky and needs a workout! Less could be more.

13. Has its impact been positive or negative?

Negative and sometimes ridiculous. For example, I don’t see the transparency benefit or the extra protection of investors, in a company having to report a director’s dealing Europe-wide with all its single transactions, which could be more than 600 partial executions.

14. How well has IR Magazine represented the industry over 30 years?

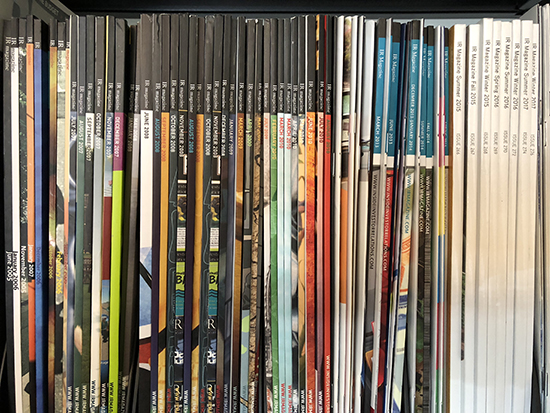

It’s the standard, benchmark must-read in the industry. I’m not only a reader of the magazine, but also an avid collector. I have many of the print editions starting from 2005 (and I have two editions of the 20th anniversary issue, so if you want to trade…). Seriously, though, I also enjoyed the time when IR Magazine had a competitor in Real IR (from 2004 to 2007), because I’m convinced that ‘competition is good for business,’ as the German saying goes.

15. For you, what has been the most standout article to appear in IR Magazine over the years, and why?

Maybe not the most outstanding, but for me the article that had the biggest impact on my job was Broker beauty contest from October 2011. Some brokers are still calling me to ask where they are currently positioned!

Patrick Kiss' collection of IR Magazine issues

As IR Magazine builds up to its 30th anniversary issue – the upcoming winter 2018 issue, which will be the 279th edition of the industry’s flagship magazine – we’ll be posting more throwbacks to old covers, revisiting some of the hot topics from the past 30 years of investor relations and hearing from some of the industry titans.