IROs to prioritize working with sell side, long term strategies and feedback loops

Getting the most of out of the sell-side is one the top priorities for IR teams around the world, according to a recent poll conducted by the Corporate Executive Board Company (CEB).

Respondents to CEB’s survey also identify the use of feedback loops between IR teams and investors – used to determine strategy – and the development of a multi-year IR strategy as their most important goals for the coming year. 59 percent rate working effectively with the sell-side as ‘valuable’ or ‘highly valuable’, 54 percent their long term strategies, and 46 percent their investor feedback loops.

While there is a general consensus on all three topics between large- and small-cap companies, 57 percent of those with a total capitalization of under $10 bn also identify collaboration with senior management as crucially important to their future plans.

Meanwhile, half of the IROs who represent companies capped at over $10 bn value making their teams ‘world-class’ and developing their messages for a global shareholder audience.

Regional differences were also explored, with IROs in EMEA companies not considering technology in IR workflows, collaborating with management or targeting financial media and short-term vendors as important to their future plans as those in US-based companies. Instead, EMEA respondents were more enthusiastic about the translation of their complex ‘operating environments’ to investors and developing their investor messages for a diverse, global audience.

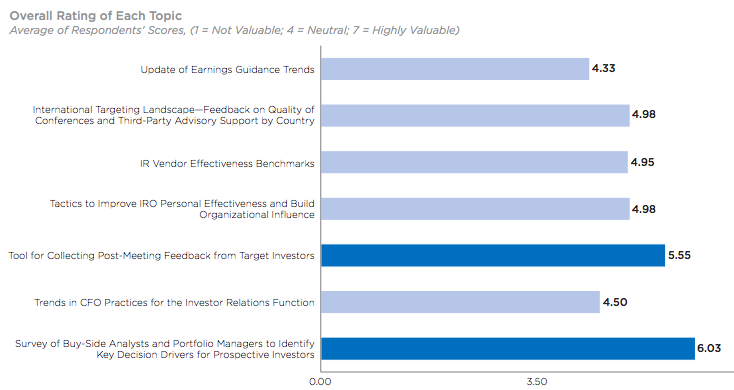

IROs were also asked to rate the research products made available to them by CEB – most chose the firm’s buy-side studies as the most useful, for its insights into what drives prospective investors to back certain companies, or CEB’s tool for collecting post-meeting feedback from targeted investors.

Product feedback – IROs identified buy-side study as most useful research available to them

Source: www.executiveboard.com

Teams were then quizzed on activities governed by ‘management by objectives’ (MBO), which turns tasks into a process of defining and meeting targets agreed between management and employees.

The vast majority (85 percent) said that their targeting and shareholder outreach programs had an MBO attached to them, with 31 percent adding that their upscale messaging was governed by the business practice.

The poll was carried out as part of CEB’s Investor Relations Leadership Council research, which questions finance professionals from leading companies on emerging and common business problems. It questioned 41 IROs around the world on a number of different subjects, intending to inform other IR departments of changes and trends in the profession that they should be aware of.